Lykas jo witte, wurdt it bedriuw dreger en hurder, allinich feroarje, hoe te feroarjen, lit ús begjinne fan it sjen nei it produkt troch de tiidline

Beoardielje út ferskate gegevens, Sina syn ekonomy hat berikt in knooppunt, wikseljen út lift modus nei rock climbing modus.

Wêrom? Hoe maklik is it om de lift te nimmen, wêrom moatte jo foar hurde rotsklimmen gean, jo kinne by ûngelok falle op 'e boaiem fan' e berch.

Dat komt om't yn 'e ôfrûne 40 jier Sineesk BBP hurd groeid is, mei in gemiddelde jierlikse groei fan sawat 9,5%, of sels mear as 10% foar in perioade fan tiid.

De konkurrinsje tusken bedriuwen is in slach fan “dy't de fluchste pakt”.

If you grab fast, get more; if you grab slow, get less. The ground is full of gold, either yours or mine.

But now? The GDP in 2019 may be a few 6%.

This is why everyone feels that business is becoming more and more difficult to do, because in the past it was an incremental business and did not care about the stock.

The current competition among enterprises is likely to be a product dispute in the inventory.

So if you want to change, if you want to find a hand in this new competition, and climb successfully, what should you do?

I suggest that you add the concept of timeline when making products.

Sadree't jo meidwaan oan 'e tiidline en sjogge nei de feroaringen yn' e skiednis mei in fûgelperspektyf, sille jo fine dat de wrâld altyd evoluearret en nea ophâldt.

Op dit stuit hat jo produkt, krekt lykas elk fan ús en elk bedriuw, syn eigen libbenssyklus.

1. Wat is de libbenssyklus fan it produkt?

Wat is de libbenssyklus fan it produkt?

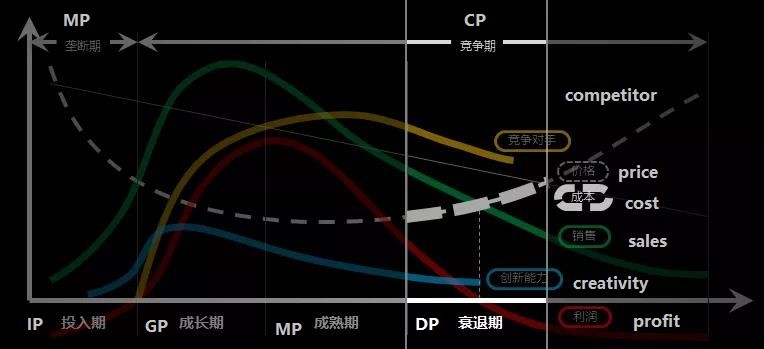

Wy ferdielen it yn fjouwer stadia: de ynvestearringsperioade, de groeiperioade, de ferfaltiid en de delgongperioade.

1.1. Ynvestearringsperioade

Op in dei fiele jo dat jo ynsjoch hawwe yn 'e behoeften fan brûkers, beslute om tiid en boarnen te ynvestearjen en begjinne in produkt te meitsjen.

Mar yn dizze perioade meitsje jo gjin jild, om't jo noch gjin brûkers hawwe.

Brûkers sille net betelje foar jo dreamen, brûkers sille allinich betelje foar har behoeften.

Dizze perioade wurdt de ynvestearringsperioade neamd.

1.2. Groei perioade

Wachtsje oant jo úteinlik de twadde etappe berikke, dat is de groeiperioade.

Dus, lokwinsken, jo produkt foldocht echt oan 'e behoeften fan guon brûkers, ynstee fan te bliuwen by de “wat tinkt jo” poadium.

Yn feite falle de measte startups yn 'e ynvestearringsperioade. Wat betsjut dat foar jo dy't it groeistadium yngien binne?

It betsjut dat jo fluch tagong moatte krije ta de merk en trochgean mei it útwreidzjen fan de skaal fan 'e merk.

1.3. Maturity

Troch de skaal fan 'e merk út te wreidzjen, wêrtroch mear brûkers jo kinne werkenne en de wearde fan jo produkten erkenne, binne jo in folwoeksen perioade ynfierd.

Op dit stadium sille jo fine dat jo einlings jild hawwe makke en jo winsten binne begon te stabilisearjen.

At this time, the most important thing for you is to optimize your supply chain, optimize your production structure, and optimize product functions.

1.4. Decline period

Whether you like it or not, your product will definitely enter the fourth stage, which is the recession period.

Don’t expect such a possibility, you can make a product that can last for 100 years. Coca-Cola is a rare case, but you can’t.

Therefore, on the first day of deciding to make a product, you have to think clearly about how your product will eventually die.

This is the four phases of the product life cycle.

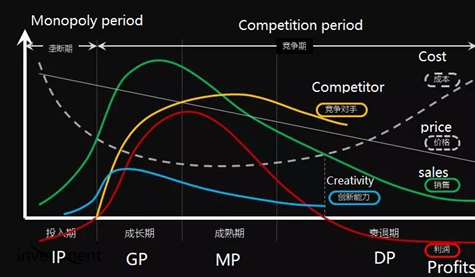

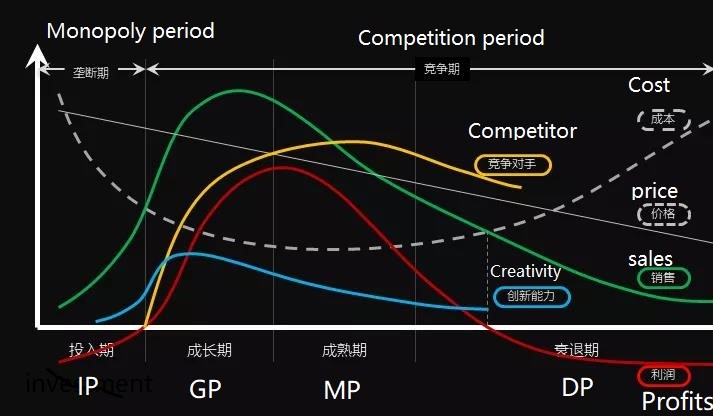

You can also see that in this model diagram, in addition to these 4 cycles, there are also several colored, solid, and dashed lines.

Why add these lines?

Dat komt om't de produktlibbensyklus ferskate prioriteiten hat foar bedriuwen yn ferskate stadia, dus ik tekene 6 benammen wichtige rigels derop, yn 'e hope dit model dúdliker te ferklearjen.

De seis rigels binne: ferkeap, kosten, priis, ynnovaasjefermogen, konkurrinten en winst.

Litte wy earst prate oer de priisline.

Wat binne de skaaimerken fan 'e priis fan it produkt?

It karakteristyk is dat as jo produkt ienris produsearre is, de priis hielendal nei ûnderen is.

Jo kinne sizze:

Is it net? Jo sjogge, de priis fan Huawei mobile tillefoans is yn 'e ôfrûne twa jier hieltyd heger wurden.

Yndied binne de prizen fan Huawei mobile tillefoans de ôfrûne twa jier hieltyd heger wurden. Dat komt om't Huawei's nije tillefoans djoerder binne as de âlde.

De priis fan elk fan har nije tillefoans is yn 'e rin fan' e tiid omleech gien.

Dat dit is it karakteristyk fan 'e priis, de priis fan' e measte produkten is hielendal del.

Lit ús prate oer de konkurrint line.

Jo moatte ûntdutsen hawwe dat dizze line allinich yn 'e groeiperioade begon en syn hichtepunt yn' e folwoeksen perioade berikte.

Wêrom? Is d'r gjin konkurrinsje yn 'e ynvestearringsperioade?

Yes, no one really competes with you because you don’t make money. Many people are watching you by the side, watching you spend your money in the education market, exploring patterns. So this period is also called the monopoly period.

But once your product starts to make money, enters the growth stage, and reaches the maturity stage, then competitors must come in droves.

When we are starting a business, you will find that you can’t feel your competitors because you are always challenging others.

But once you make money, you become a challenger, and you become a helper who spends a lot of money trying out business models and product forms, helping others save everything.

As a result, the competitor directly takes the result of your trial and fights with you.

It sounds cruel, but this is cruel business competition.

What do these lines of sales, cost, innovation ability, and profit mean?

Don’t worry, I want to elaborate on these lines when I explain the different stages of the product life cycle below.

As entrepreneurs, as entrepreneurs, when we add a timeline and look at product changes from a bird’s eye view, what should our focus be at different stages?

This is the most important thing for us.

Next, we will talk about which line is the most important according to the different stages of the product life cycle.

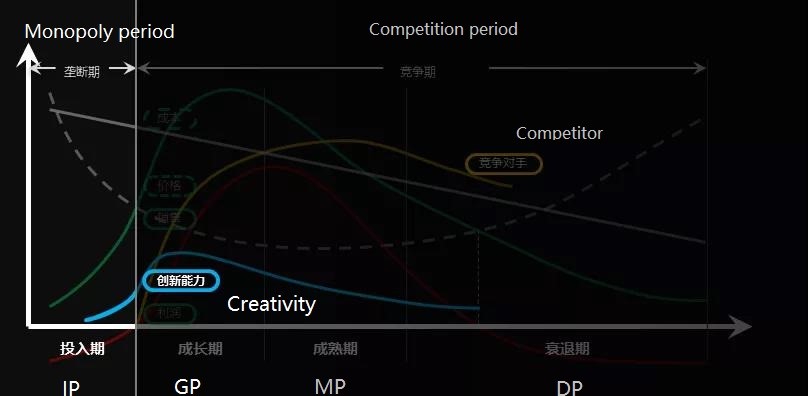

2. What is the most important investment period?

What is the most important investment period?

In the investment period, which line of price, sales, cost, innovation ability, and profit is the most important?

Creativity.

In this period, the ability to innovate is the most important for a startup company.

There are often entrepreneur friends who say that innovation and R&D capabilities require a strong reserve of funds and talents, which can only be done by large companies.

Is it really?

Not really. If you think carefully and pursue the ultimate, you will find that every industry and every product around you is actually worthy of being redone.

We often say that the starting point of all business is the benefit of consumers. Are you pretending to be the product or the user?

Those who only have products will eventually be eliminated;

People who follow users are always iterating.

All products are used to solve problems. The problem is that there is a price.

For example, what problem does the car solve? It is to send people from A to B. How did it go in the past? carriage. I take the carriage, and the sum of the various costs (expense, time, comfort, pride, etc.) from A to B is the total cost of this thing.

In the past, it cost 10 yuan to go by carriage. But if you add all the hidden costs (time, comfort, pride, etc.), it may actually be worth a total of 100 yuan.

Note that this is the key: many people only see 10 yuan, but not 100 yuan. This 100 yuan is the real cost of the user.

Isn’t this innovation in automobiles essentially reducing costs by 30%?

In the investment period, when starting a business, the starting point must be to benefit consumers.

The same thing that meets the needs of consumers, you can make more money and reduce costs by 30%.

Such an enterprise is admirable. Such entrepreneurs are worthy of respect.

In the new era, everything deserves to be redone.

Of course, during the investment period, there are many ways to innovate. In any case, as an entrepreneur, you have made an innovative product recognized by consumers.

At this time, there is another important thing for you, and that is to build barriers and create a moat of intangible assets.

What are barriers?

No matter how good your product is, is it possible for others to do as well as you? If others can do it, then you have no barriers and your users will be taken away by others.

How can we have barriers?

You just need to build a moat of your intangible assets during the investment period, so that others can’t make your products and can’t steal your customers.

So, what is most important during the investment period?

The ability to innovate is the most important, and the most important thing is to dig a moat of intangible assets for oneself and form barriers.

I heard many people say that in the investment period, products made first have first-mover advantages.

Indeed, first mover has an advantage, but we must clearly know in our hearts that first mover advantage is not a moat, first mover advantage just helps you get the time to dig the moat.

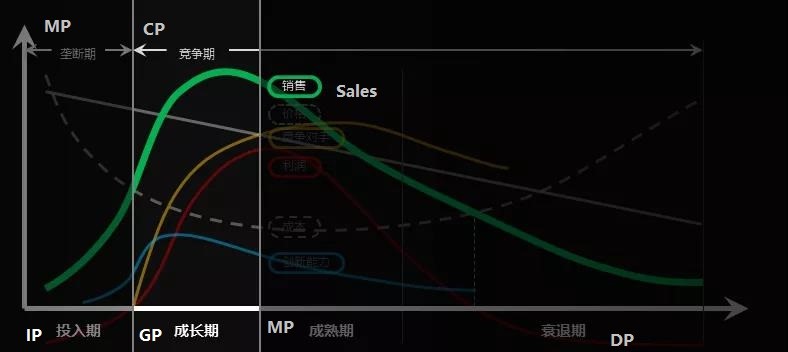

3. What is most important during the growth period?

After talking about the investment period, what is the most important thing to enter the growth period?

Which of the six lines of sales, cost, price, innovation ability, competitors, and profit is the most important?

Sales are the most important.

Why?

Because your business has reached the growth stage and your products have been recognized by some users, what you have to do at this time is to continuously expand the market through sales.

As the market continues to expand, you can continue to reduce costs.

This will give you a huge advantage.

Therefore, in the growth period, the sales line is the most important to you.

In the growth period, how can we increase sales?

Amazon’s founder Bezos is often asked a question: “What will happen in the next 10 years?”

He did not answer the doubts of others, but left another classic answer:

Few people ask me another question, what will remain the same in the next 10 years?

I think the second question is more important than the first because you need to base your strategy on things that are constant.

What do consumers always want?

Consumers always want lower-priced products, faster logistics, and more product choices. These things will never change.

So Amazon puts its energy on these constant things-to give customers the most benefits.

So the question of how to increase sales and expand the scale of the market has become, how do we reduce the cost of our products.

To reduce the cost of goods, don’t just focus on production costs, but more on transaction costs.

For example, live broadcasts and online celebrities bring goods, which greatly reduces the cost of consumer trust;

For example, the high-speed rail and the Arctic waterway, which has been hyped up this year, may reduce logistics costs.

All of what we do is to benefit users and allow consumers to enjoy better quality products at lower prices.

Only in this way can we continue to expand the market scale.

When your scale is large enough, then you will find that you have unknowingly dug a second moat for your business-the effect of scale.

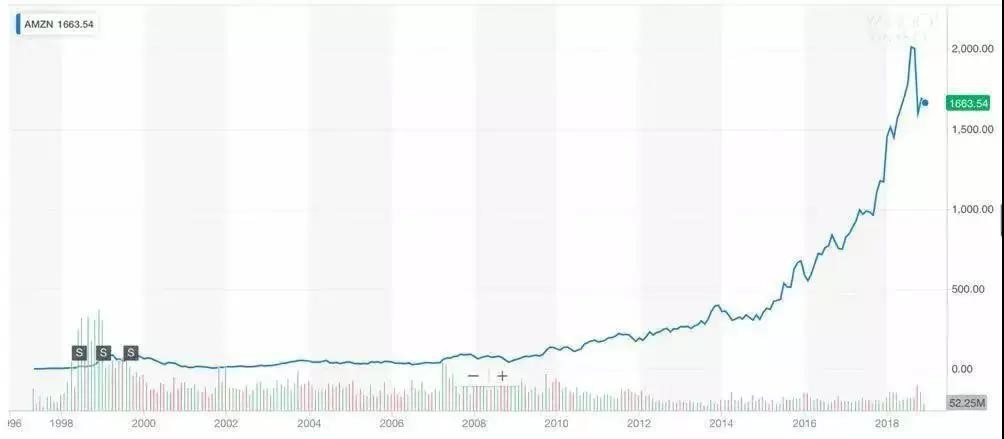

Bezos’s Amazon has been losing money and has been losing money since its establishment. Why?

Because he wants to give consumers lower prices.

But he has become the richest man in the world, why?

Because lower prices can increase Amazon’s larger sales scale. Until 2015, Amazon’s scale was so large that other competitors couldn’t get in, and couldn’t do anything cheaper than Amazon’s price.

Because of this scale effect moat, Amazon’s stock price has skyrocketed since then.

4. What is most important at maturity?

The enterprise has passed the growth period and reached the maturity period.

Op dit stuit, hokker fan 'e seis rigels fan ferkeap, kosten, priis, ynnovaasjefermogen, konkurrinten en winst is it wichtichste?

It is winst, en winst is it wichtichste.

Nei't jo de groeiperioade hawwe trochgien, hawwe jo produkten al skaal en ferkear hân, jo hawwe barriêres fêststeld, en hawwe in merk. Sille jo op dit stuit begjinne mei jild te meitsjen?

Hoe jild te meitsjen?

Fertsjinje jild troch te foldwaan oan 'e differinsearre behoeften fan konsuminten fia ferskaat produkten.

Wat is de betsjutting?

Yn 'e ynvestearringsperioade en groeiperioade brûke in protte fan ús bedriuwen eksplosive produktstrategyen, konsintrearje alle boarnen fan it bedriuw om ien of twa ultime inkele produkten te meitsjen, en de merkskaal út te wreidzjen.

Mar as it giet om folwoeksenheid, binne dizze inkele produkten meastal ôfwetteringsprodukten. Wy moatte oare produkten produsearje om te foldwaan oan 'e behoeften fan ferskate brûkers en winst te meitsjen.

Lei Jun sei ienris dat it wierskynlik betsjuttet dat in protte fabrikanten fan mobile tillefoans elk jier in protte enerzjy besteegje om in ferskaat oan mobile tillefoans te ûntwikkeljen, en Xiaomi moat al har ynspanningen konsintrearje om in mobile tillefoan te meitsjen.

Mar wêrom hat Xiaomi no safolle produkten, neist mobile tillefoans, machtbanken, armbanden en oare technologyprodukten, makket it ek deistige needsaak fan hege kwaliteit lykas handoeken en matrassen.

Why?

Ik frege Liu De, de persoan dy't ferantwurdlik is foar de ekologyske keten fan Xiaomi, foar dizze fraach.

Liu De sei dat dit soarte fan bedriuw is in “roastere swiete ierappel bedriuw” for Xiaomi. What’s the meaning?

Xiaomi has developed a huge amount of user traffic to this day. In addition to technological products such as Xiaomi mobile phones, power banks, bracelets, etc., they also need high-quality daily necessities such as towels and mattresses.

So instead of letting these traffic dissipate in vain, it is better to use these traffic to convert some turnover.

Just like a hot stove, its heat will dissipate, it is better to use the residual heat to roast some sweet potatoes.

This is Xiaomi’s “roastere swiete ierappel bedriuw”, which is actually a diversification strategy in essence.

Another example is Apple. Jobs once said that Apple only makes products that can fit a table.

But now, a table of Apple products has long been unable to fit.

Another example is Google. Google renamed its parent company Alphabet a few years ago, which means alphabet in English.

So, let’s look at the companies under Alphabet.

In the mature period, the most important thing is to make profits through diversified products to meet the differentiated needs of consumers. So at this stage, what moat should we continue to build?

The answer is the two moats of network effects and branding.

What is the brand? A brand is actually a knife handed by a company to consumers, saying that if I dare to lie to you, you will stab me to death with this knife.

The company builds a brand and invests a lot of cost in advertising every year, which is to store value on this brand.

In case there are some problems with this brand, consumers can report this brand through online exposure, 12315 complaints, etc.

The value that this brand has kept in these years has disappeared.

So the brand is a knife handed to consumers.

It will never be the product that really gives you a competitive advantage, but the brand that continues to precipitate through the product.

The ultimate destination of the product is the brand.

What about network effects. Network effects mean that the value of a certain product to a user depends on the number of other users using the product. The more users, the more valuable, the more valuable, and the more users.

Such as WeChat.

Once the scale of WeChat breaks through a critical point to form a network effect, there will be almost no chance for other social products that are similar to WeChat.

Because as a social tool, even if the new tool is better to use, but without my friends on it, I would not use it.

This is the network effect.

In the mature period, you must continue to build your network effect and brand moats while continuing to make profits.

5. What is most important in a recession?

After the maturity period, we have to face a reality, that is, our products will eventually come to its decline.

So in a recession, what is the most important of these 6 lines?

Cost.

Because during this period, you can make the product decline more slowly by continuously reducing costs.

When Steve Jobs regained control of Apple, why would he only make a product that fits a table?

That’s because when Jobs said this, the funds on Apple’s books were not enough to support Apple’s life for three months.

So Apple must shrink its unprofitable product lines and reduce costs.

For another example, once the PC giant IBM, what did IBM do after IBM’s PC business entered a period of decline? Sold to Lenovo.

Procter & Gamble, which owns more than 200 brands, has already cut off more than 100 brands during the period of decline.

During the recession, we continue to reduce costs to delay the recession. At this time, what moat do we need to make the product decline more slowly?

It requires a moat of migration costs.

What is the moat of migration cost?

For example, two companies A and B provide services at the same time.

You are using the service of Company A, and the service assumption is 7. And B can provide 8 services.

If the migration is very smooth and there is no cost, then of course you will use B’s service. But once you migrate there is a cost in the past, you are afraid of trouble, suppose this cost is 2.

Then you won’t turn it over. After all, the value that B gives you is 8, and the cost you spend in the past is 7+2=9>8.

Ferjit it, draai it net. Jo tinke sa.

Dit is de grêft fan migraasjekosten.

De tiid/enerzjykosten fan brûkers dy't jo produkt net brûke, de kosten fan ferlerne aktiva, en de kosten fan relaasjekonverzje kinne jo allegear in grêft grave en brûkers tastean om jo stadich te ferlitten.

Gearfetsje

Produkten, lykas minsken en bedriuwen, kinne ek wurde beskôge as in libben. D'r binne ynvestearringsperioade, groeiperioade, ferfaltiidperioade, en ôffalperioade.

Yn 'e ynvestearringsperioade is it fermogen om te ynnovearjen it wichtichste. Op dit stuit, beskôgje it bouwen fan in patint grêft;

Tidens de groei perioade, ferkeap binne de wichtichste, en fierder te bouwen fan in grêft fan skaalfergrutting effekt;

In the mature period, profit is the most important, and continue to build network effects and brand moats;

During the recession period, cost is the most important, and the cost of migration is used to slow down the decline of the product.

On the first day when we decide to make a product, we have to think clearly about how our product ultimately died.

For example, Apple launches a new iPhone every year. You can think of it as giving birth to a son, but what does it mean when he launches this iPhone?

It means that he killed the last iPhone by himself.

It’s like Apple keeps having sons every year, and then kills another son.

It sounds particularly cruel, but this is the cruel business world.

If this son is not killed by Apple itself, but by a competitor, the result will only be worse.

Finally, I want to say that although the business is getting harder and harder, it has changed from elevator mode to rock climbing mode. But when we add the timeline, you know which direction you should go in the future.

It’s like, even if you are at the starting point, your heart has already reached the other side.