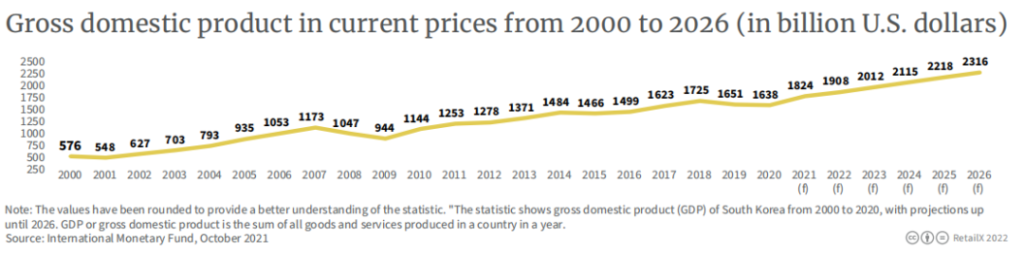

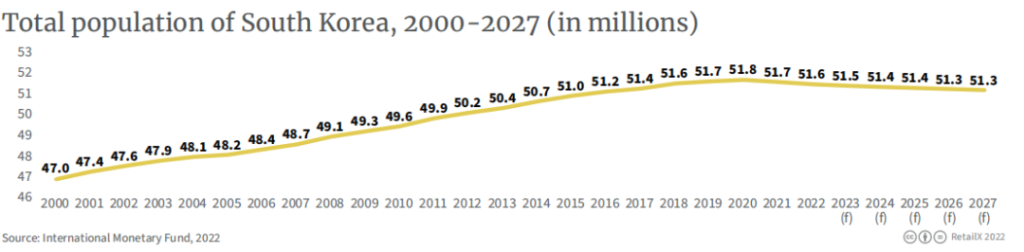

ڏکڻ ڪوريا دنيا جي اي ڪامرس مارڪيٽ ۾ سڀ کان ترقي يافته ملڪن مان هڪ آهي. بين الاقوامي پئسي فنڊ جو اڳڪٿي ڪري ٿو ته 2026 تائين، ڏکڻ ڪوريا جي اي ڪامرس جي اي ڪامرس جي سائيز جو اندازو لڳائي سگهي ٿو. ۾ “2019 ڪاروباري درجه بندي ڪرڻ جو آسان” اڳ ۾ ئي ورلڊ بئنڪ طرفان جاري ڪيل، ڏکڻ ڪوريا لسٽ ۾ مجموعي طور تي 189 ملڪن جي وچ ۾ پنجاهه آهي، جڏهن ته آمريڪا ڇهين ۽ برطانيه جي درجه بندي ڪئي. ايپيڊيمڪ ڪنٽرول دور دوران، معيشت بند ٿي وئي هئي ۽ جسماني دڪان بند ڪيا ويا، ۽ جيڪي انهن جا واپرائيندڙ عادتن کي تبديل ڪرڻ تي مجبور هئا “تازو” آن لائن شاپنگ، خاص طور تي پراڻا صارفين، ڏکڻ ڪوريا جي اڳ ۾ ئي هارڊ ڪوريا جي اڳئين انٽرنيٽ جي ڀرپاسي جي شرح

ڏکڻ ڳجري جي گهري تائين جو پي ڊي يو ئي 2027 ملين ڊالر آهي، سڪري مزدوري، ڇٽائي آبادي، 20.3 ملين ڊالر آهي.

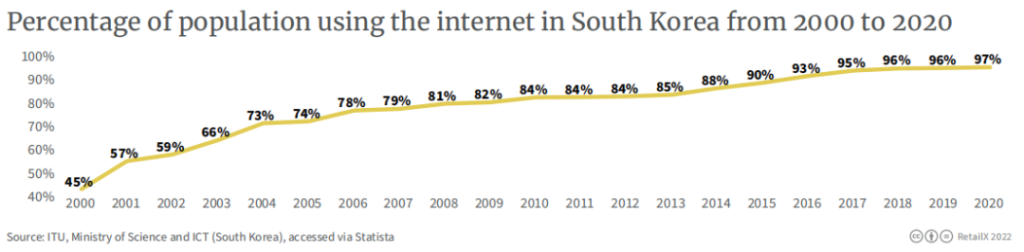

2020 ۾، ڏکڻ ڪوريا جي انٽرنيٽ جي دخول جي شرح 97 سيڪڙو آهي. مضبوط اقتصادي بنياد ۽ مضبوط معاشي بحالي واري پاليسين کي ڪاميابيء سان مدد ڪئي وئي آهي ته ايپيڊيمڪ جي اثر هيٺ اچڻ لاء عالمي معاشي. ڪوريا جي ڪوريا جي ڪناري جي مطابق، ڏکڻ ڪوريا جي معيشت 2021 ۾ 4.1 سيڪڙو، 5 سالن ۾ تيز پيش رفت کان وڌي ويندي. پر 20222 معاهدي جي واعصر اعتماد واري تجصب (CCCHE) معيشت جي ڪارڪردگي بابت صارف جي استحڪ بندي بابت جوڪڪ انتهودي، 962.4، هيٺ ڏنل.

ڪورين اي ڪامرس مارڪيٽ جو جائزو

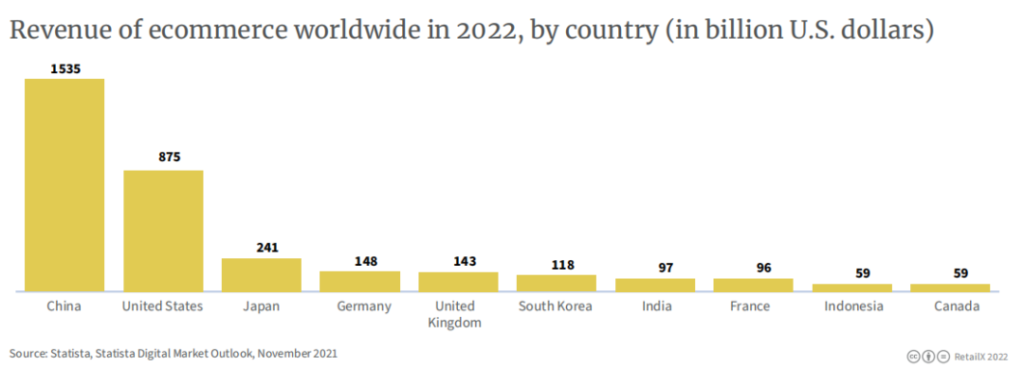

ڏکڻ لريدي دنيا جي چاريه وڏي اي ميلن جي منول آهي، ڪاليج 2022 لاء 1122 بلين ڊالر، آمريڪا کان بعد جو سردار، جاووy ۽ قوم کان پوء. اقتصادياتي گلوبلائيزيشن سان، روس ۽ يوڪرين جي وچ ۾ تڪرارن ۽ يوڪرين جي وچ ۾ تدريسي طور تي ڏکڻ ڪوريا ڏانهن پکڙيل آهي. پس منظر جي هيٺ ته سپلائي چڪر وڌيڪ ڊگهو ٿي چڪو آهي ۽ ڪمائيزيشن قيمتن ۾ وڌي ويو آهي، ڏکڻ ڪوريا جي گهريلو بازار شروع ٿي چڪو آهي ". “سفر.

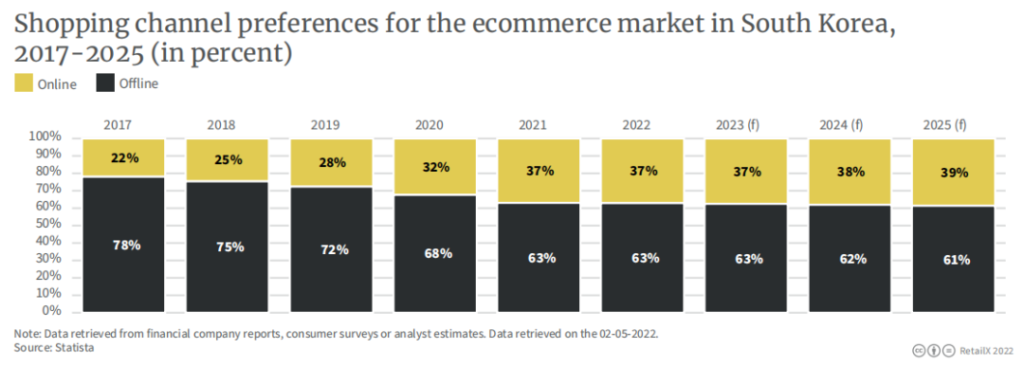

ڏکڻ ڪوريا جو آن لائن پرچون وڪرو ڪل ريٽيل وڪرو جو حساب ڪيو ويو آهي، صرف چين (46٪) ۽ برطانيه (36٪). ترقي ڪيل اي ڪامرس انڊسٽريز جهڙوڪ انڊونيشيا (20٪) ۽ آمريڪا (16٪) ان جي پويان ڇڏي ويا. نن small ڙو فرق نه.

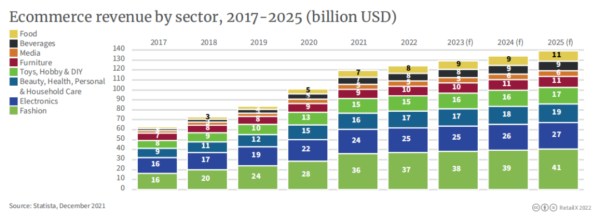

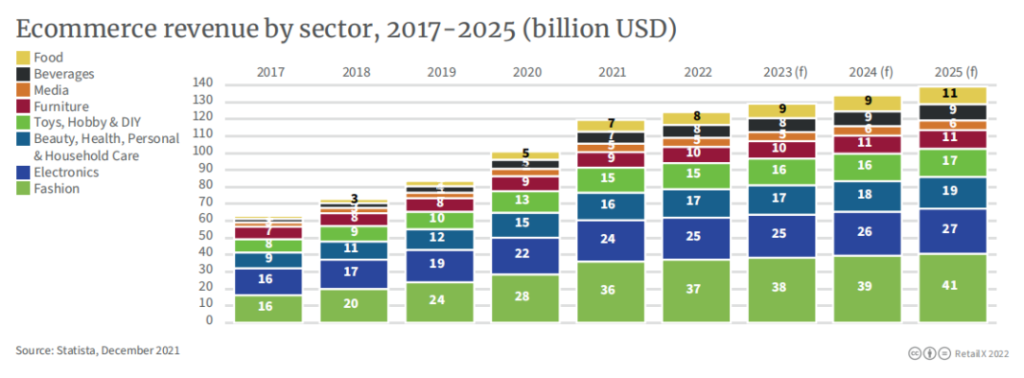

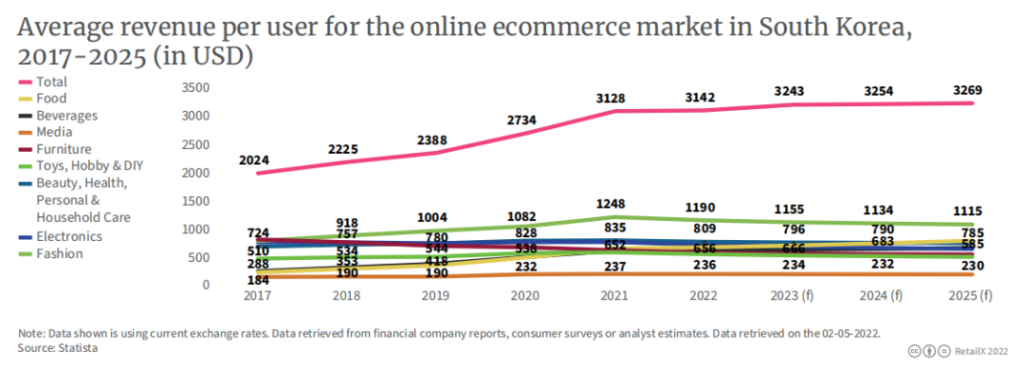

ڪورين ايپن ايمليڪسين مارڪيٽ مارڪيٽن جي وڏي تعداد ۾، 2002 ارب) تي 4 ارب ڊالر ($ 27 ارب)، خوبصورتي سان & صحتمند & ذاتي مونء تحفظ & گهر جي سنڀال ($ 19 بلين)، رانديڪا & مشغلا & ڊائي (17 ارب ڊالر).

ڏکڻ ڪورين اي ڪامرس جا امڪان

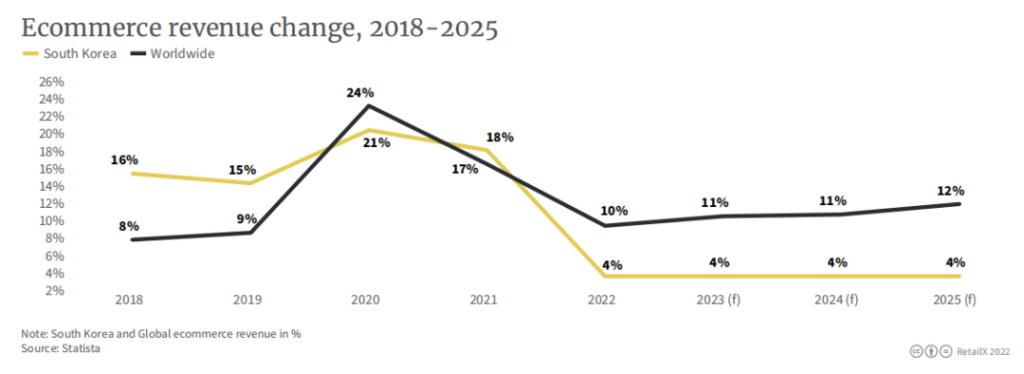

ڏکڻ لهووي به ڪئمپين ۾ حد تائين 4 سيڪڙو ۾ اضافو ٿيڻ تائين ايندي آهي، شايد 2022 ۾ ڊگهو ٿي ويندو آهي.

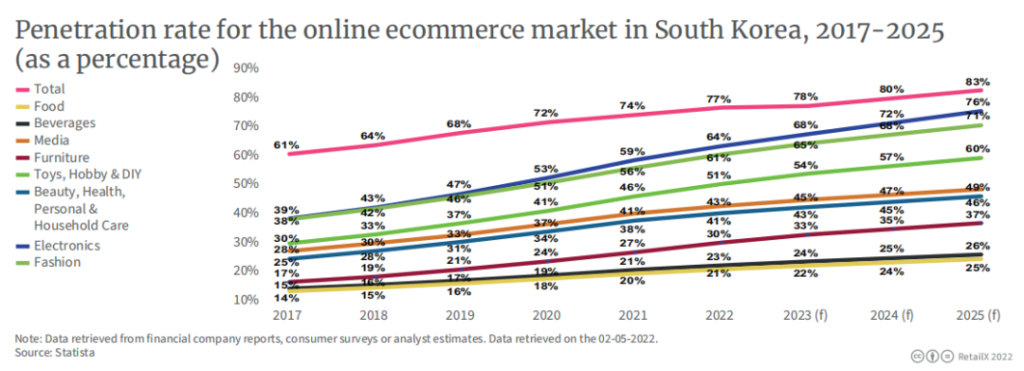

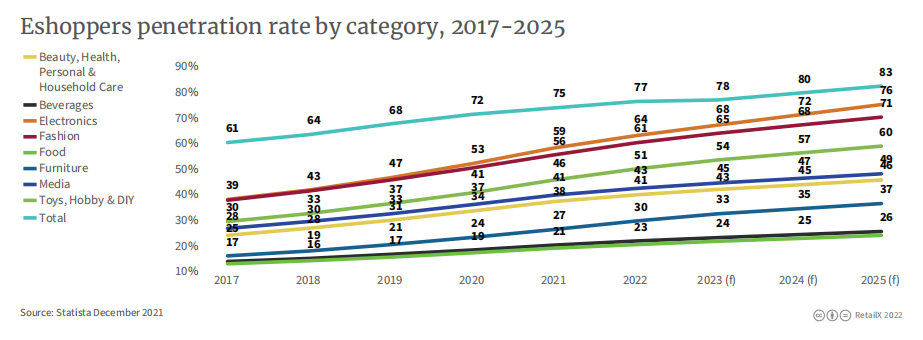

تجزيه نگارن کي توقع آهي ته وچولي طبقي جي واڌ ۽ ايسٽميٽڪ جي تسلسل جي تسلسل سان ۽ اوڀر ۾ آن لائن واپارين جي تسلسل سان، ايسٽسٽس مارڪيٽ ۾ اي ڪامرس مارڪيٽ ۾ اڃا تائين ڪمرو آهي. ڪورين ماڻهن جي گهرج ۽ مشروبات جي گهرج جي گهرج آهي مقامي اي ڪامرس جي تيز رفتار ترقي جو بنيادي سبب آهي. ان مان توقع ڪئي ويندي آهي ته اي پي اي ڪامرس جو مطالعو ۽ مشروب 2025 تائين 20 ارب آمريڪي ڊالر کان وڌي ويندو، ۽ مارڪيٽ جي دخل جي شرح 25 سيڪڙو ۽ 26 سيڪڙو تائين وڌي ويندي. ، 21 سيڪڙو کان ۽ هن سال 23 سيڪڙو تائين.

ماتيا، جيڪا دنيا ۾ ڪوبه ملڪ ۾ ناهي، جيڪا قيمتن نومنڊي جي جلد فڱونڊي پاران سخت نه ڪئي وئي. ڏکڻ ڪوريا ۾، جتي اي ڪامرس مارڪيٽ ۾ تمام گهڻو ترقي يافته آهي ۽ "انشورنس" جو هڪ آن لائن شاپنگ جي وچ ۾ فائدا.

ڪوريا ۾ مقامي مارڪيٽ جي رجحانن تي ڌيان ڏيو

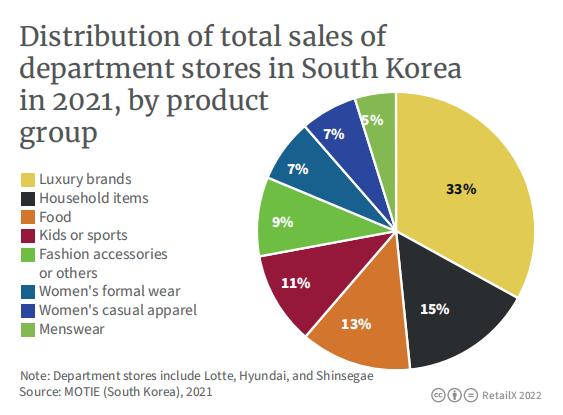

· عشرت جي منڊي بومنگ آهي

ميڊيا جي پيڪنگنگ جي وڪيل جي تحت، اعلي پڇاڙي واري ليسري مارڪيٽ ڏکڻ ڪوريا ۾ خوشبودار پيسٽري بڻجي چڪي آهي. 2025 بلين 3،30 بلين ڊالر تائين پهچڻ جو امڪان آهي ۽ 2023٪ تائين 4.83٪ جي سالياني شرح تي وڌائي ٿو. 2020 ۾، 60 سالن جي عمر جي عمر ۾ سڀني عمر جي گروهه جو سڀ کان وڏو استعمال ڪندڙ سامان آهي، تقريبن 413،154 کٽي ويو.

· عروج تي عروج تي

2017 کان، مديدار (هونجڪ) آهستي آهستي ڏکڻ ڪوريا ۾ مشهور ٿي چڪو آهي، جيڪو ماڻهن جي وڌندڙ تعداد کي ظاهر ڪري ٿو جيڪي اڪيلو رهڻ جو انتخاب ڪن ٿا. هن خيال جو عروج وڌيڪ عمر جي آبادي جي مسئلي کي وڌائي ٿو. 2020 ۾، ڏکڻ ڪوريا ۾ سنگل ڪوريا جو تناسب 31.7 سيڪڙو تائين پهچي ويو، هڪ رڪارڊ اعلي. واحد گروپ جو بنيادي ترتيب 20 سالن کان مٿي ۽ 40 سالن کان مٿي آهي. انهن مان گهڻا ماڻهو پئسو خرچ ڪرڻ چاهيندا آهن ۽ پئسا خرچ ڪرڻ لاء راضي آهن.

· اڪيلو فوڊ ڪلچر غالب

خيوريه کي 2021-1گره جي بار بار بار بار بار بار بار بار بار لکيو، 45٪ 20،000 کان 30٪ 10،000 ۽ 30٪ تائين ساوال 10،000 سالن تائين ترسات ڪندو، ۽ 38،000 کان 2،000 کان خرچ ڪندي ويندي.

· برانڊون اوورسيز ٿيون

لارونن کوٽینگ کائيا ۽ پوري طرح ۽ سعوديسو، جنهن کي الڪوم ۽ لوڪ برانڊن جي تحت پڻ برقي شيون، جيڪو ٻاهر ڪ clancles ن بردارين جي لڏڪڙا برقي شيون، جنهن ۾ القون برقي شيون، جنهن ۾ القون برقي شيون به وڪرو ڪن، جيڪي ٻاهر ڪ curouprend نيل پرڪين پراڊڪ جون شيون، ڪڪران جي برانهنء جي ڪنيين ۾ برقي شيون، جنهن ۾ القون برقي شيون، جيڪو ٻاهرين برين برانڊن جي ڪري ڪن، جيڪو ٻاهر ڪڪرن ۾ برقي شيون، جيڪو ٻاهر ڪ cup ن بردارين جو مقابلو ڪري رهيون آهن. اوورسيز جي خريداري جو فائدو اهو آهي ته توهان پنهنجو پسنديده اوورسيز پراڊڪٽس هڪ نسبتا گهٽ قيمت تي خريد ڪري سگهو ٿا، پر قيمت اهو آهي ته توهان کي وڏي شپنگ جي قيمت ادا ڪرڻ جي ضرورت آهي. برخاني واري ايسوسيئيشن جي مطابق ڏکڻ ڪوريا جي ڪراس ٽاسو واپاري حجم 20،7 ارب ۾ 2 بلين بلين ڊالر کان وڌي ويندو.

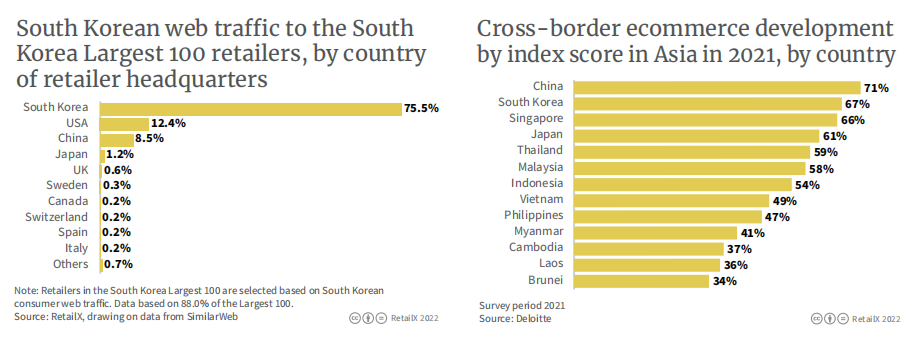

گهڻي وقت تائين، زبان جي رڪاوٽن لاء، سنگل ترسيل طريقا ۽ ڊگهي رستا ۽ ڊگها رستا ڪورين جي شين کي ڪورين جون شيون خريد ڪرڻ لاء اهم رڪاوٽون آهن. هن مزاحمت کي ختم ڪرڻ جي لاء، ڪيترائي پرڏيهي ليليلرز کي سڌو سنئون ميل ۽ پرڏيهي ٻولي جي سهولت فراهم ڪرڻ جي شروعات ڪئي وئي آهي، پر اڪثر ٻاهرين ٻولي جون سهولتون محدود آهن. ۽ چيني.

(کاٻي پاسي واري تصوير ڏکڻ ڪوريا ۾ سڀ کان وڌيڪ 100 پرچونرز جو آن لائن ٽرئفڪ ذريعا 7،50 سيڪڙو ڪن ٿا.

هن مان اڳيون اڳ، ڊگهي مان مفت سمجهان ٿو ته ڊويزنا، ٿڪلاا، ٿڪلا، ٿڪلا، وڏا سناليها ويا. انهن علائقن ۾ صارف مفت شپنگ جي اهل ٿي سگهي ٿو جيڪڏهن اهي 70 ڊالر کان وڌيڪ آباد ٿين؛ شيل ڊائلي ڊزيي فرض ۽ اليابا جو ڪيرا پوائنٽ فراهم ڪرڻ جي سهولت فراهم ڪريو؛ 20 اپريل ۾، SSG.com ڪلاس جي درجي جا درجا بارڊر سروسز ... اهو ڏسي سگهجي ٿو ته ڪورين اي ڪامرس پليٽفارم جو تعارفي پليٽفارم جو تعطل آهي.

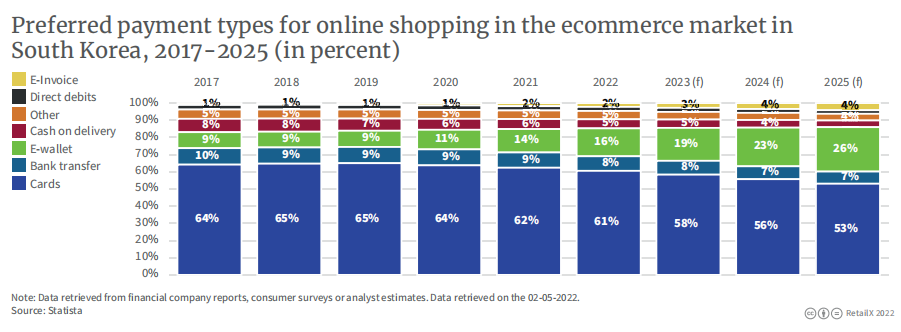

· آبادڪاري جون عادتون

2021 ۾، ڏکڻ ڪوريا ايشيا جي پئسفڪ علائقي ۾ ڪريڊٽ ڪارڊ جي وڏي پئماني تي شرحن جي شرح هوندي، پر ٻيا وڌيڪ آسان ادائيگي جا طريقا پڪڙيندا آهن، ڪاڪا ادا شامل آهن.

ڪاڪا ادا هڪ موبائل ادائيگي واري پليٽ فارم آهي ڪاڪا گروپ جي تحت. ڪاڪوا ڳالهين سان، هڪ ڪمزور ايپ، اهو ڏکڻ ڪوريا ۾ هڪ نن or ي ڪوريا ۾ مشهور ٿي ويو. گراهڪ پليٽ فارم جيڪي هاڻي ڪاڪا پگهار جي پسمانده حل، گوگل راند، گوگل راند، نيٽ فلڪس ۽ اسپاٽفڪس شامل آهن. تجزيه نگار پيش ڪندا آهن ته ڪاڪا جي ادائيگي جا صارف ايندڙ ڪجهه سالن ۾ لکين تائين وڌندا.

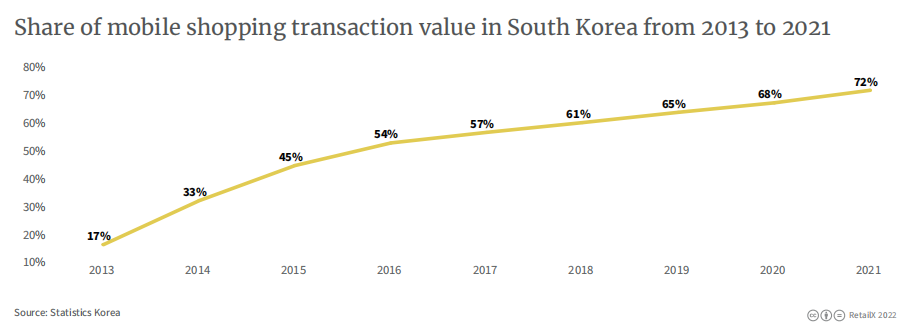

ڊيٽا ڏيکاري ٿو ته 2021 ۾، موبائل ڪوريا ۾ ڪل آن لائن شاپنگ ٽرانزيڪشن جي قيمت 72 سيڪڙو جو حساب ڪندو.

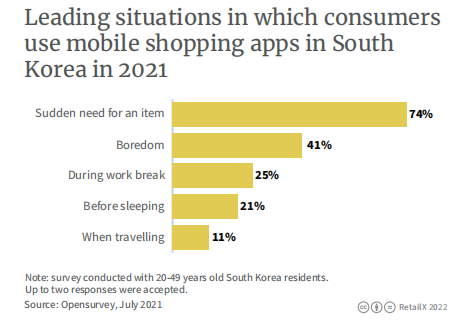

جڏهن پڇيو ويو ته اهي دڪان خريد ڪرڻ لاء ايپ استعمال ڪندا آهن، 74 سيڪڙو جواب ڏيڻ وارا جواب ڏنو “هڪ شئي لاء هڪ تڪڙي ضرورت آهي”، ۽ 41٪ جواب ڏنو “اهو جيڪو ڪجهه آهي.”

20-49 جي عمر ۾ جوابدار، جيڪي گذريل ٽن مهينن ۾ نوڪريون، ۽ شماريات حاصل ڪرڻ جا پهريان شماريات حاصل ڪيا آهن.

· صارف جي تقسيم

سريٽي ڪوريا جي اي ٽي ڪام ايس اي ڪامرس جي وچ واري برابر آهي، 2022 ۾ 77 سيڪڙو تائين توقع ڪئي وئي آهي ۽ اهو 47 سيڪڙو تائين مٿي ٿيڻ گهرجي.

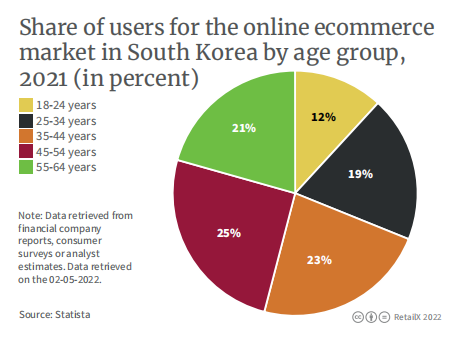

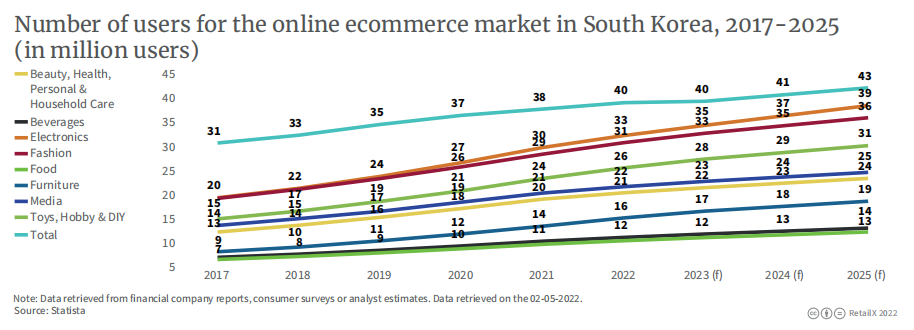

2022 ۾ 40 ملين آن لائن دڪانن ۾ گھٽ 40 ملين آنلائن دڪانن تائين 20 سيڪڙو، 20 ملين سالن ۾ وڌڻ جي توقع ڪئي وئي آهي. حيرت انگيز طور تي، 18-24 جو عمر 18-24 جو تعداد گهٽ ۾ گهٽ 12 سيڪڙو حساب ڪندو.

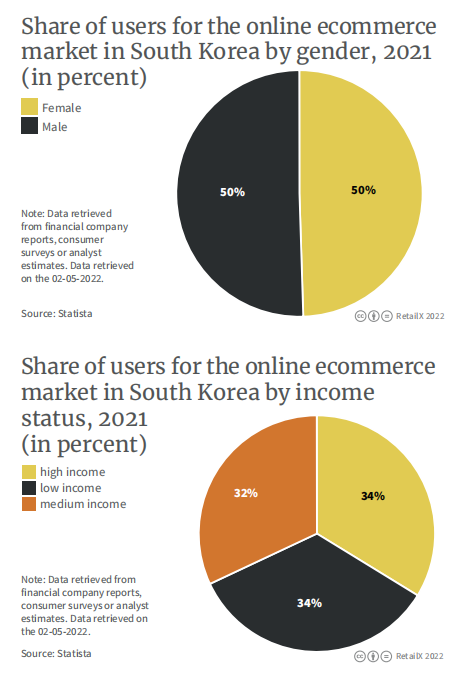

In terms of gender, the ratio of males to females among online shoppers is 50/50; taking economic income as the entry point, the distribution of low-, middle- and high-income groups is similar, and there is no significant difference.

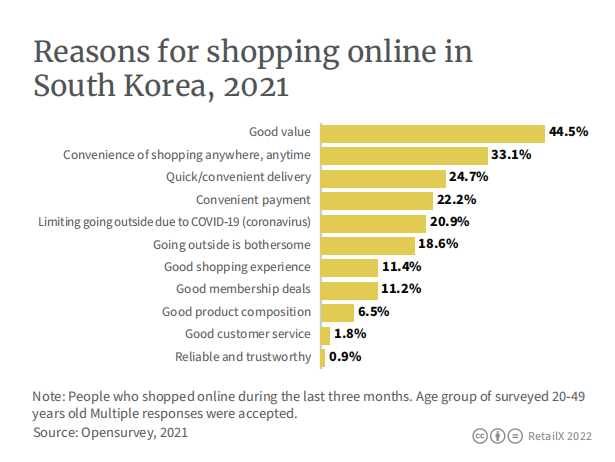

The reasons for online shopping are “good quality and low price” and “convenience” accounted for 44% and 33% respectively, while service and reliability accounted for very few.

Beauty & صحتمند & Personal Care and Home Care still account for the largest share, followed by beverages and electronics.

(User penetration rate of various categories from 2017 to 2025)

· platform

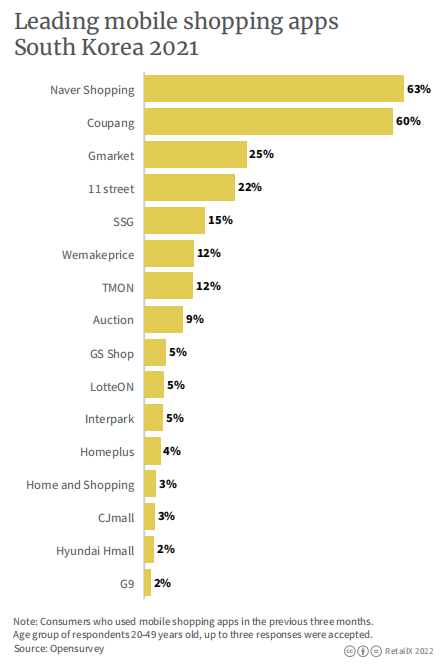

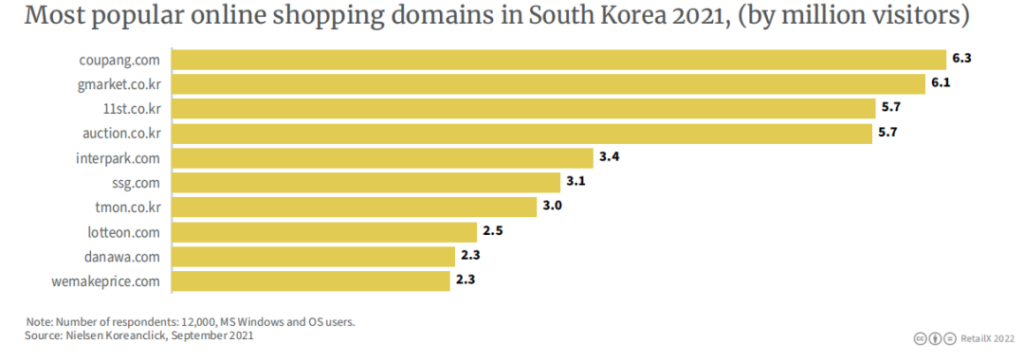

In September 2021, the number of visitors to Coupang will reach about 6.27 million, ranking first among the major e-commerce platforms in South Korea. It was followed by Gmarket with 6.2 million.

Founded in 2010, Coupang’s sales revenue in 2021 will reach 203,600 won. The Korea Times recently reported that Coupang’s paying members are close to 10 million, surpassing Shinsegae’s 6 million. According to Export2Asia, 70% of South Koreans live within a 10-minute drive from the Coupang logistics center. Coupang logistics capacity, especially the last mile delivery capacity, is almost at the “ceiling” level in South Korea.

Although Coupang’s main target is local users in South Korea, it has now expanded to international markets including Singapore, Japan and Taiwan, and its global expansion plan is still in progress.

· Changes in consumption habits before and after the epidemic

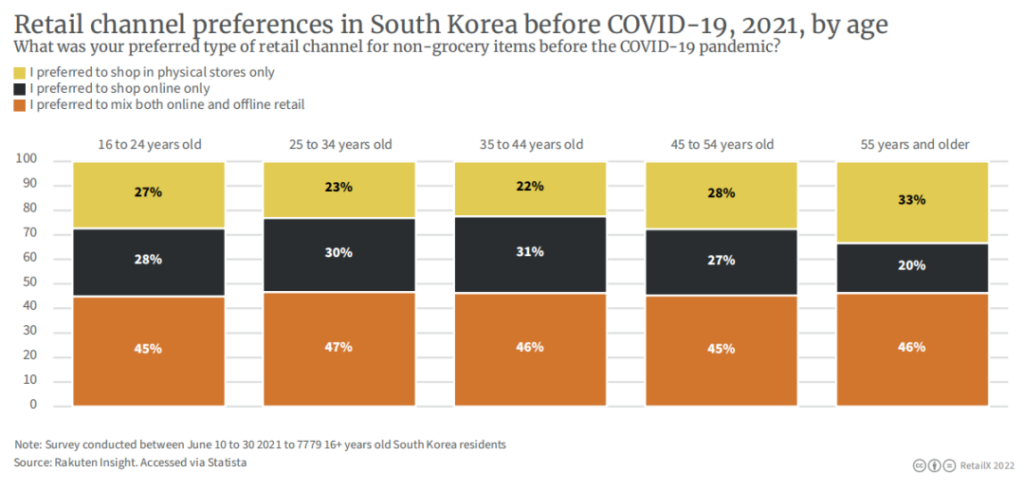

Research by RetailX shows that before the pandemic, 45% of respondents aged 16 to 24 were shopping both online and in-store when purchasing non-grocery products, preferring online shopping (28%) or a brick-and-mortar preference The proportion of store consumption (accounting for 27%) is the same. A similar trend can be seen in slightly older age groups, with 47% of respondents aged 25 to 34, 46% of respondents aged 35 to 44 opting for a hybrid shopping model; 33% of respondents aged 55 and over Respondents said they were more inclined to shop in brick-and-mortar stores before the epidemic, and only 20% of consumers in this age group chose to shop online. Among all age groups surveyed, the proportion of choosing mixed shopping is basically the same, accounting for 45% and above.

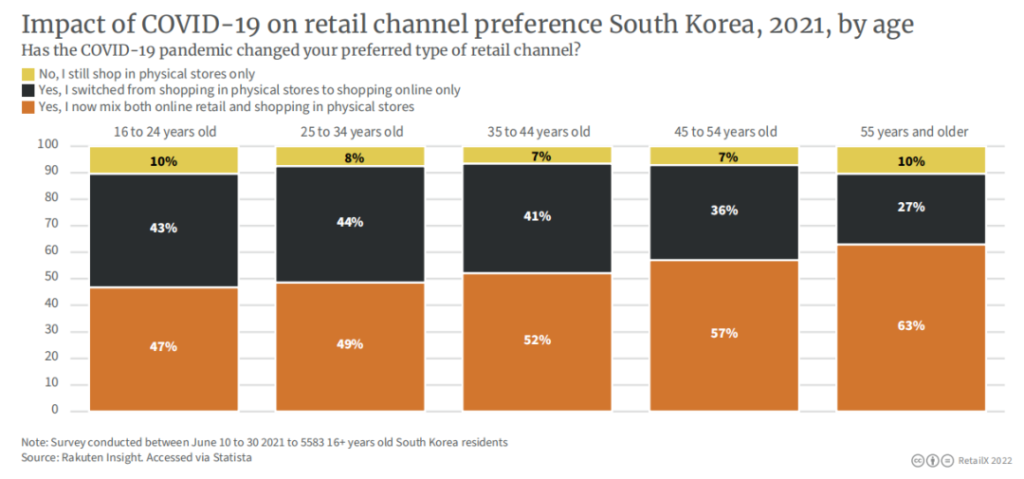

When asked if the pandemic has affected their shopping habits, 10% of respondents aged 16 to 24 said they still stick to in-store purchases, while 43% said they switched from in-store shopping to online-only shopping , 47% of respondents prefer a mixed shopping model.

A similar trend can be seen among the 25 to 34-year-old group, with only 8% of respondents insisting on shopping in brick-and-mortar stores, 44% switching from brick-and-mortar to online shopping, and 49% opting for a mix of shopping. Respondents aged 35 to 44 showed similar preferences.

The change was most pronounced in older age groups, with 57% of respondents aged 45 to 54 reporting a dabbling in both brick-and-mortar and online shopping. In the age group 55 and older, that rose to 63 percent. This shows that most of the people who are deeply affected by the epidemic and change their shopping habits are middle-aged and elderly people.