جنوبی کوریا دنیا کی ای کامرس مارکیٹ کے سب سے ترقی یافتہ ممالک میں سے ایک ہے۔ بین الاقوامی مالیاتی فنڈ نے پیش گوئی کی ہے کہ 2026 تک ، جنوبی کوریا کی ای کامرس مارکیٹ کا سائز جاپانی مارکیٹ میں تقریبا 12 فیصد تک رہنمائی کرسکتا ہے۔ میں “2019 کاروباری درجہ بندی کرنے میں آسانی” اس سے قبل ورلڈ بینک کے ذریعہ جاری کیا گیا تھا ، جنوبی کوریا اس فہرست میں مجموعی طور پر 189 ممالک میں پانچویں نمبر پر ہے ، جبکہ امریکہ چھٹے نمبر پر ہے اور برطانیہ آٹھویں نمبر پر ہے۔ وبا کے کنٹرول کی مدت کے دوران ، معیشت بند کردی گئی تھی اور جسمانی اسٹورز بند کردیئے گئے تھے ، اور جن کو اپنی کھپت کی عادات کو تبدیل کرنے پر مجبور کیا گیا تھا ان کا ذائقہ اس کا ذائقہ تھا “تازگی” آن لائن شاپنگ ، خاص طور پر بوڑھے صارفین ، جنوبی کوریا کی پہلے سے ہی اعلی انٹرنیٹ دخول کی شرح کو ایک ریکارڈ بلند کرنا۔

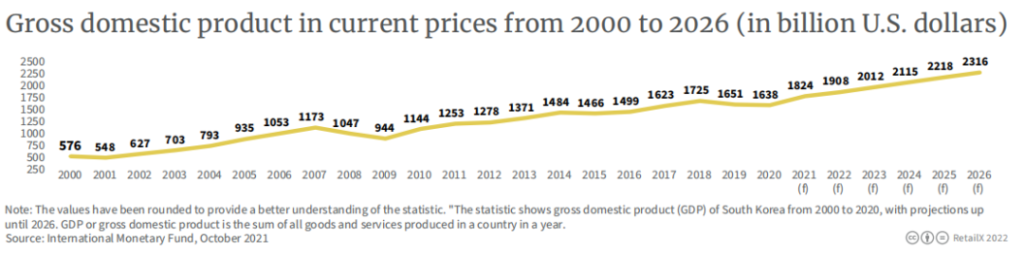

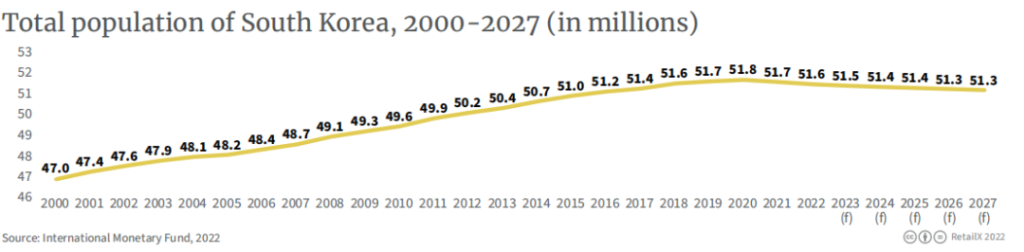

پورے سال 2022 کے لئے جنوبی کوریا کی جی ڈی پی کی پیش گوئی .8 190.8 بلین ڈالر ہے ، جو 2027 تک بڑھ کر 2،316 بلین ڈالر ہوگئی ہے۔ جنوبی کوریا کی موجودہ کل آبادی تقریبا 51.7 ملین ہے ، لیکن کم شرح پیدائش کے اثر و رسوخ کے تحت ، اوسط متوقع عمر میں اضافہ اور اس کی کمی کی کمی ہے۔ غیر ملکی مزدوری ، کل آبادی میں تبدیلی نے نیچے کی طرف رجحان ظاہر کیا ہے ، اور یہ 2070 تک پہاڑ کی طرح کمی کا باعث بن سکتا ہے۔

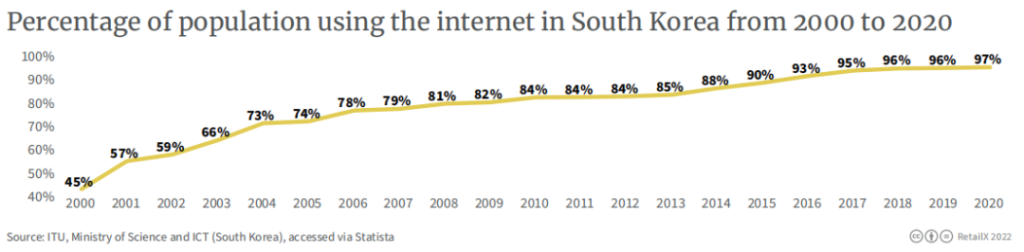

2020 میں ، جنوبی کوریا کی انٹرنیٹ دخول کی شرح 97 ٪ ہے۔ ٹھوس معاشی بنیاد اور مضبوط معاشی بحالی کی پالیسیوں نے جنوبی کوریا کو وبا کے زیر اثر عالمی معاشی بدحالی سے بچنے میں کامیابی کے ساتھ مدد کی ہے۔ بینک آف کوریا کے اعداد و شمار کے مطابق ، 2021 میں جنوبی کوریا کی معیشت میں 4.1 فیصد اضافہ ہوگا ، جو 11 سالوں میں سب سے تیز اور 4 ٪ کی پچھلی پیش گوئی سے زیادہ ہے۔ لیکن جون 2022 کا جامع صارف اعتماد انڈیکس (سی سی ایس آئی) ، جو معیشت کی کارکردگی کے بارے میں صارفین کی امید پرستی کا ایک پیمانہ ہے ، مئی سے 6.2 فیصد کم تھا۔

کورین ای کامرس مارکیٹ کا جائزہ

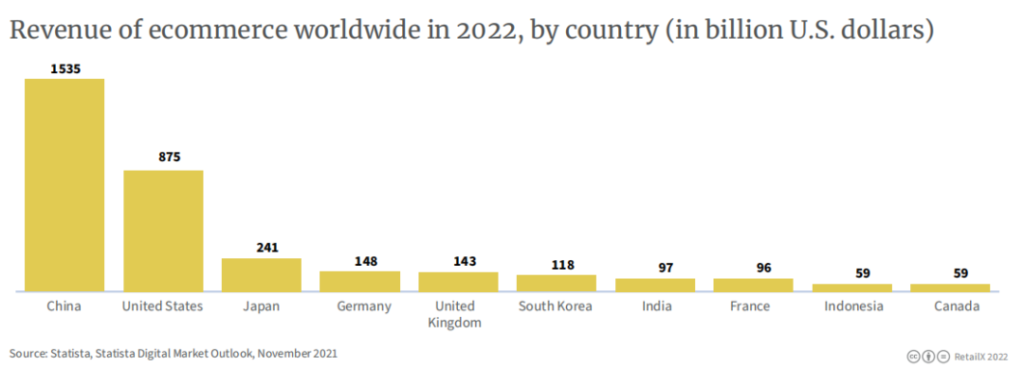

چین ، ریاستہائے متحدہ امریکہ ، جاپان ، جرمنی اور برطانیہ کے بعد ، جنوبی کوریا دنیا کی چھٹے سب سے بڑی ای کامرس مارکیٹ ہے ، جس میں پورے سال 2022 میں 118 بلین ڈالر کی متوقع آمدنی ہے۔ معاشی عالمگیریت کو گہرا کرنے کے ساتھ ، روس اور یوکرین کے مابین تنازعات آہستہ آہستہ جنوبی کوریا میں پھیل چکے ہیں۔ اس پس منظر کے تحت کہ سپلائی چین سائیکل کو مزید لمبا کردیا گیا ہے اور اجناس کی قیمتوں میں زیادہ افراط زر کی وجہ سے تیزی سے اضافہ ہوا ہے ، جنوبی کوریا کی گھریلو مارکیٹ "بھاری بوجھ کے ساتھ آگے بڑھنے" شروع ہوگئی ہے۔ “سفر

جنوبی کوریا کی آن لائن خوردہ فروخت میں کل خوردہ فروخت کا 32 ٪ حصہ تھا ، جو صرف چین (46 ٪) اور برطانیہ (36 ٪) کے بعد دوسرا ہے۔ ترقی یافتہ ای کامرس صنعتوں جیسے انڈونیشیا (20 ٪) اور ریاستہائے متحدہ (16 ٪) والے ممالک کو اس کے پیچھے چھوڑ دیا گیا تھا۔ ایک چھوٹا سا خلا نہیں۔

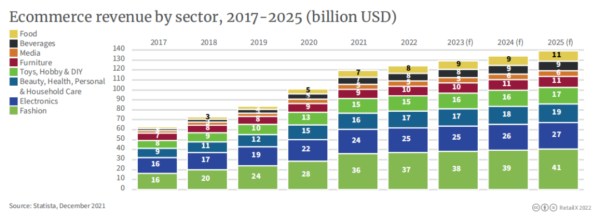

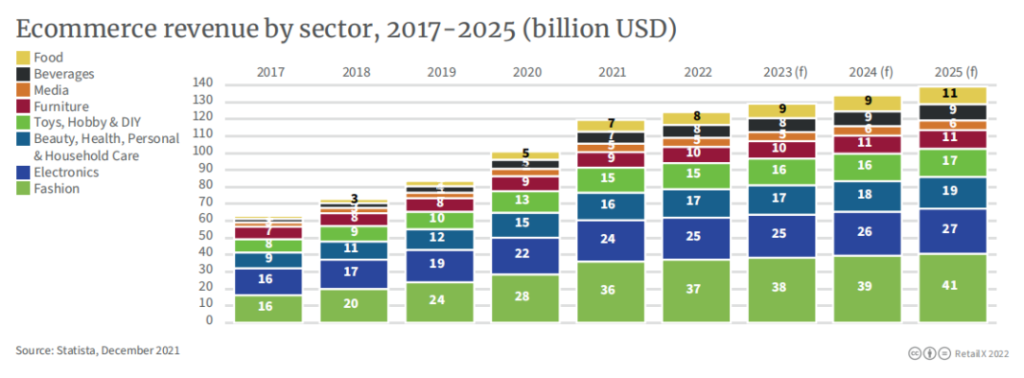

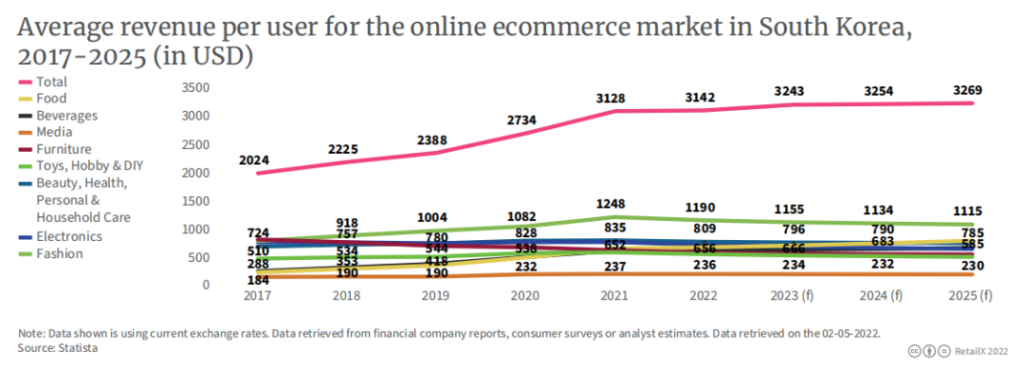

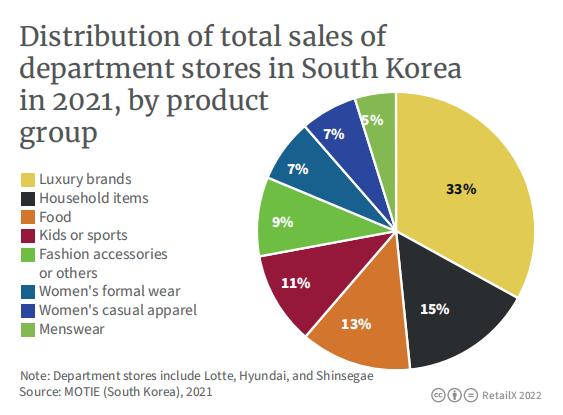

زمرہ کے لحاظ سے ، فیشن کی مصنوعات کورین ای کامرس مارکیٹ کی آمدنی کا زیادہ تر حصہ ہیں ، جس کی تخمینہ شدہ آمدنی 2025 میں billion 41 بلین ہے ، اس کے بعد الیکٹرانکس (27 بلین ڈالر) ، خوبصورتی ہے۔ & صحت & ذاتی نگہداشت & ہوم کیئر (19 بلین ڈالر) ، کھلونے & شوق & DIY ($ 17 بلین)

جنوبی کوریا کے ای کامرس کے امکانات

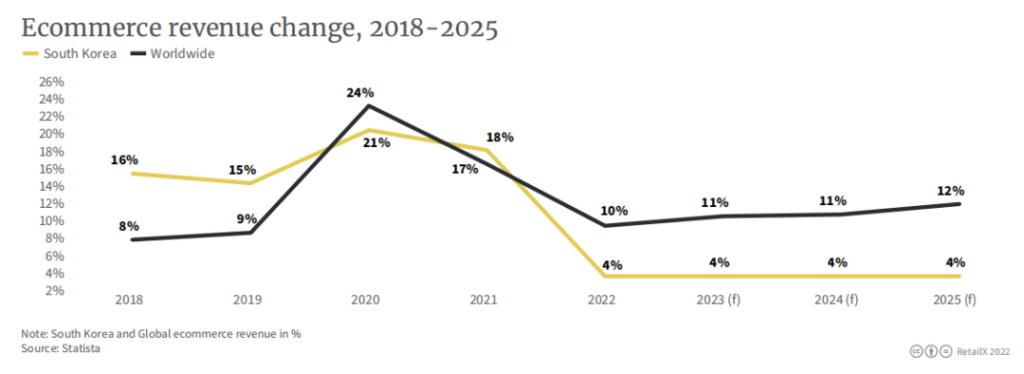

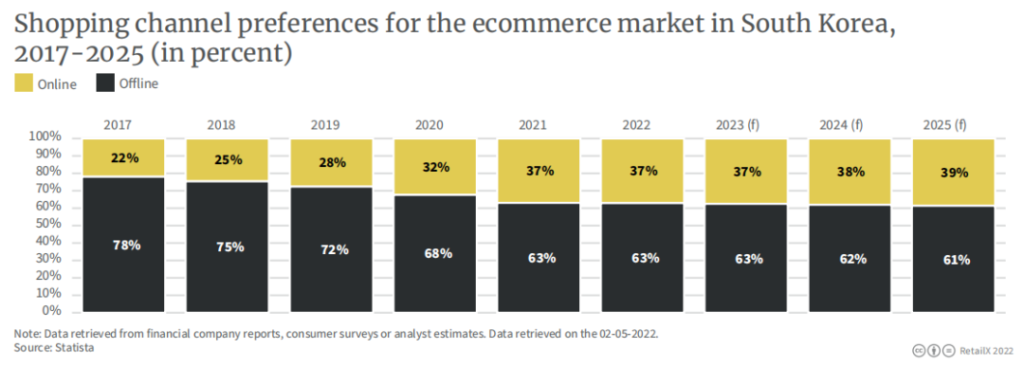

توقع کی جارہی ہے کہ جنوبی کوریا کے ای کامرس کی آمدنی اگلے چند سالوں میں سالانہ شرح نمو کو 4 ٪ برقرار رکھے گی ، جبکہ اسی عرصے کے دوران عالمی آمدنی میں 10 فیصد اضافے کی پیش گوئی کی جارہی ہے ، اور 2025 میں اس میں 12 فیصد اضافہ ہوگا۔ تناسب توقع ہے کہ 2025 میں جنوبی کوریا میں آن لائن خریداری نسبتا 39 39 فیصد رہے گی ، جو 2022 میں 37 فیصد تھی۔

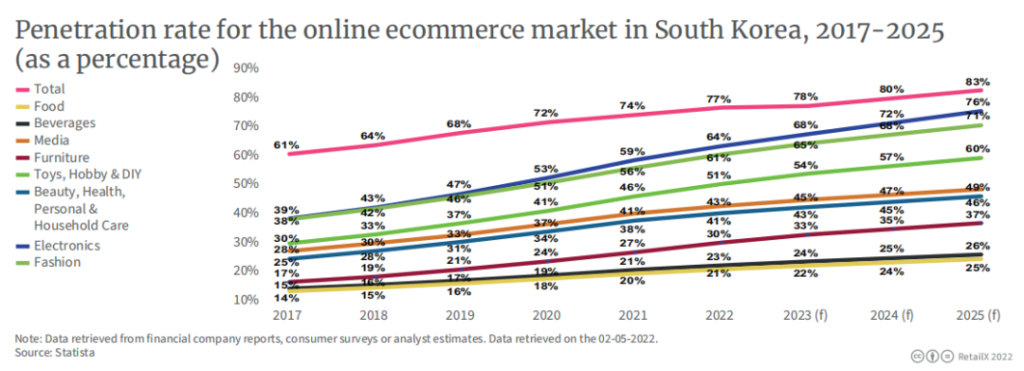

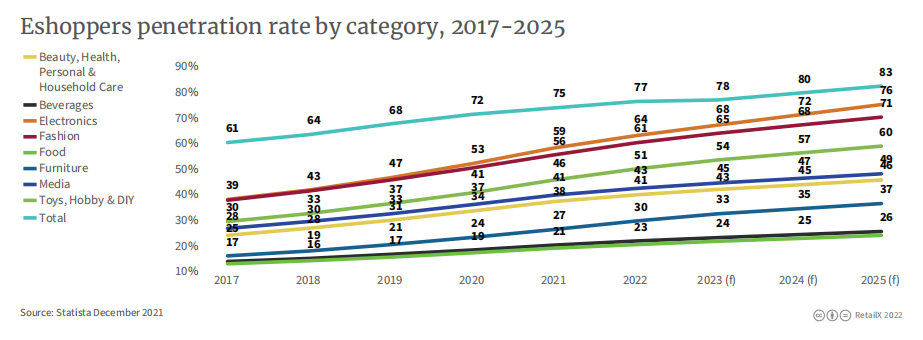

Analysts expect that with the expansion of the middle class and the continuation of online shopping habits after the epidemic, the e-commerce market in East and Southeast Asia still has room to rise. The Korean people’s demand for food and beverage products is the primary reason for the rapid growth of local e-commerce. It is expected that the e-commerce revenue of food and beverage will exceed 20 billion US dollars by 2025, and the market penetration rate will reach 25% and 26% respectively. , up from 21% and 23% this year.

Nowadays, there is no country in the world that is not burdened by rising prices. In South Korea, where the e-commerce market is highly developed and “invoked”, people do enjoy benefits through online shopping, which is also the key reason behind the increase in e-commerce penetration rate year after year.

Focus on local market trends in Korea

· The luxury market is booming

میڈیا کی پیکیجنگ کی وکالت کے تحت ، اعلی کے آخر میں لگژری مارکیٹ آہستہ آہستہ جنوبی کوریا میں خوشبودار پیسٹری بن گئی ہے۔ 2022 میں ، توقع کی جارہی ہے کہ لگژری مارکیٹ کی آمدنی 6.39 بلین ڈالر تک پہنچ جائے گی اور توقع کی جاتی ہے کہ 2027 کے دوران 4.83 فیصد کی سالانہ شرح میں اضافہ ہوگا۔ جنوبی کوریا کی نسبتا high زیادہ ڈسپوز ایبل آمدنی کا مطلب یہ ہے کہ زیادہ تر لوگ عیش و آرام کی چیزیں برداشت کرسکتے ہیں۔ 2020 میں ، 60 سال سے زیادہ عمر کے کوریائی باشندوں کے پاس تمام عمر کے گروپوں میں سب سے زیادہ استعمال والے لگژری سامان خرچ ہوتے ہیں ، جو اوسطا تقریبا 413،154 ون ون تک پہنچ جاتے ہیں۔

· عروج پر برہم

2017 کے بعد سے ، برہم کی اصطلاح (ہانجوک) آہستہ آہستہ جنوبی کوریا میں مقبول ہوگئی ہے ، جس سے مراد ان لوگوں کی تعداد ہے جو تنہا رہنے کا انتخاب کرتے ہیں۔ اس خیال کا عروج عمر بڑھنے والی آبادی کے مسئلے کو مزید بڑھاتا ہے۔ 2020 میں ، جنوبی کوریا میں سنگل شخصی گھرانوں کا تناسب 31.7 فیصد تک پہنچ گیا ، جو ریکارڈ اعلی ہے۔ سنگل گروپ کی بنیادی ترکیب 20 سال سے زیادہ اور 40 سال سے زیادہ پرانی ہے۔ ان میں سے زیادہ تر لوگ پیسہ خرچ کرنا پسند کرتے ہیں اور پیسہ خرچ کرنے کو تیار ہیں۔

food سنگل فوڈ کلچر غالب ہے

2021 میں راکوٹین انسائٹ کے ذریعہ شروع کیے گئے ایک سروے کے مطابق ، آرڈر دینے کے لئے فوڈ ڈلیوری ایپس کا استعمال کرتے ہوئے سروے کیے گئے 45 ٪ کوریائی باشندے 20،000 سے 30،000 ون کے درمیان خرچ کریں گے ، اور 38 ٪ 10،000 سے 20،000 ون کے درمیان خرچ کریں گے۔

· Brands go overseas

Korean cosmetics such as Innisfree and Sulwhasoo, as well as electronic products under Samsung and LG, which sell well all over the world, have laid a good foundation for Korean brands to go abroad. The advantage of overseas shopping is that you can buy your favorite overseas products at a relatively low price, but the price is that you need to pay high shipping costs. According to the International Trade Association, South Korea’s cross-border trade volume will increase from $2 billion in 2017 to $4.5 billion in 2022.

ایک طویل عرصے سے ، بیرون ملک مقیم صارفین کو کورین مصنوعات خریدنے میں زبان کی رکاوٹیں ، واحد ترسیل کے طریقے اور لمبے راستے بنیادی رکاوٹیں رہے ہیں۔ اس مزاحمت کو ختم کرنے کے ل many ، بہت سے خوردہ فروشوں نے براہ راست میل اور غیر ملکی زبان کی کسٹمر سروس سے متعلق مشاورتی خدمات فراہم کرنا شروع کردی ہے ، لیکن زیادہ تر غیر ملکی زبان کی خدمات صرف انگریزی تک ہی محدود ہیں۔ اور چینی۔

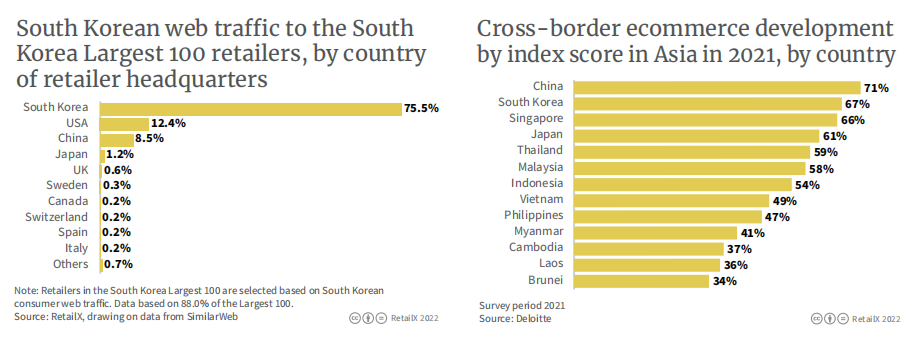

(The picture on the left shows the online traffic sources of the largest 100 retailers in South Korea. Korean consumers account for the vast majority, and consumers in China and the United States account for 12.4% and 8.5% respectively; the picture on the right shows cross-border e-commerce in Asian countries in 2021. In terms of development, South Korea has achieved second place after China)

اس سال کے شروع میں ، لوٹی ڈیوٹی فری نے سنگاپور ، ملائشیا ، تھائی لینڈ ، ریاستہائے متحدہ ، جاپان اور چین جیسے بیرون ملک ممالک کے لئے اپنا پہلا ای کامرس پلیٹ فارم شروع کیا ، جس میں بنیادی طور پر جنوبی کوریا سے تعلق رکھنے والی مصنوعات تھیں۔ اگر ان علاقوں میں صارفین مفت شپنگ کے لئے اہل ہوسکتے ہیں اگر وہ $ 70 سے زیادہ کے لئے طے کریں۔ شیلا ڈیوٹی فری اور علی بابا کا کینیاو پوائنٹ ٹو پوائنٹ لاجسٹک خدمات مہیا کرتا ہے۔ اپریل 2022 میں ، ایس ایس جی ڈاٹ کام سرحد پار سے کھانے کے زمرے کی خدمات… یہ دیکھا جاسکتا ہے کہ کوریائی ای کامرس پلیٹ فارم کا باہر کی طرف بڑھنے کا عزائم۔

· تصفیہ کی عادات

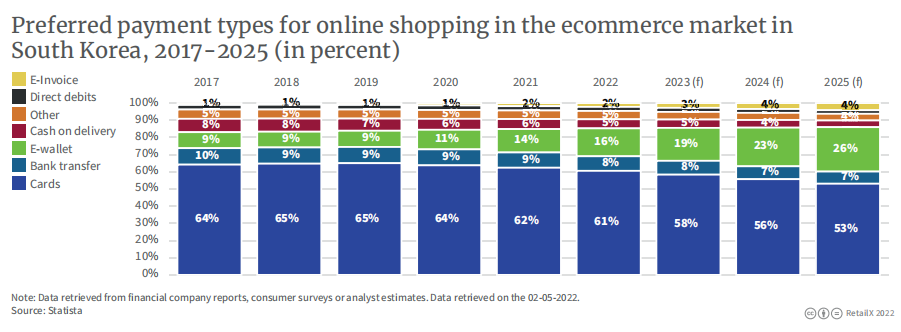

2021 میں ، جنوبی کوریا میں ایشیاء پیسیفک کے خطے میں کریڈٹ کارڈوں کی سب سے زیادہ دخول کی شرح ہوگی ، لیکن ادائیگی کے دیگر آسان طریقے بھی شامل ہیں ، جن میں کاکاو پے بھی شامل ہیں۔

Kakao Pay is a mobile payment platform under the Kakao Group. With Kakao Talk, a WeChat-like APP, it became popular in South Korea in a short period of time. Consumer platforms that now support Kakao Pay settlement include Apple Store, Google Play, Netflix and Spotify. Analysts predict that Kakao Pay’s users will grow by the millions in the next few years.

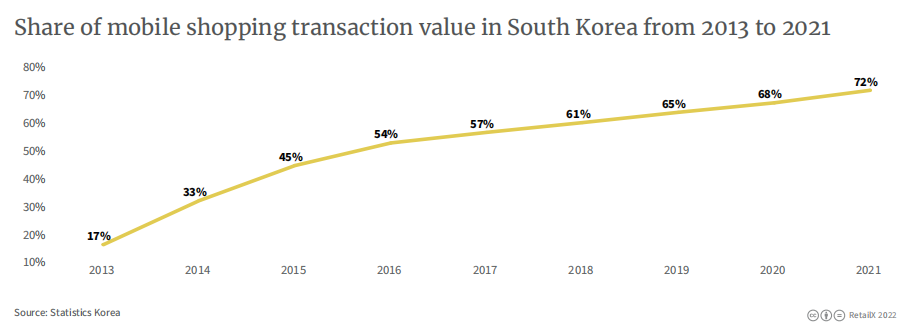

Data shows that in 2021, mobile consumption will account for 72% of the total online shopping transaction value in South Korea.

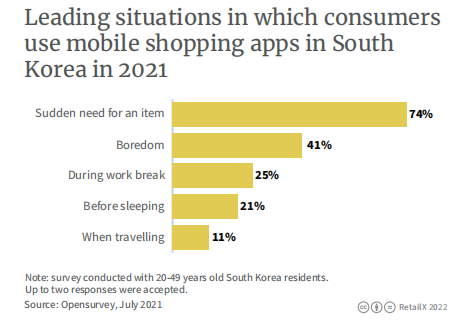

When asked why they use the app to shop, 74% of respondents answered “an urgent need for an item”, and 41% answered “whatever it is.”

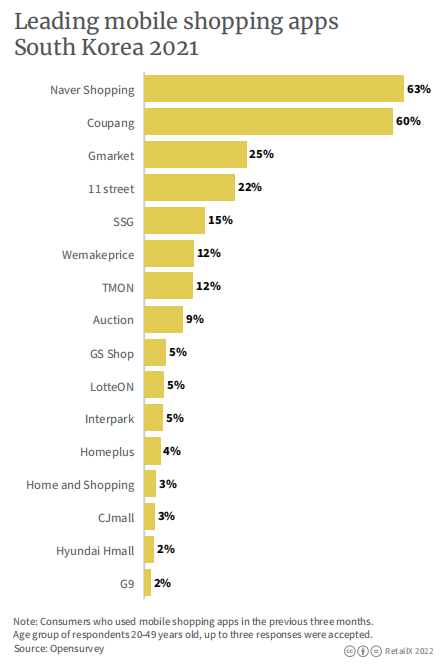

Respondents aged 20-49 who have used Naver Shopping, Coupang, and Gmarket in the past three months (the statistical time is the first three months of receiving the questions) accounted for 63%, 60%, and 25%, respectively.

· Consumer distribution

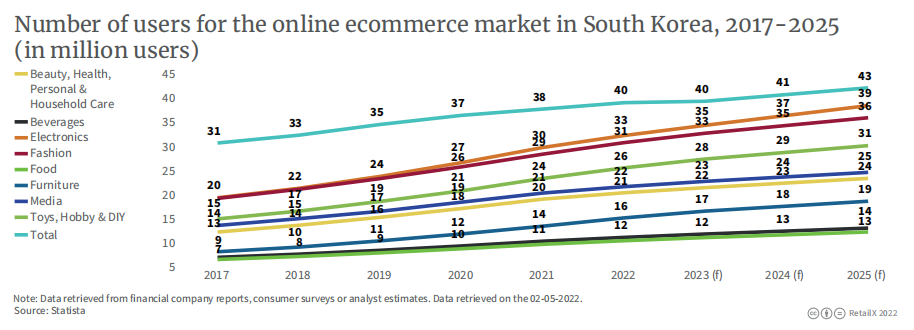

The penetration rate of e-commerce in South Korea is high, expected to be 77% in 2022, and it is expected to rise to 83% by 2025.

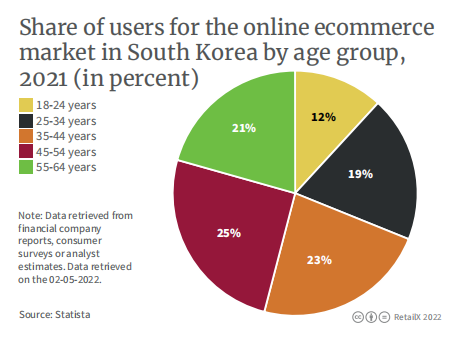

There will be about 40 million online shoppers in South Korea in 2022, and it is expected to grow to 43 million by 2025. In 2021, users in the age group of 45-54 will account for 25%, ranking first among all age groups. Surprisingly, the age group of 18-24 will account for the least, only 12%.

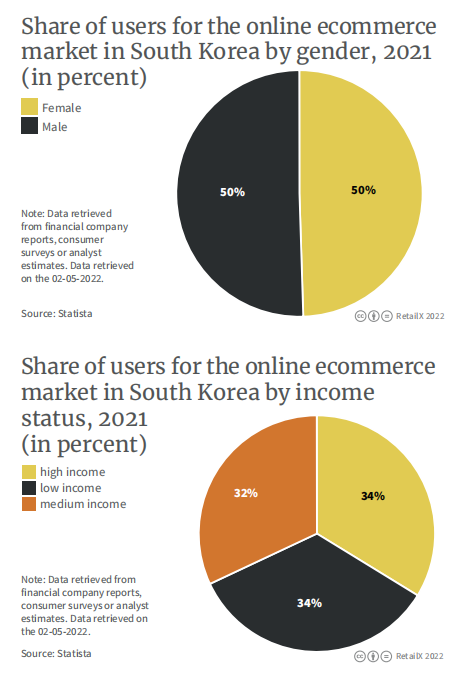

In terms of gender, the ratio of males to females among online shoppers is 50/50; taking economic income as the entry point, the distribution of low-, middle- and high-income groups is similar, and there is no significant difference.

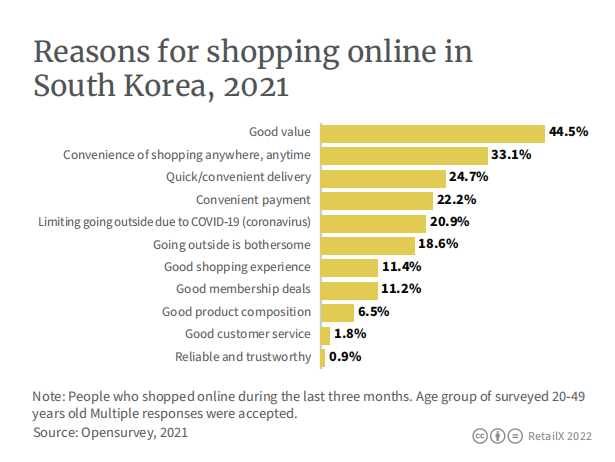

The reasons for online shopping are “good quality and low price” and “convenience” accounted for 44% and 33% respectively, while service and reliability accounted for very few.

Beauty & صحت & Personal Care and Home Care still account for the largest share, followed by beverages and electronics.

(User penetration rate of various categories from 2017 to 2025)

· platform

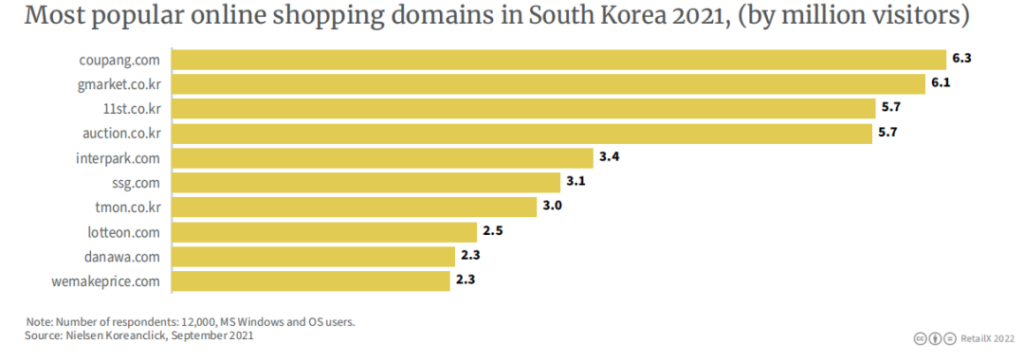

In September 2021, the number of visitors to Coupang will reach about 6.27 million, ranking first among the major e-commerce platforms in South Korea. It was followed by Gmarket with 6.2 million.

Founded in 2010, Coupang’s sales revenue in 2021 will reach 203,600 won. The Korea Times recently reported that Coupang’s paying members are close to 10 million, surpassing Shinsegae’s 6 million. According to Export2Asia, 70% of South Koreans live within a 10-minute drive from the Coupang logistics center. Coupang logistics capacity, especially the last mile delivery capacity, is almost at the “ceiling” level in South Korea.

Although Coupang’s main target is local users in South Korea, it has now expanded to international markets including Singapore, Japan and Taiwan, and its global expansion plan is still in progress.

· Changes in consumption habits before and after the epidemic

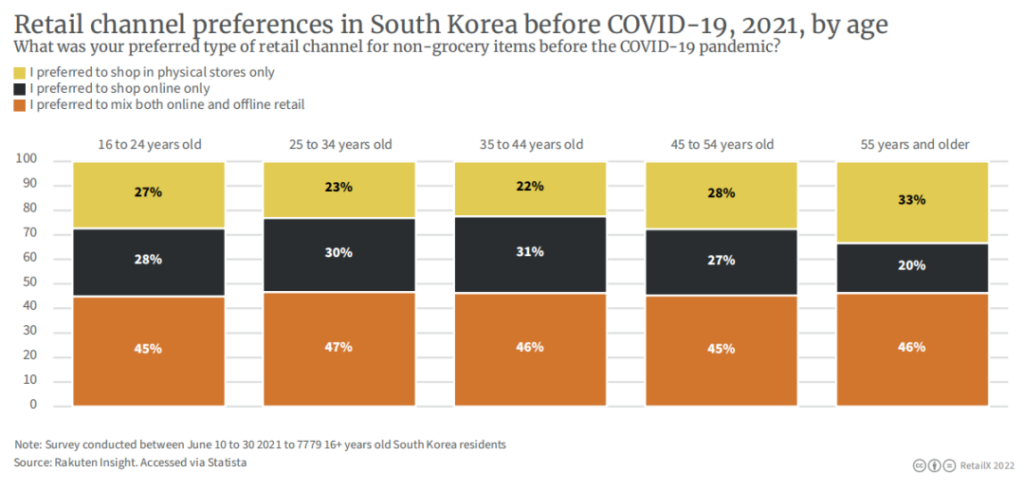

Research by RetailX shows that before the pandemic, 45% of respondents aged 16 to 24 were shopping both online and in-store when purchasing non-grocery products, preferring online shopping (28%) or a brick-and-mortar preference The proportion of store consumption (accounting for 27%) is the same. A similar trend can be seen in slightly older age groups, with 47% of respondents aged 25 to 34, 46% of respondents aged 35 to 44 opting for a hybrid shopping model; 33% of respondents aged 55 and over Respondents said they were more inclined to shop in brick-and-mortar stores before the epidemic, and only 20% of consumers in this age group chose to shop online. Among all age groups surveyed, the proportion of choosing mixed shopping is basically the same, accounting for 45% and above.

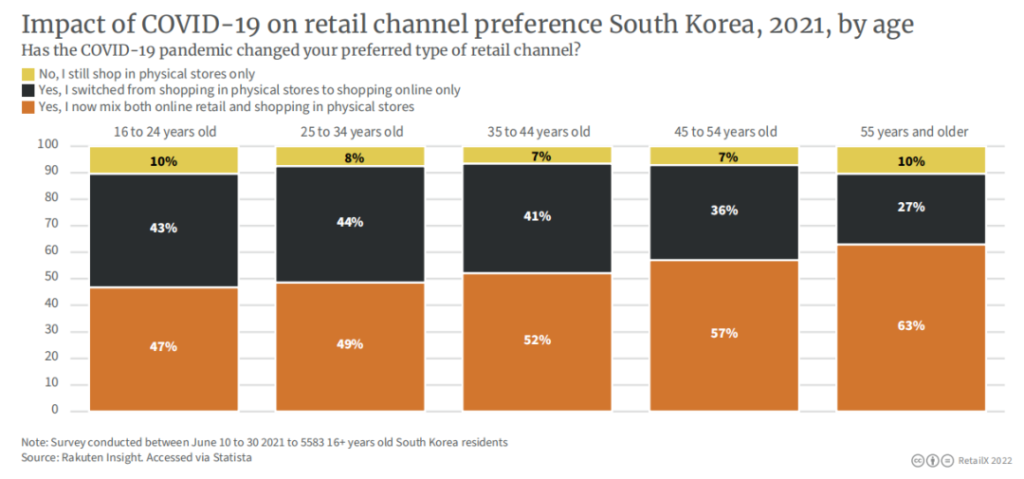

When asked if the pandemic has affected their shopping habits, 10% of respondents aged 16 to 24 said they still stick to in-store purchases, while 43% said they switched from in-store shopping to online-only shopping , 47% of respondents prefer a mixed shopping model.

A similar trend can be seen among the 25 to 34-year-old group, with only 8% of respondents insisting on shopping in brick-and-mortar stores, 44% switching from brick-and-mortar to online shopping, and 49% opting for a mix of shopping. Respondents aged 35 to 44 showed similar preferences.

The change was most pronounced in older age groups, with 57% of respondents aged 45 to 54 reporting a dabbling in both brick-and-mortar and online shopping. In the age group 55 and older, that rose to 63 percent. This shows that most of the people who are deeply affected by the epidemic and change their shopping habits are middle-aged and elderly people.