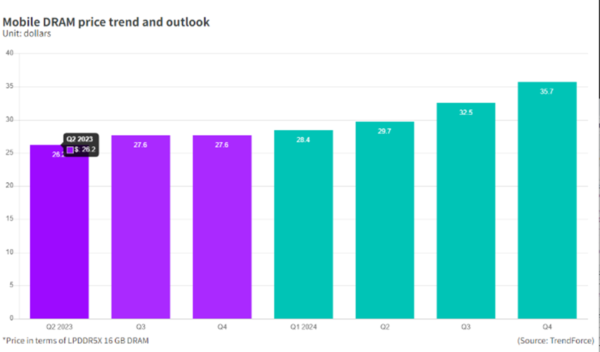

சமீபத்திய செய்திகளில், மெமரி சிப் தொழில் மீண்டும் 20%வரை குறிப்பிடத்தக்க விலை உயர்வுடன் அலைகளை உருவாக்குகிறது. முன்னணி மெமரி ஜயண்ட்ஸ் ஸ்மார்ட்போன் உற்பத்தியாளர்களான சியோமி, ஓப்போ மற்றும் கூகிள் உள்ளிட்ட ஒப்பந்தங்களில் கையெழுத்திட்டுள்ளது, டிராம் மற்றும் என்ஆன்ட் ஃப்ளாஷ் மெமரி சில்லுகளை தற்போதுள்ள ஒப்பந்தங்களை விட 10% முதல் 20% வரை விலையில் வழங்கவும். நினைவக விலையில் இந்த திடீர் எழுச்சி தொழில்நுட்பத் துறையில் வழங்கல் மற்றும் தேவை இயக்கவியல் பற்றிய விவாதங்களைத் தூண்டியுள்ளது.

விலை உயர்வுக்கு பின்னால் உந்து சக்திகள்

1. ஸ்மார்ட்போன் விற்பனையில் எதிர்பார்க்கப்படும் அதிகரிப்பு: ஸ்மார்ட்போன் உற்பத்தியாளர்கள் அதிக விலையை ஏற்க ஒப்புக் கொண்ட முக்கிய வீரர்களில் ஒருவர். ஸ்மார்ட்போன் விற்பனையில், குறிப்பாக சர்வதேச சந்தைகளில் அதிகரிப்பதை அவர்கள் எதிர்பார்க்கிறார்கள். அதிக நுகர்வோர் தங்கள் சாதனங்களை மேம்படுத்த முற்படுவதால் உற்பத்தியாளர்கள் அதிகரித்த தேவைக்கு தயாராகி வருகின்றனர்.

2. உயரும் உற்பத்தி செலவுகளை எதிர்க்கும்: சாம்சங் போன்ற மெமரி ராட்சதர்களும் தங்கள் உள்ளக மொபைல் சாதன உற்பத்தி பிரிவுகளுக்கு அதிக விலைக்கு நினைவக சில்லுகளை வழங்க திட்டமிட்டுள்ளனர். இந்த மூலோபாயம் மொபைல் சிப் விலைகளின் மேல்நோக்கிய போக்குக்கு பதிலளிக்கிறது, இது உற்பத்தி செலவுகள் மற்றும் இலாப வரம்புகளுக்கு இடையில் சமநிலையை உறுதி செய்கிறது.

3. அப்ஸ்ட்ரீம் செல்வாக்கு: சாம்சங், எஸ்.கே.ஹைனிக்ஸ் மற்றும் கியோக்ஸியா உள்ளிட்ட அப்ஸ்ட்ரீம் நண்ட் ஃப்ளாஷ் உற்பத்தியாளர்கள் ஏற்கனவே செதில் ஒப்பந்தங்களுக்கான விலைகளை உயர்த்தத் தொடங்கியுள்ளனர். மிடில்மேன் மற்றும் கீழ்நிலை கணினி தொகுதி உற்பத்தியாளர்களிடையே குறைந்த இயல்பான சரக்கு நிலைகள் வாங்கும் ஸ்பிரீயைத் தூண்டியுள்ளன, இதனால் விலைகள் உயர்ந்துள்ளன. நுகர்வோர் எஸ்.எஸ்.டி.எஸ், சேமிப்பக அட்டைகள் மற்றும் எம்.எம்.எம்.சி மற்றும் ஈ.எம்.சி.பி போன்ற மொபைல் தொடர்பான கூறுகள் போன்ற தயாரிப்புகள் விரிவான விலை அதிகரிப்புகளைக் கண்டன.

4. விநியோக சங்கிலி இயக்கவியல்: சில சேமிப்பக தயாரிப்புகளுக்கான தற்போதைய குறைந்த சரக்கு அளவைக் கருத்தில் கொண்டு, சராசரி இலக்கங்களில் சராசரி விலை அதிகரிப்பு உள்ளது. இருப்பினும், சில சேமிப்பு தயாரிப்புகள் காரணமாக’ ஒப்பீட்டளவில் குறைந்த பங்கு நிலைகள், இரட்டை இலக்கங்களில் விலை அதிகரிப்பு நான்காவது காலாண்டில் காணப்படலாம்.

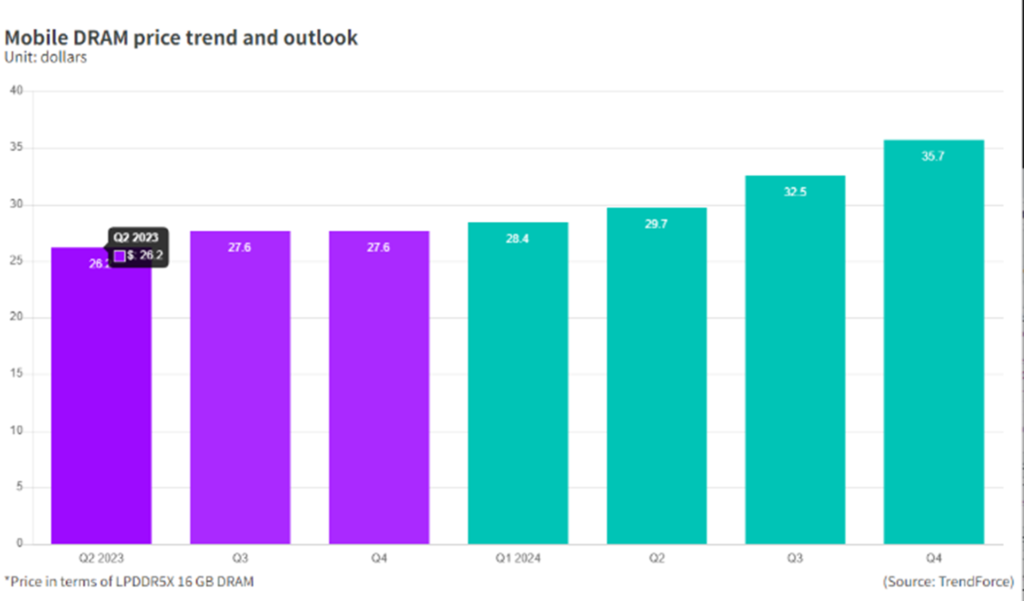

5. நடந்துகொண்டிருக்கும் போக்கு: கொரிய மெமரி சிப் உற்பத்தியாளர்கள் தங்கள் சமீபத்திய சில்லுகளுக்கான விலையை உயர்த்த முடிவு செய்துள்ளதாகவும், இந்த விலை உயர்வு நான்காவது காலாண்டில் தொடரக்கூடும் என்றும் ட்ரெண்ட்ஃபோர்ஸ் தெரிவித்துள்ளது. ஆகஸ்ட் மாதத்தில் NAND ஃபிளாஷ் செதில் ஒப்பந்த விலைகளில் மீளுருவாக்கம், உற்பத்திக் குறைப்புகளின் அதிகரிப்பு ஆகியவற்றுடன், தேவையை அதிகரிக்கும் என்று எதிர்பார்க்கப்படுகிறது, இது செப்டம்பர் மாதத்தில் NAND ஃபிளாஷ் செதில் ஒப்பந்த விலைகளில் 0-5% அதிகரிப்புக்கு ஆதரவளிக்கிறது.

6. அதிகரித்த ஆர்டர்கள்: NAND ஃபிளாஷ் நினைவக வாடிக்கையாளர்கள் இனி ஆர்டர்களைக் குறைக்கவில்லை, ஆனால் அவற்றை அதிகரிக்கிறார்கள் என்பதை தொழில்துறை உள்நாட்டினர் வெளிப்படுத்துகிறார்கள்.

உற்பத்தி குறைப்பின் தாக்கம்

சாம்சங், குறிப்பாக, NAND ஃபிளாஷ் நினைவக உற்பத்தியில் அதன் குறைப்பை தீவிரப்படுத்தியுள்ளது மற்றும் 2023 ஆம் ஆண்டின் இறுதிக்குள் உற்பத்தியை 50% குறைக்கும் என்று எதிர்பார்க்கப்படுகிறது. நிறுவனம் ஏற்கனவே ஆண்டின் முதல் பாதியில் NAND ஃபிளாஷ் உற்பத்தியை 20% குறைத்து, இரண்டாவது பாதியில் சுமார் 40% குறைப்பைக் குறைத்தது.

மற்ற சப்ளையர்கள் நான்காவது காலாண்டில் உற்பத்தி குறைப்புகளை விரிவுபடுத்துவார்கள் என்று எதிர்பார்க்கப்படுகிறது. 2024 ஆம் ஆண்டின் இரண்டாம் பாதியில், சாம்சங்கின் மாதாந்திர டிராமின் உற்பத்தி தற்போதைய மட்டங்களிலிருந்து மேலும் குறையும் என்று OMDIA கணித்துள்ளது.

மெமரி சிப் உற்பத்தியாளர்கள் இந்த ஆண்டின் தொடக்கத்தில் தங்கள் வருடாந்திர திட்டங்களை விட உண்மையான மூலதன செலவினங்களையும், செதில் உள்ளீட்டு அளவுகளையும் குறைத்து வருகின்றனர் என்று தொழில் வல்லுநர்கள் சுட்டிக்காட்டுகின்றனர், குறைப்புக்கள் 50%ஐத் தாண்டுகின்றன. இந்த சூழலில், டிராம் மற்றும் NAND ஃபிளாஷ் நினைவக விநியோகத்தின் சரிவு இந்த ஆண்டு 10% ஐ தாண்டக்கூடும்.

முன்னணி நிறுவனங்கள் உற்பத்தி வெட்டுக்களை செயல்படுத்துவதால், நினைவக சந்தையின் திருப்புமுனை அடிவானத்தில் உள்ளது. நினைவக தொழிற்சாலைகள் மாறிவரும் கோரிக்கைகளை பூர்த்தி செய்ய உற்பத்தியை சரிசெய்யும்போது, சரக்கு அளவுகள் உறுதிப்படுத்தப்படுகின்றன, மற்றும் விலைகள் ஒரு திருப்புமுனையின் அறிகுறிகளைக் காட்டுகின்றன. சந்தை சேமிப்பிற்கான உச்ச பருவத்தை நாம் அணுகும்போது, ஏற்றுமதியின் ஒட்டுமொத்த வேகம் துரிதப்படுத்துகிறது, நினைவக சுழற்சியில் மீட்பைக் குறிக்கிறது.

முடிவில், மெமரி சிப் விலையில் சமீபத்திய எழுச்சி ஸ்மார்ட்போன் உற்பத்தியாளர்களிடமிருந்து அதிகரித்த தேவை, அப்ஸ்ட்ரீம் விநியோகச் சங்கிலியில் அதிகரித்து வரும் உற்பத்தி செலவுகள் மற்றும் இயக்கவியலை எதிர்ப்பதற்கான முயற்சிகள் ஆகியவற்றால் இயக்கப்படுகிறது. இந்த விலை உயர்வுகள் நான்காவது காலாண்டில் தொடரும், இது பல்வேறு தொழில்நுட்ப தொழில் துறைகளை பாதிக்கும். நினைவக சந்தை மாறும் நிலைமைகளுக்கு ஏற்றவாறு, தொழில் நினைவக சுழற்சியில் குறிப்பிடத்தக்க மாற்றத்தின் கூட்டத்தில் இருக்கலாம். எப்போதும் வளர்ந்து வரும் இந்த நிலப்பரப்பில் மேலும் முன்னேற்றங்களுக்காக காத்திருங்கள்.