Recently, the market research firm NPD Group, based on the tracking of the toy category in the US market, revealed the “top-selling” products in this category through its sales data in the first half of this year, and summarized the changes in American toy consumption behavior. .

- S. toy industry sales rose 2% ($231 million) to $11.4 billion from January to June 2022, according to NPD Group. Of this, unit sales fell 6%.

In addition, in line with the annual U.S. inflation rate, the average selling price of its toy category increased by 8% in the first half of this year to $11.3, while the previous year and last year increased by 19% and 6% respectively.

In the past two years, the sales for toy industry in U.S have increased by 18% and 20%, respectively, breaking sales records repeatedly.

American toy industry consultant Juli Lennett said that although the toy industry grew by only 2% in the first half of this year, the momentum of this category in the U.S. market is still not to be underestimated. Because of the 14 industries tracked by NPD, only 6 industries still achieved growth in the first half of this year after two years of growth at the peak of the epidemic.

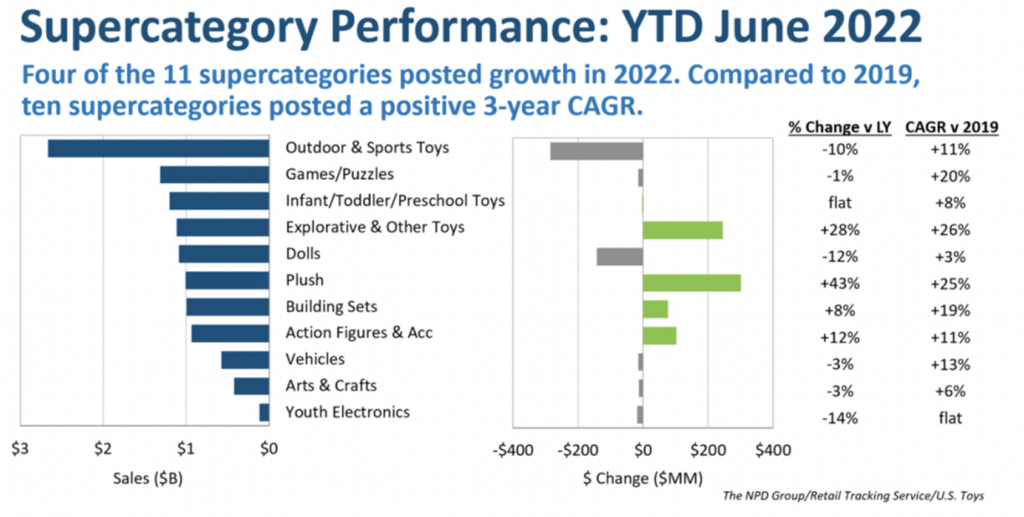

Among the 11 major toy categories tracked by NPD, four experienced sales growth in the first half of the year. There are 10 major categories with positive three-year CAGRs compared to 2019.

Outdoor and sports toys still hold the top spot in the U.S. toy market, with sales of $2.7 billion. And plush toys saw the fastest growth, up 43 percent to $301 million.

These figures demonstrate the resilience of the U.S. toy industry in these uncertain economic times.

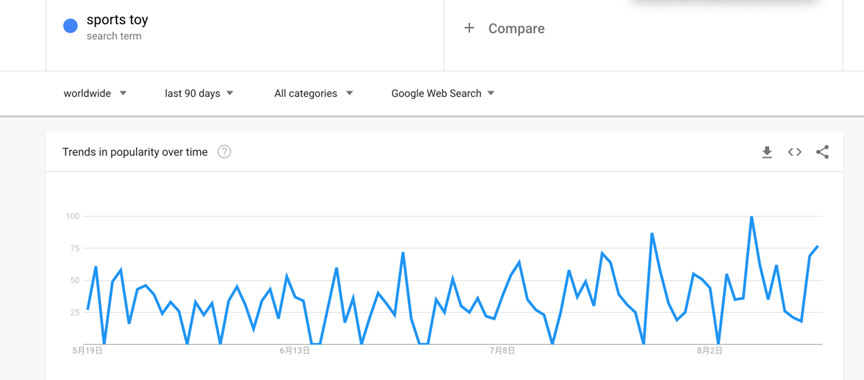

Predict the market trend the second half of the year based on sales data in the first half in the U.S.

Recently, the market research firm NPD Group, based on the tracking of the toy category in the US market, revealed the “top-selling” products in this category through its sales data in the first half of this year, and summarized the changes in American toy consumption behavior. .

- S. toy industry sales rose 2% ($231 million) to $11.4 billion from January to June 2022, according to NPD Group. Of this, unit sales fell 6%.

In addition, in line with the annual U.S. inflation rate, the average selling price of its toy category increased by 8% in the first half of this year to $11.3, while the previous year and last year increased by 19% and 6% respectively.

In the past two years, the sales for toy industry in U.S have increased by 18% and 20%, respectively, breaking sales records repeatedly.

American toy industry consultant Juli Lennett said that although the toy industry grew by only 2% in the first half of this year, the momentum of this category in the U.S. market is still not to be underestimated. Because of the 14 industries tracked by NPD, only 6 industries still achieved growth in the first half of this year after two years of growth at the peak of the epidemic.

Among the 11 major toy categories tracked by NPD, four experienced sales growth in the first half of the year. There are 10 major categories with positive three-year CAGRs compared to 2019.

Outdoor and sports toys still hold the top spot in the U.S. toy market, with sales of $2.7 billion. And plush toys saw the fastest growth, up 43 percent to $301 million.

These figures demonstrate the resilience of the U.S. toy industry in these uncertain economic times.

Multi-product growth, strong market driving force

For the plush toy category, Squishmallows, Magic Mixies and Disney toys were the main drivers of growth. In the first half of the year, 7 of the 15 best-selling toys in the United States were Squishmallows.

Exploration and related toys grew 28%, with the NBA, NFL and MLB leading the growth in this category with sports trading cards.

Sales of figures, figures and accessories also showed double-digit growth. With the release of “Jurassic World 3: Domination” in June, the sales of its peripheral toy products have increased, and it has become the first of such products. Second is Funko Pop! A series of toys and “Sonic the Hedgehog” merchandising figures.

Building sets saw an 8% increase, with LEGO Star Wars seeing the fastest growth, followed by LEGO Creator Expert and LEGO Craft.

Inflation persists, consumer toy spending changes

Through its insights into U.S. toy consumers, NPD also summarizes the following 4 changes in consumer behavior.

In the U.S., adult demand for toys is also high, with households without children spending more on toys (up 4 percent) than households with children (up 1 percent).

With the current negative economic impact, American households with higher incomes have more purchasing power. Spending on toys for households with incomes above $100,000 rose 6 percent, while those with incomes under $50,000 fell 2 percent.

At the same time, Americans increased their spending on toys, but bought them less frequently, which was associated with higher product prices. And compared to the past, Americans are more fond of online shopping toys this year.

Currently, U.S. toy buyer penetration has increased by 0.1%, adding about 155,000 buyers overall. Overall, buyer penetration was largely flat throughout the year, but maintained a substantial increase in new buyers over the past few years, with nearly 16 million more buyers in the toy industry compared to 2019.

Juli Lennett said the toy industry is expected to continue to outperform other industries in the second half of the year, although U.S. consumers have reduced spending due to the financial crisis.

Multi-product growth, strong market driving force

For the plush toy category, Squishmallows, Magic Mixies and Disney toys were the main drivers of growth. In the first half of the year, 7 of the 15 best-selling toys in the United States were Squishmallows.

Exploration and related toys grew 28%, with the NBA, NFL and MLB leading the growth in this category with sports trading cards.

Sales of figures, figures and accessories also showed double-digit growth. With the release of “Jurassic World 3: Domination” in June, the sales of its peripheral toy products have increased, and it has become the first of such products. Second is Funko Pop! A series of toys and “Sonic the Hedgehog” merchandising figures.

Building sets saw an 8% increase, with LEGO Star Wars seeing the fastest growth, followed by LEGO Creator Expert and LEGO Craft.

Inflation persists, consumer toy spending changes

Through its insights into U.S. toy consumers, NPD also summarizes the following 4 changes in consumer behavior.

In the U.S., adult demand for toys is also high, with households without children spending more on toys (up 4 percent) than households with children (up 1 percent).

With the current negative economic impact, American households with higher incomes have more purchasing power. Spending on toys for households with incomes above $100,000 rose 6 percent, while those with incomes under $50,000 fell 2 percent.

At the same time, Americans increased their spending on toys, but bought them less frequently, which was associated with higher product prices. And compared to the past, Americans are more fond of online shopping toys this year.

Currently, U.S. toy buyer penetration has increased by 0.1%, adding about 155,000 buyers overall. Overall, buyer penetration was largely flat throughout the year, but maintained a substantial increase in new buyers over the past few years, with nearly 16 million more buyers in the toy industry compared to 2019.

Juli Lennett said the toy industry is expected to continue to outperform other industries in the second half of the year, although U.S. consumers have reduced spending due to the financial crisis.