The market value of Sports & Outdoors in Europe, Middle East and Africa (EMEA) is 12.04 billion euros in 2021 and is expected to exceed 13.18 billion euros in 2022. This report will interpret the performance of sports & outdoor products in the European market from multiple perspectives, and guide sellers to fully appreciate the trend of popular European categories.

Table of contents:

1. Overview of European Sports & Outdoor Products Market

2. Consumer Trends

3. Popular categories

4. Regional Economy of European Sports Market

5. Competitive landscape of European sports market

6. Growth points of the European sports industry in 2022

- Overview of European Sports & Outdoor Products Market

The epidemic is undoubtedly the strongest assist for the surge in sales of sports & outdoor products. In March 2020, the epidemic spread to the European continent, and team sports and indoor sports could not be carried out. This led to a fundamental change in the sports preferences of the entire European continent in 2020 and 2021. Affected by travel restrictions, participating in these two years Sales of winter sports apparel fell with fewer people skiing and other winter sports.

More consumers are turning to personal exercise, including yoga and Pilates. During the epidemic, there are not many projects that people can go out to implement, mainly hiking and running, which has created a good market for outdoor clothing and walking equipment. The sports and leisure clothing market, which combines the characteristics of yoga clothing, sportswear and casual clothing, has become a hot category as people work from home and take online classes. Online shopping, as the only way for consumers to shop when brick-and-mortar stores are closed, has opened up sales due to the epidemic.

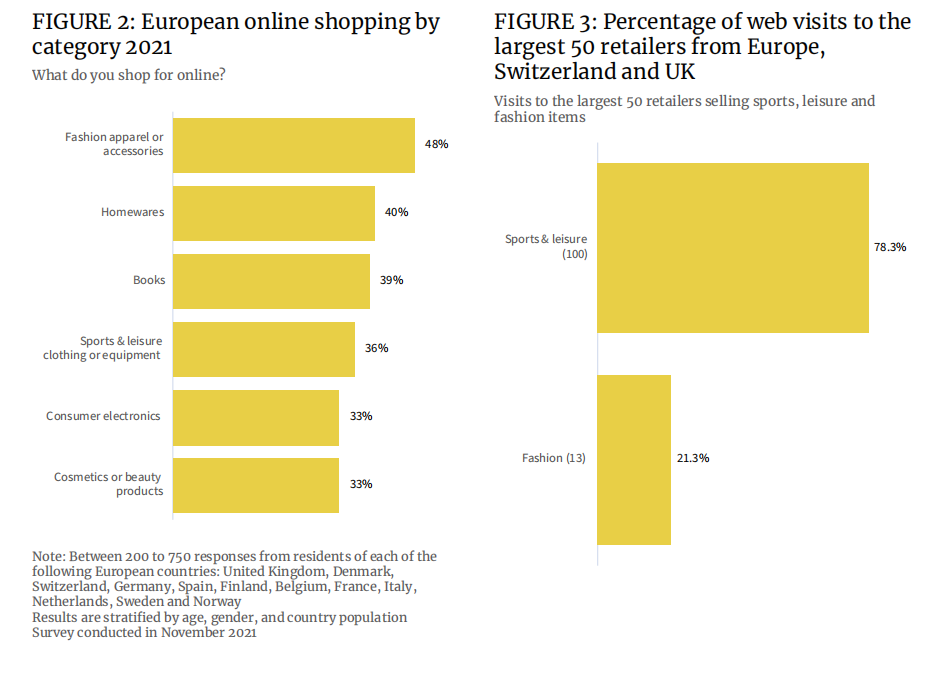

Data shows that in 2021, 36% of Europeans will buy sports and leisure clothing & equipment online, and the proportion of online shopping in this category is only slightly behind books (39%) and household items (40%). Online shopping for fashion apparel & accessories accounted for 48%, indicating that the overall online shopping intention of consumers in this region is lower than that in other regions.

In terms of the proportion of visits to the top 50 retailers in Europe, more than 78% searched for the keyword “sports and leisure”, while only 21% searched for “fashion” alone. This means that sportswear, athleisure and sports fashion will be part of more and more clothing brands’ product lines.

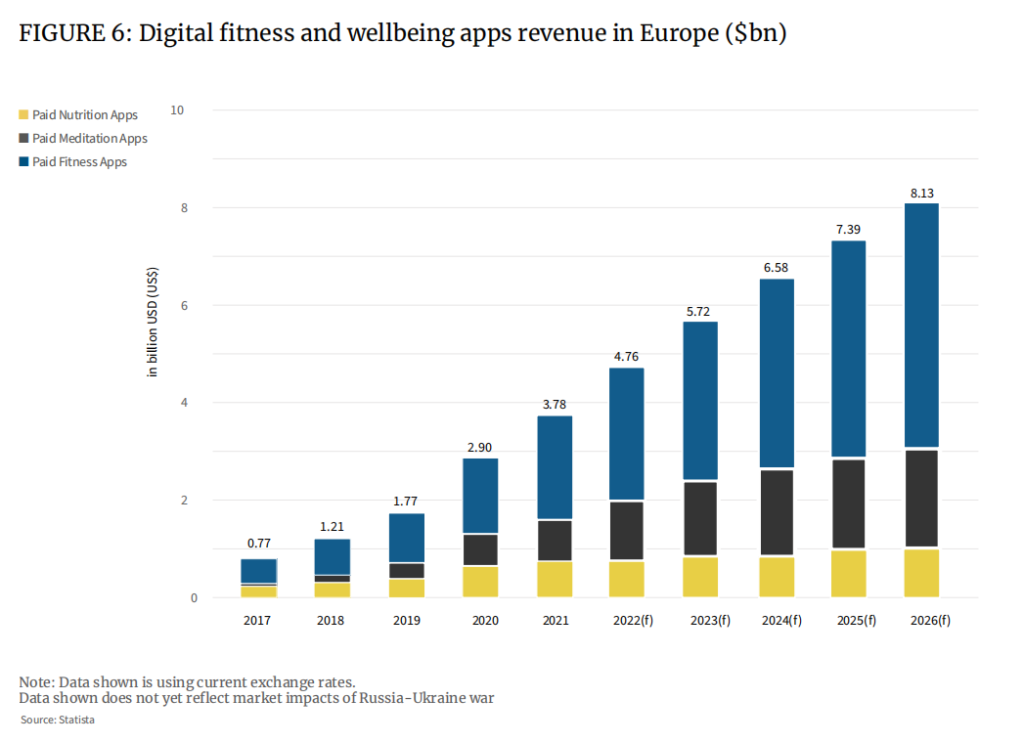

At the same time, health testing and physical training applications that claim to improve people’s conscious exercise enthusiasm have set off another round of fitness “revolution”.

Many first-line sports brands have created their own fitness apps, established user communities, and urged users to exercise while opening up new monetization channels, including paid subscriptions. Nike’s Run Club app has 15.4 million downloads in 2020, an increase of 45% compared to 2019, and has become a more important part of Nike’s revenue structure. The analysis also shows that the app has brought a very large amount of exposure to Nike in the communication community of outdoor sports users such as running. Nike’s marginal but high-end products equipped with “black technology” have been sold at high prices.

These applications collect a series of biometric data from users, such as height, weight, age, clothing and shoe size, etc., and record changes in various physical function indicators including heart rate during exercise. This alone brings benefits to these brands. The reason is that brands can provide users with more personalized purchasing recommendations based on data. In 2021, the average spend on paid fitness apps in Europe will increase from $41 in 2017 to $60, and it is expected to continue to grow over the next 10 years.

In addition, sustainable concepts are also influencing consumers’ shopping decisions.

The data shows that about 5% of sports and leisure products purchased by consumers in 2021 are based on sustainable development reasons (4.5% for men and 5.4% for women), although relatively small, compared with 3.8% in 2019. Compared with 4.6% of women, the proportion of men has been greatly improved. By the end of 2022, sustainable sporting goods sales could reach 4.9% (men) and 5.9% (women).

In European sporting goods, the market value of sustainable products is around 600 million euros in 2021 and may reach 800 million euros in 2022.

Businesses now have a responsibility to explore new, sustainable materials and make their production, transport and packaging as sustainable as possible. Suppliers, producers and brands will also pay closer attention to the recycling of materials, driving the maturity of the used sporting goods market.

While sustainable products rely on materials, technology and manufacturing processes and are material and energy intensive, their audience is more inclined to pay a premium for sustainable goods, accounting for 64% of respondents. This will prompt the industry to increase investment accordingly to adapt to market demand.

For example, Nike, since 2019, has realized that 99.9% of the waste in shoe manufacturing can be recycled or converted into other energy sources. Since 2016, Nike has reduced its freshwater use by about 23 billion liters per year. Another giant in the industry, Adidas, said on its website that from 2020, 60% of its products will be made from sustainable materials. Brands such as Patagonia are themselves positioned to be environmentally friendly, and as consumers’ interest in sustainable products increases, sales also rise.

A number of new brands have also emerged. Organic Basics, Girlfriend Collective and Wolven have all become more popular since 2020, and SportsShoe, a professional running shoe company, has restructured its business aggressively in response to market trends to achieve the title of “World’s Greenest, Durable Running Shoes” title.

- Consumer Trends

1. Personal exercise

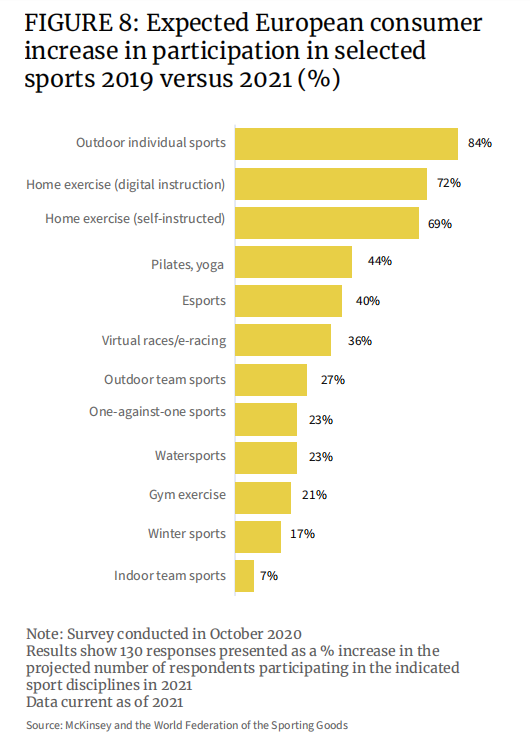

According to the data, about 65% of the respondents in Germany, Italy, Spain and the United Kingdom said that after the epidemic, they would integrate their personal health into their daily life. The way is exercise. The survey results show that, compared with 2019, the sports that Europeans are more inclined to in 2021, personal outdoor sports will be among the best, with an increase of 84% within two years, indoor exercise (online follow-up) will increase by 72%, e-sports and virtual sports. Motorsports activity also recorded substantial growth, up 40% and 36% respectively.

2. High-performance products

Users who love high-performance products understand that they are buying consumables, such as running shoes. After 500 miles of wear, the supportive foam and tread begin to wear out, and the impact resistance is no longer available; sweat-wicking clothing uses tiny silver threads to help wick away sweat and keep clothes dry, with limited effectiveness; and sports bras It loses its important support function after repeated use. Based on this, users of high-performance products are generally loyal repeat buyers. With the popularization of the concept of health, the sales of such products gradually opened up.

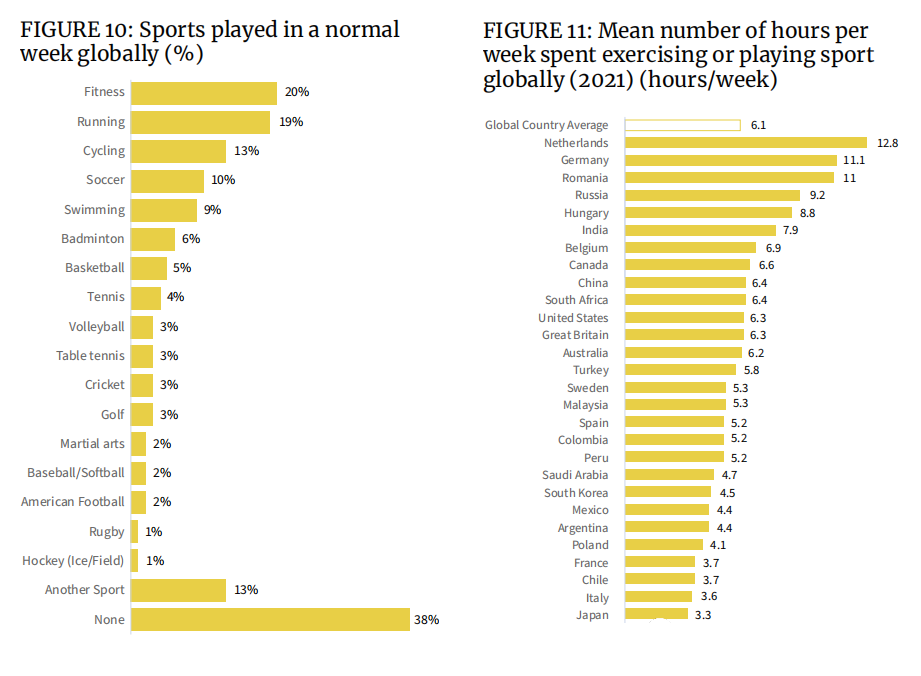

3. Sports

As you can see from the figure below, fitness, running, and cycling are the top 3 popular sports worldwide. Team sports such as football, basketball, volleyball, and cricket, as well as one-on-one ball sports such as badminton, tennis, and table tennis, are also becoming more and more popular, driving up sales of specialized clothing, shoes, and equipment.

From the perspective of weekly exercise time, people in Spain and Italy in Europe are not very motivated to exercise. About 16% of Italians and 14% of Spanish respondents said that it was affected by weather. From a societal perspective, both countries have been hit hard by the pandemic, and unlike other countries in Europe see exercise and fitness as the key to a healthy lifestyle.

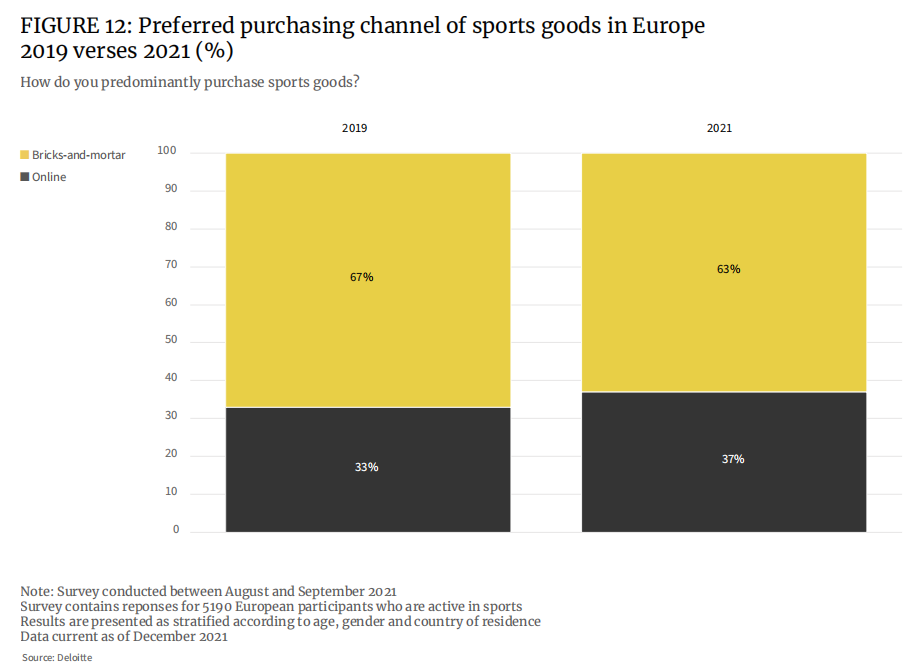

4. Purchase preference

Before the epidemic, 67% of respondents preferred physical stores to buy sporting goods. By 2021, that percentage drops to 63 percent.

Before the epidemic, the proportion of Europeans shopping for sporting goods online was 33%, and it will rise to 37% in 2021. More product choices and higher cost performance on e-commerce platforms are the main reasons for the increase in the proportion of online shopping.

However, it can be seen that physical stores are still the first choice for most Europeans to buy sporting goods, such as some expensive professional sportswear shoes, or customized styles, which require consumers to come to the store, as well as rackets or bats and other equipment. Appearance and performance need to be experienced in the store before you can buy with confidence.

- Popular categories

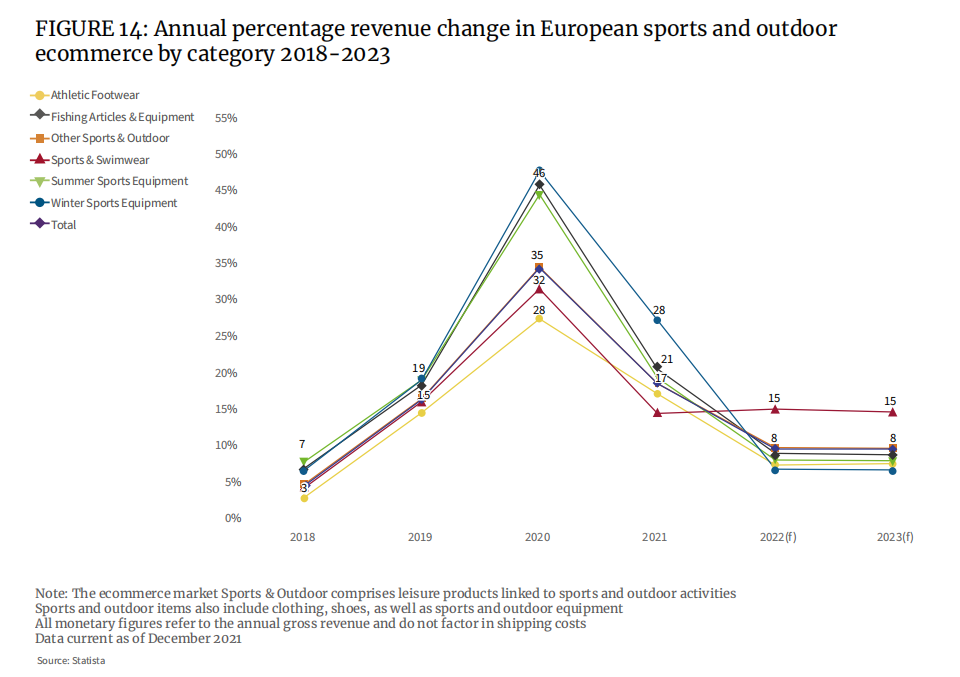

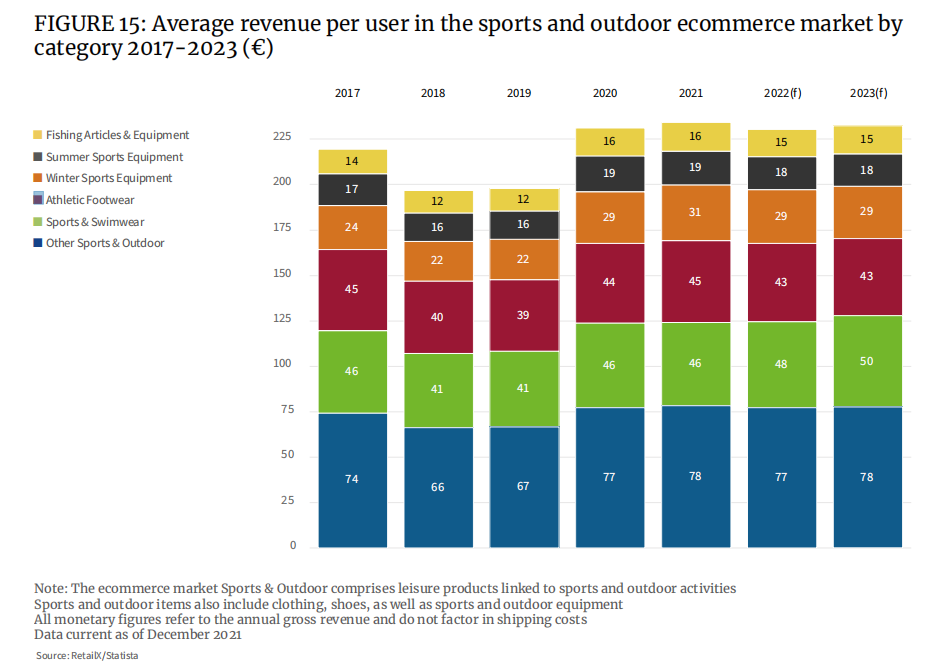

Market data shows that sales of all market segments, from sneakers, fishing tackle, and swimwear, have surged in 2020. The average gain across all categories peaked at 35% during this period.

It was evident during the pandemic that consumer spending on fishing, personal sports and other outdoor sports gear has skyrocketed. Team sports equipment and shoes are the other way around. The average unit price of a single consumer shows that from 2019 to 2020, the consumption of fishing and other outdoor sports has increased significantly. The average unit price of fishing rose from 12 euros to 16 euros, and the average unit price of other outdoor sports jumped from 67 euros to 77 euros, an increase of 33% and 15% respectively.

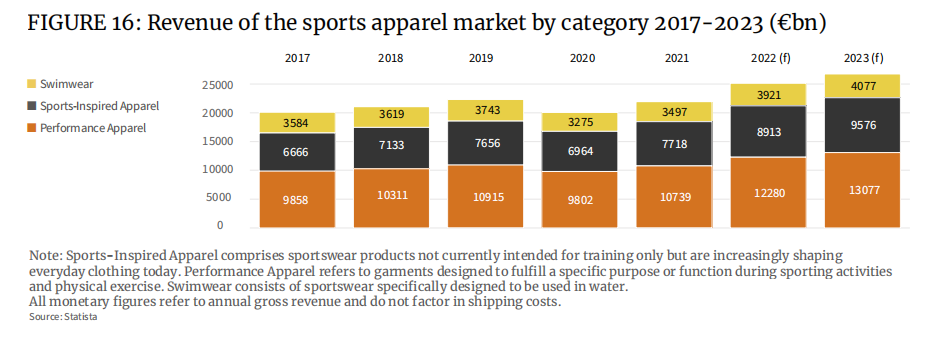

1. Sportswear

Sportswear can be further refined into high-performance sportswear, fashionable sportswear, etc., especially the latter, which has gradually taken shape as a wearing style since the 1960s, and sports brands such as Fila, Adidas Originals, Champion, etc. (or product branches). ) belong to this style. After the epidemic, sportswear such as yoga clothes has been accepted by more and more people and has become a daily wear. This directly drives the growth of fashion sportswear, which will reach 7.7 billion euros in 2021 and may rise to nearly 9 billion euros in 2022.

2. Outdoor shoes

As a sub-category of the outdoor functional clothing market, the market value of outdoor sportswear shoes in Europe is about 3 billion euros, accounting for about half of the market value of the outdoor industry, and it is expected to achieve strong growth in the future. After the epidemic, people are increasingly yearning for the outdoors, and the purchase of outdoor clothing and equipment for hiking, camping and mountaineering has surged. In the past, this was a luxury, but for more and more consumers, it has become a hobby and a pastime.

Bikes have also seen a surge in demand in 2019, 2020 and 2021. The European bicycle market grew by a staggering 40% in 2020 to €18 billion. Against this backdrop, the European cycling apparel market will also grow by 6% between 2020 and 2026. In Europe, there is a growing interest in using bicycles as a daily means of transportation.

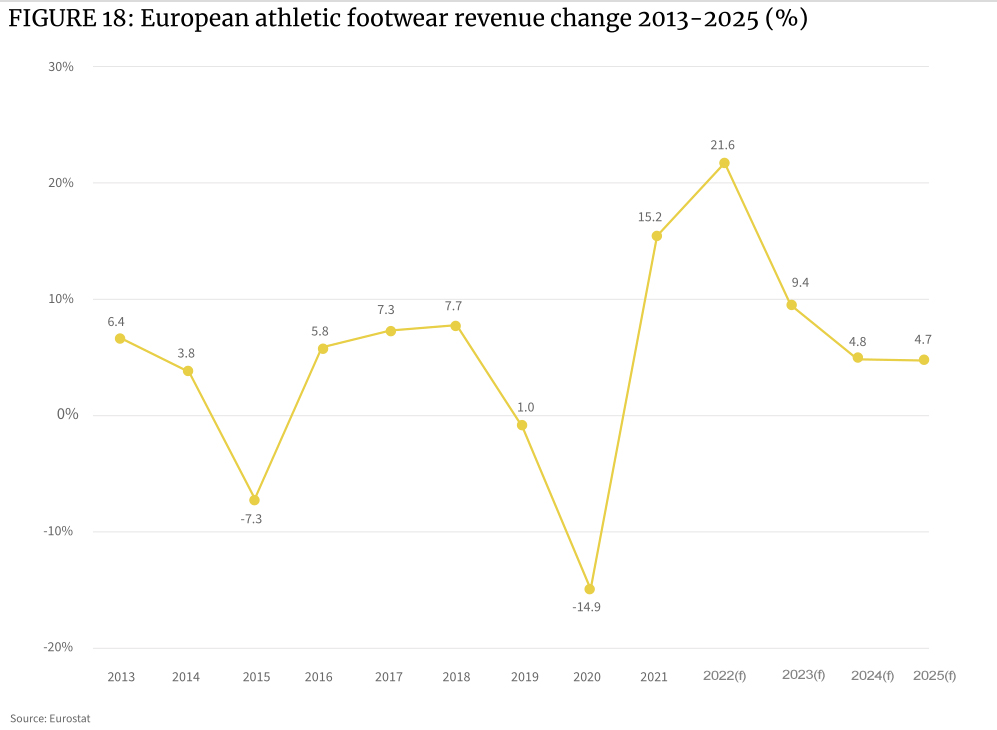

3. Sports shoes

Sneaker sales in Europe plummeted during the coronavirus lockdown in 2020 as many sports venues used for professional sports were forced to close. However, the ensuing rebound in 2021 is astounding, with revenue for the category across the continent growing by 15.2%, and a further increase to 21.6% in 2022.

The epidemic has stimulated consumers’ shopping desire, especially the younger group in the market, who are eager for a healthier lifestyle, so more people are seriously participating in sports. People’s disposable incomes are increasing, and so has the strong interest in the right footwear to wear for every sport.

The emerging fitness apps are also fueling interest in sports and playing a role in how to choose the right footwear as well as information on preventing injuries and improving athletic performance. This once again drove the sales of high-performance sports shoes on the market side.

The entire European footwear market is worth about 130 billion euros, of which the sports footwear market is worth about 50 billion euros and the sports and outdoor footwear market is worth 48 billion euros.

4. Swimwear

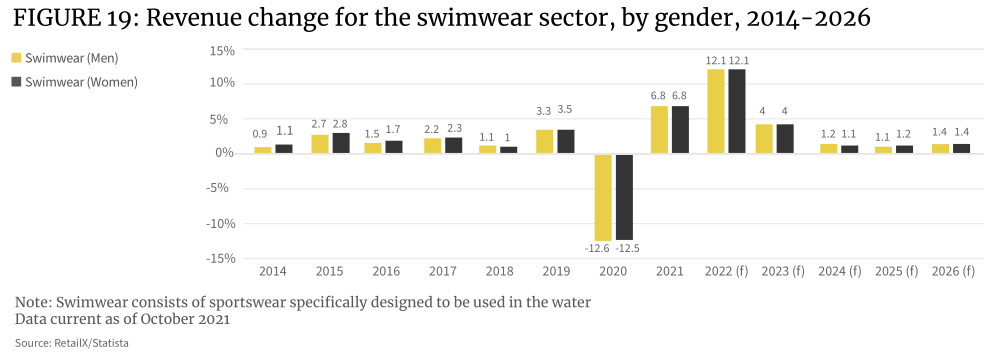

It is expected that the growth of the swimwear market will reach 12.1% in 2022, and some of the pent-up holiday consumption and travel demand will be released. The segment will then stabilize above 2019 levels.

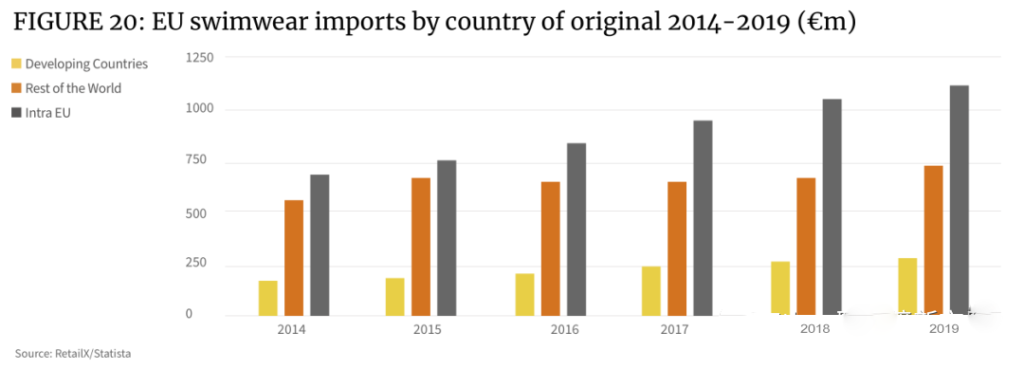

The value of EU swimwear imports has grown at an annual rate of 8.5% over the past five years, higher than the average growth rate of 5.8% for all EU clothing imports. In 2019, European swimwear imports were worth 2.1 billion euros, up from 1.4 billion euros in 2014

Germany (295 million euros), France (176 million euros), the Netherlands (171 million euros), Italy (166 million euros), the United Kingdom (157 million euros) and Poland (109 million euros) are Europe’s largest exporters of swimwear. The total export market size of swimwear clothing in these six countries accounts for more than 70% of the overall EU market.

5. Sports and leisure wear

Athleisure has become a key trend ahead of 2019, and the work-from-home mandate has kept sales growth strong in 2020 and 2021 and shows no signs of slowing down.

Casual sportswear has become not only a specialized segment of sportswear, but also an alignment target for fashion brands. Therefore, the line between sportswear and fashion clothing is also rather blurred.

The changing shopping habits of many consumers place a healthy lifestyle above other pursuits and make physical activity part of their daily routine. For example, wearing sportswear to Zoom meetings has become more widely accepted in many business areas.

The rise of fitness software and corresponding supporting services during the epidemic has also prompted more consumers to accept sportswear in their daily lives and actively engage in sports on weekdays.

As a result, the sportswear industry is quickly combining it with the fashion forward of clothing to create garments that meet the needs of fashion, leisure and sports, enabling the growth of this new product segment.

Other factors have also shifted the focus of the fashion industry towards athleisure. In 2020, the online sales of DTC sports brands will increase, and the cooperation between social media and self-media practitioners has gradually become an important marketing method.

At present, the main players in the sportswear market are Nike and Adidas. Later new entrants, Under Armour and Lululemon, both have pre-eminent market positions in the pantheon of sportswear fashion.

6. Sports equipment

The size of the sports equipment market has experienced shrinkage in 2020 and then experienced rapid expansion in 2021. The expansion rate of this category market is expected to level off in 2022.

Tennis equipment is a good reference indicator. Europe owns 52% of the world’s tennis clubs, and the European tennis racket market will be worth 103.55 million euros in 2021 and is expected to reach 114.13 million euros in 2028, with a CAGR of 1.4%.

Also worthy of attention is the football equipment market. The global football equipment market size was valued at USD 1.9 billion in 2019 and is expected to reach USD 3.7 billion by 2027. The global market is expected to grow at a CAGR of 18.3% from 2021 to 2027.

The European home fitness equipment market has boomed during the pandemic, and while it will continue to grow in the future, it will show weakness faster than other types of sports equipment. The home fitness and fitness equipment market is valued at EUR 2 billion in 2021 and will grow at an annual rate of 3.1% between 2021 and 2031.

- Regional economy of major sports markets in Europe

Europe is home to many world-renowned sports brands, including Adidas, Puma and Fila. Meanwhile, Western European markets such as Germany, France, Italy, Spain, the UK and the Netherlands dominate the continent. In contrast, the Central and Eastern European market is smaller but has greater growth potential.

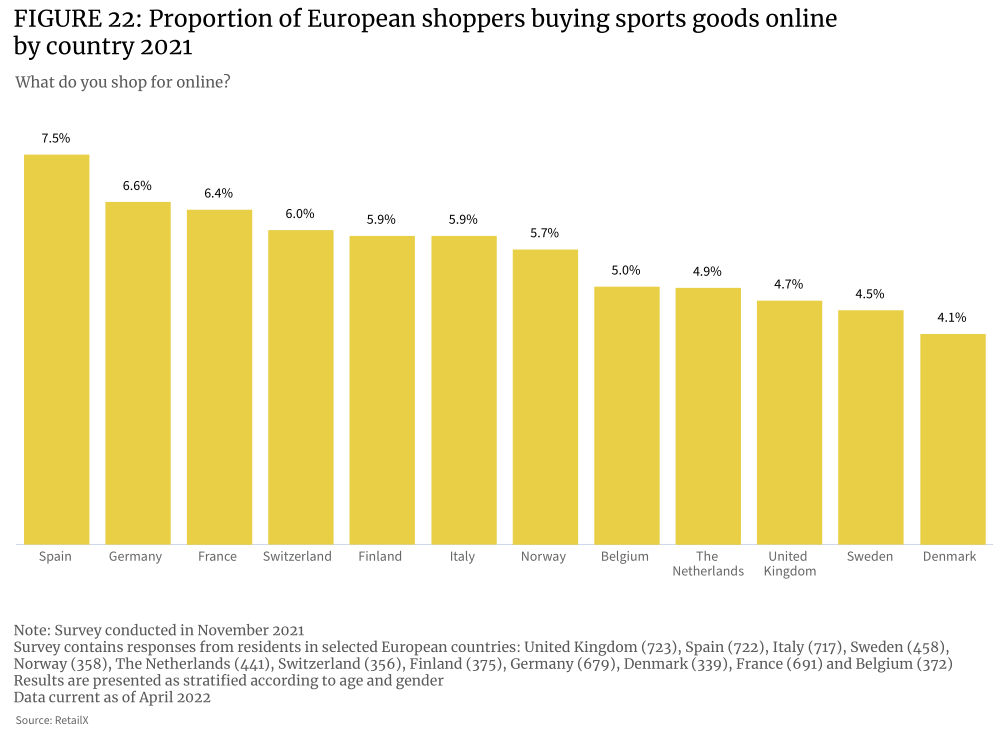

An analysis of the shopping patterns of European sports consumers found that less than 10% of consumers across the region actively buy sporting goods online. The main reason is that consumers prefer the shopping experience of a brick-and-mortar store when purchasing sporting goods. While the pandemic has prompted a surge in online sales across industries, online retail sales of sporting goods have grown relatively slowly.

Interestingly, among the online consumer groups, sports consumers account for the largest proportion (7.5%), and Spain is one of the countries in the European Economic Area that use sports as a pastime. The sports e-commerce category penetration rate in the Netherlands is relatively low (4.9%).

Many consumers want to shop in-person for sporting goods and equipment in brick-and-mortar stores. In sports-oriented countries, consumers are more focused on finding the right professional gear and apparel. In markets where sports are less developed, the opposite is true, where consumers have higher e-commerce participation rates (eg Spain).

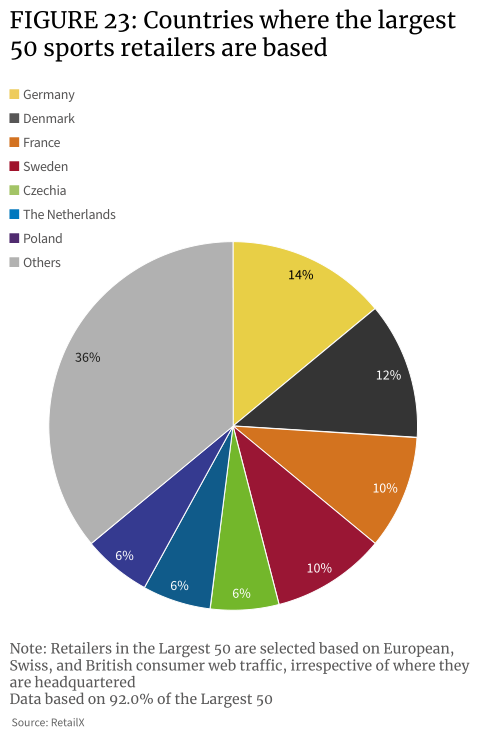

Germany and Denmark have the highest concentration of online traffic among the TOP 50 sports retailers, accounting for 14% and 12% of the overall market traffic in Europe, respectively. Germany ranks second in the number of online sports consumers. In the Netherlands, which has the largest number of sports consumers, its online sports retailers account for only 6% of the traffic.

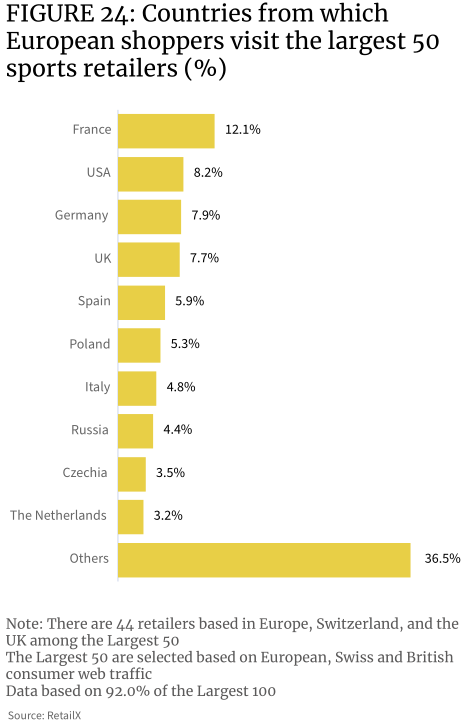

The data shows that the sports category has a relatively strong performance in the cross-border market. For example, the top 50 sports retailers capture 7.9% of German consumers, and 14% of these retailers are headquartered in Germany. Likewise, the top 50 sports retailers capture 12% of French consumers, of which only 10% are headquartered in France. More than 8% of the TOP 50 sports retailers’ website traffic comes from the United States.

This also shows, to a certain extent, that the European online sporting goods and equipment market is less affected by national borders than other retail categories.

Even the UK, where there may be additional barriers to buying from the EU post-Brexit, has a whopping 7.7% of visits to TOP 50 retailers by local consumers, suggesting that many UK consumers are still on European e-commerce sites When buying sporting goods, UK sports consumers have always valued EU specialist brands and retailers.

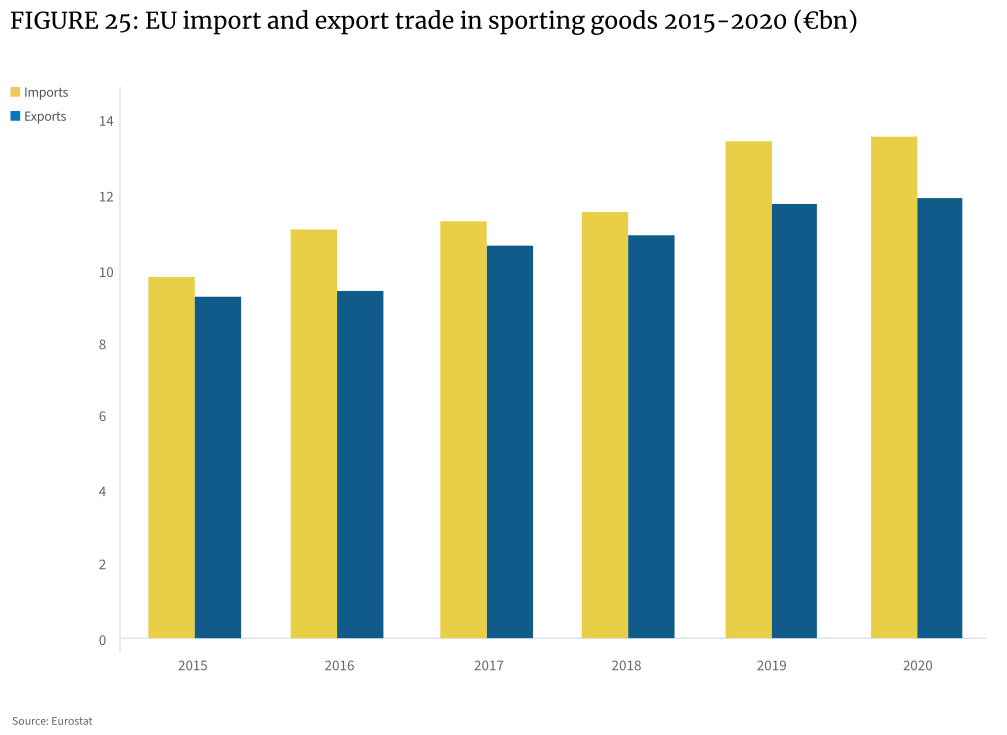

Europe is a major supply and marketing market for sporting goods and equipment, with imports increasing between 2015 and 2020. Compared with 2015, both imports and exports have increased in 2020, and the growth rate of imports (37.8%) is higher than that of exports (28.2%), with an increase in imports of about 3.7 billion euros and an increase in exports of about 2.6 billion euros . As of 2020, Europe’s exports were 11.8 billion euros and imports were 13.5 billion euros.

European sneaker exports are growing, with a 74% increase between 2015 and 2020. Most of these exports go to the United States, Japan, China, Russia, South Korea, Turkey, Canada, the United Arab Emirates, Ukraine and other countries. Among them, the largest decline in exports was snowboards, which fell by 5% year-on-year.

The number of boats and water sports equipment imported into Europe is increasing, increasing by 155% in the five years to 2020. Imports of gymnastics, sports and swimming equipment also surged, up 33% over the same period.

In 2020, in terms of value, Germany and the Netherlands were the EU’s leading exporters of sporting goods, with exports worth around 5.3 billion euros, followed by Italy (4.4 billion euros) and Belgium (3.6 billion euros). The main importers in Europe are Germany (6.3 billion euros), the Netherlands (4.7 billion euros) and France (3.7 billion euros). Italy, which has a sizable trade surplus of 23 billion euros, exports almost twice as much sports-related goods and equipment as it imports.

Intra-EU trade in sporting goods is strong, with imports from within the EU and imports from outside the EU accounting for 51%:49%. The import of fashion sportswear within the EU is dominated by Germany, which accounts for 11.7% of the market share, equivalent to a market value of 1.8 billion euros. This is followed by Italy (5.7%), the Netherlands (5.3%) and Belgium (4.9%).

Meanwhile, Poland is a national market to watch. It has one of the fastest growing imports of sporting goods of any country in continental Europe, has a large and increasingly affluent consumer base, and is one of the emerging online retail markets.

- European Sporting Goods Market Competitive Landscape

Sporting goods are sold through retailers, stores and distributors across Europe, with the market segmented between specialty stores, general sports retailers and brands. The marketplace is also increasingly in play, and the industry is also seeing indirect and digital competition from other industries, such as fashion brands, department stores and other retailers.

Large integrated sports retailers constitute the dominant retail landscape of the market, consisting of retailers selling a wide range of sports and recreational sporting goods, catering to a large customer base. However, they remain focused on outdoor sports and are therefore able to offer products to consumers who focus on performance and recreational sports. Key market competitors in Europe include Decathlon and Sports Direct. These retailers, which have traditionally been brick-and-mortar stores, have gradually opened up to the e-commerce space and are now focusing on omni-channel business models.

Mainstream platforms such as Amazon and eBay have long been major sporting goods sellers, and well-known brands such as Adidas and Nike have also opened their own branded stores on e-commerce platforms to sell end products and other merchandise to avoid cannibalization. Retailers such as Decathlon have gone a step further by opening their own marketplaces to enhance their core expertise and expand their reach into the wider sporting goods market. Other, more specialized platforms that cater to specific sports and categories are also emerging.

The European sporting goods market is served by a range of online and omni-channel retailers, with at least one major player in the top 100 in each country. For example, Germany has several ball retailers appearing in the rankings, representing a certain size in the sports and outdoor goods and equipment market, which is also the development of cross-border e-commerce with countries such as Switzerland, Austria, Poland and the Czech Republic. result of development. In contrast, the UK has only one retailer (Sports Direct) in the top 20.

The distribution of European retailers is also influenced by some well-known brands, usually brand giants such as Nike and Adidas to promote cross-border sales through other retailers and brand stores around the world.

- Growth points of the European sports industry in 2022

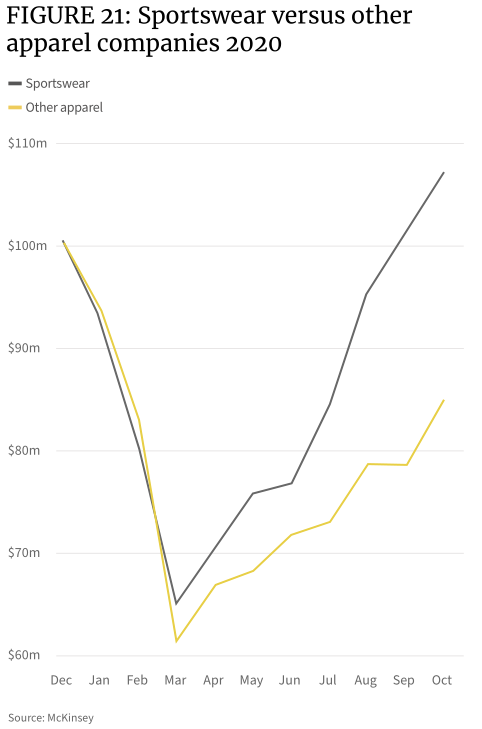

Like all retail verticals, sports shoppers in Europe have seen dramatic changes in their shopping habits throughout the pandemic, but perhaps not as dramatically. In sporting goods, the shift in consumer behavior to online shopping has been far less dramatic than in other areas, while the return to brick-and-mortar retail has been more rapid.

So what are the growth points and trends of European sporting goods in 2022 and beyond?

The epidemic has made more consumers in Europe pay attention to their health, thanks to the strong focus on fitness among young people and the growing influence of the fitness industry. Paradoxically, Europe’s obesity crisis is also growing, and governments are starting to take action to curb it.

A 2020 UK study found that eight times as many teenagers are exercising to lose weight than in 1986. When surveyed last year, 6 in 10 14-year-olds said they exercised to lose weight, compared with just 7 percent in 1986.

Millennials and Gen Z make up 80% of the overall fitness club membership, while 85% of gym members also exercise at home. 89% of people aged 16 to 34 use fitness apps to exercise.

As these young users continue to exercise and resume team sports and other activities that have been curtailed during the pandemic, this will further drive growth in sporting goods sales.

The fitness industry is also being driven by the Gen Z and millennial cohorts as they focus not only on fitness but also on overall physical and mental health. From 2017 to 2021, the global health industry market size has grown by 6.4%, with a market value of approximately $3.7 trillion.

Fitness is just one key area of that. The growth of the wellness industry directly drives the growth in the purchase of sporting goods, especially footwear, apparel and sports equipment, and promotes related technology upgrades.

Childhood obesity is on the rise in southern European countries. The figures show that in Cyprus, Greece, Italy, Malta, San Marino and Spain, around one in five boys (ranging from 18% to 21%) are obese.

This is where the government is taking action to improve children’s health and encourage people to participate in sports and exercise. This will lead to an increase in the demand for sporting goods in the entire European market, and the business opportunity can be described as self-evident.

At the same time, Gen Z and millennials are driving growth in the sports and fitness industries. Younger groups account for more than 65% of the overall proportion of virtual fitness users. The main consumer groups are eager for a seamless and interconnected fitness experience. The experience provided by merchants needs to adapt to people’s lifestyles and match different sports scenarios. Therefore, fitness software that incorporates virtual technologies such as AR, and the corresponding fitness equipment/technology can attract consumers’ attention more than ever.