The reason why the shortage of chips continues is mainly because the supply exceeds demand.

Focus on:

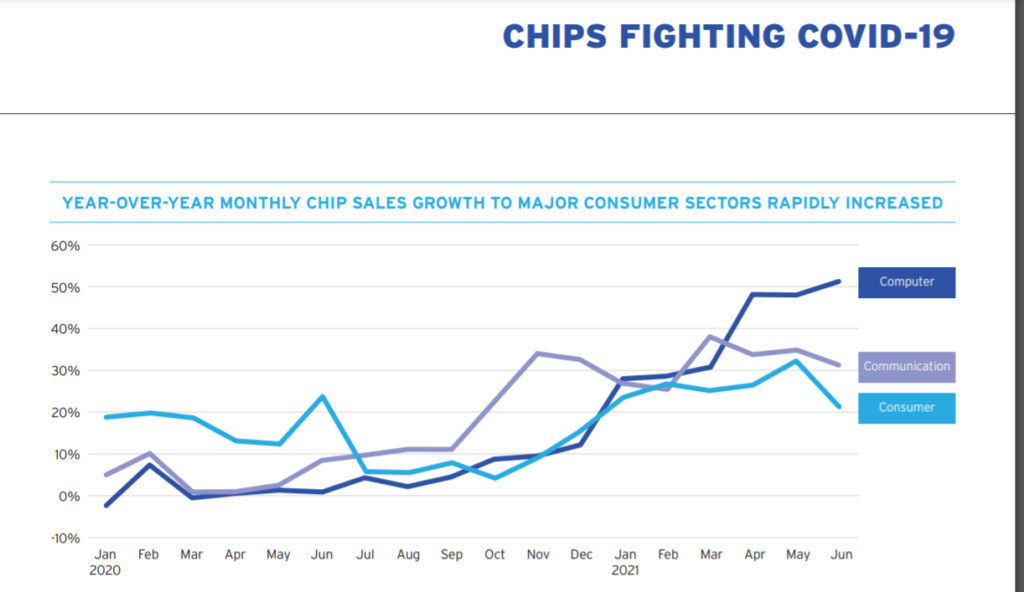

1. The epidemic has promoted the development of home office, home entertainment, and e-commerce, leading to a sharp increase in demand for technology products, but it takes a long time to build a chip factory and cannot keep up with the growth rate of demand;

2. A Cornell University professor said: “If everyone wants to produce chips, they will snap up the same equipment”; because to deal with toxic chemicals, only trained professionals can “make cores”, which leads to labor Shortage status

3. When all aspects are in short supply, the existing resources are tilted towards the more demanding cutting-edge chips, while the old-fashioned chips are placed in a relatively secondary position.

From the outbreak of the COVID-19 epidemic to the present, the shortage of chips has always plagued the electronic product supply chain. The epidemic has caused industry turmoil for nearly two years. As the heart of many technological products, there is still a severe shortage of chips; manufacturers in industries such as game consoles, network equipment, medical equipment, and automobiles are still suffering from the lack of chipsets.

People initially thought that this problem would be resolved on its own-either manufacturers step up efforts to meet demand, or demand naturally cools down, but now the “core shortage” problem is still very serious.

The chip problem has not been alleviated, but it has become more difficult to control. The lockdown of the city and the quarantine of all people’s homes have become a thing of the past, but the shortage of chips is still a big problem at hand.

Supply chain issues suspended the production of electric vehicles in Germany. The Associated Press reported in September that due to the lack of cores, GM and Ford’s many North American assembly plants once suspended production; Tesla CEO Elon Musk once reminded in employees’ internal emails that Tesla’s delivery volume depends on global chip shortages Status, and the shortage is still serious.

In October of this year, Apple attributed its poor financial performance to chip shortages. There were also reports that iPhone 13 would cut production by 10 million due to chip shortages. Intel also warned that the shortage of supply may continue until 2023.

The gaming hardware industry is also not doing well. Nintendo also announced this month that it had to lower its sales expectations due to factors such as chip shortages. Nintendo expects total sales for the current fiscal year to be 24 million units, which is about 6% lower than the previously set sales target of 25.5 million units.

In short, the semiconductor supply chain has been extended in new ways that are deeply entrenched and difficult to solve. The growth rate of demand exceeds the capabilities of chip companies, especially the use of a wide range of basic components, which will bring several major investment risks due to huge demand fluctuations.

Brian Matas, vice president of market research at IC Insights, a semiconductor industry analyst firm, said: “The global economy has been stagnated for so long because of the epidemic, and the supply chain has not yet recovered.”

The reason why the shortage of chips continues is mainly because the supply exceeds demand-the demand for chips is still surging, but the construction of new factories is not always a matter of overnight. In addition, the cyclical changes in history have also discouraged some investors.

The demand is rising fast and building new plants is not so fast

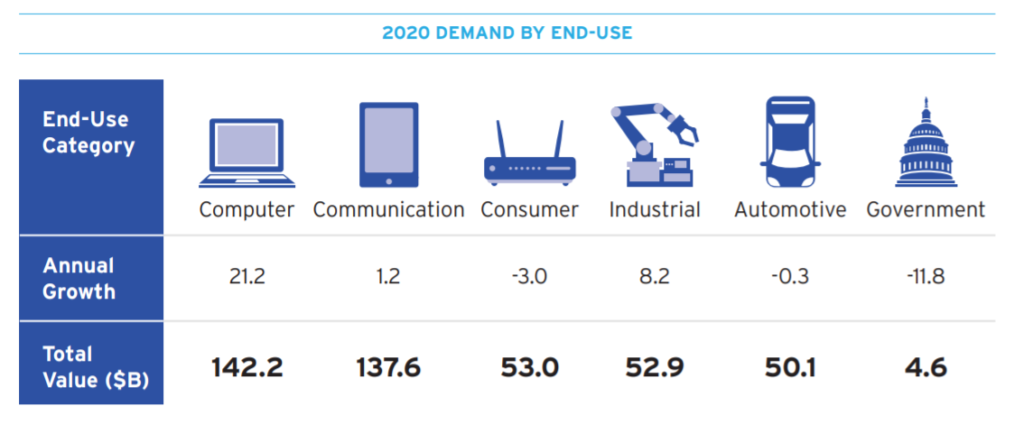

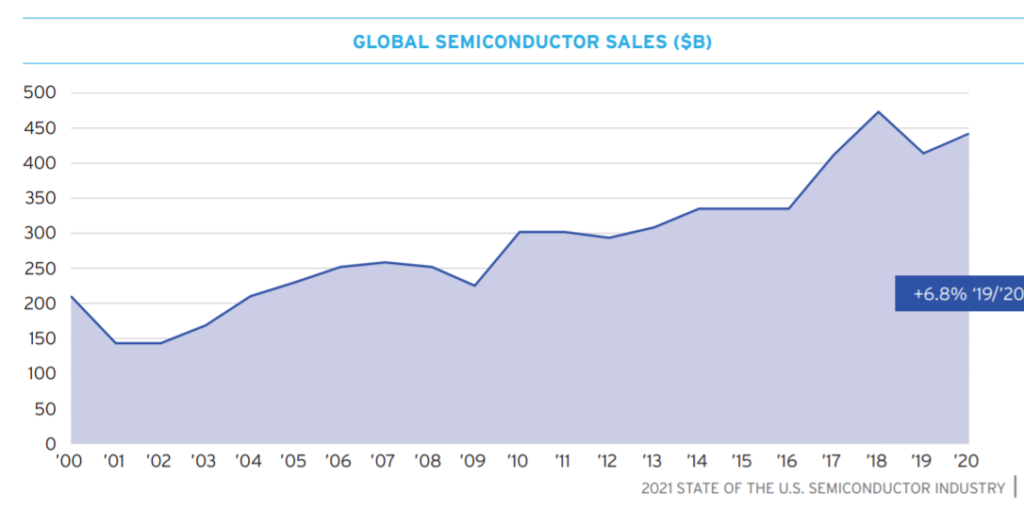

In 2020, when the economic impact of the new crown epidemic gradually becomes apparent, the chip industry has begun to anticipate demand growth. According to data from the Semiconductor Industry Association, global chip sales fell 12% in 2019. But in December 2019, the organization predicted that the global chip industry will grow by 5.9% and 6.3% in 2020 and 2021, respectively.

The latest data shows that global chip sales between August 2020 and August 2021 have increased by 29.7%. Demand benefits from the promotion of cloud computing and 5G technologies, and various products such as automobiles and home appliances are also increasing the use of chips.

Harvard Business School professor and former Intel director David Yoffie said that home office, home entertainment and e-commerce have caused the demand for many high-tech products to skyrocket, which is beyond many people’s expectations.

Chip makers didn’t realize the continued strength of this demand until about a year ago, but the transition did not happen overnight. It will cost billions of dollars to build a new chip factory, and it will take several years. Joffe pointed out: “It will take about two years to build a new factory. And the factory is getting bigger and bigger, the cost is getting higher and higher, and it’s getting more and more complicated.”

Sony and TSMC recently announced that they will invest 7 billion U.S. dollars to build a chip factory capable of producing old components in Japan, but it will not start production until the end of 2024. Intel is also investing in the construction of several new technologically advanced factories, but they will not go online until 2024.

Joffe pointed out that only the Dutch company ASML (one of the world’s largest semiconductor equipment manufacturers) can supply the extreme ultraviolet lithography machine required to produce cutting-edge chips, priced at up to 120 million U.S. dollars. But ASML cannot speed up the supply and meet the surge in demand.

Equipment and materials shortage

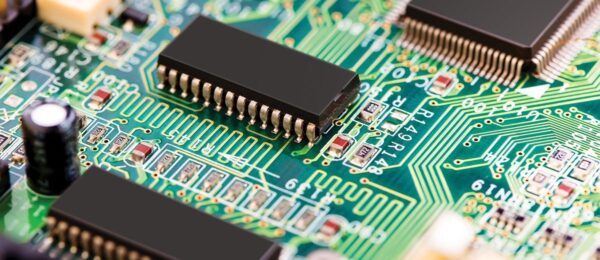

Many items needed to produce semiconductors are also in short supply. The substrate for making printed circuit boards, that is, the surface on which the chip is fixed, has always been difficult to purchase.

These current plates are the key to communication between chips. Ron Olson, director of operations at the Center for Nanoscience and Technology Research at Cornell University, also pointed out that some complex items related to the manufacturing process, such as personal protective equipment and natural gas pipes, are now also experiencing delays in delivery.

Building new factories and expanding the capacity of existing factories also put pressure on the semiconductor production equipment supply chain. “We tend to pay attention to chip factories, but chip factories need a whole set of things to become chip factories, and these things are now having problems.” Cornell University materials engineering professor Chris Ober (Chris Ober) said, “If everyone wants If you produce chips, you will snap up the same equipment.”

The number of highly specialized semiconductor equipment manufacturers is limited and the delivery cycle is very long. In addition, it also takes a lot of time to install and test the reliability of these devices in the factory.

“It takes half a year to a year to buy equipment, and then various process development and equipment appraisal are required.” Olsen said, “It takes time.”

Labor shortage

To meet the ever-increasing demand for chips, in addition to building more chip factories, more people have to be recruited. The semiconductor trade organization IPC issued a report at the end of September that nearly four-fifths of manufacturers have difficulty recruiting suitable workers, and the problems in Europe and North America are particularly severe.

To deal with the toxic chemicals used in the chip production process, employees have to receive special training, which brings another bottleneck to the increase in labor. Companies are now relying on higher salaries, more flexible working hours, and training and education opportunities to attract new employees.

The Oregonian of the United States reported that Intel has even placed “help wanted” advertisements on TV and radio, specifically recruiting work-study college students.

Resources tilt towards cutting-edge chips, “difficult to produce” old chips

The further impact of insufficient resources is reflected at this time-not all chips are “born equal.”

Simple semiconductor components such as power control chips, micro-control chips and sensors have become the main source of shortages. The complexity of these devices is far less than the CPU and GPU used in smartphones and game consoles, and the manufacturing processes used are not too complicated. But their application range is extremely wide, from microwave ovens to medical equipment to toys, almost all products will use this kind of electronic components.

According to Josh Pucci, vice president of Sourceability, an electronic component platform, the power control chip used in many products once only cost $1, but now it has skyrocketed to $150. IC Insights said the lead time for such components has been extended from 4-8 weeks to 24-52 weeks. Old-fashioned chip production equipment is now hard to find, and the shortage of these products pushes up the demand for such equipment.

Market research company Gartner predicts that the global chip factory capacity utilization rate will reach 95.6% in the second quarter of 2021, compared to only 76.5% in the second quarter of 2019. Gartner analyst Gaurav Gupta (Gaurav Gupta) said that this shows that the factory is already running at full capacity because some production lines need to be shut down for maintenance.

Chip foundry company GlobalFoundries CEO Tom Caulfield (Tom Caulfield) said in October this year that his company’s production capacity has been booked until 2023. Some products of Analog Devices are facing extremely high demand. The CFO of this company told investors in August this year that orders have been scheduled for the next fiscal year beginning this month.

Part of the challenge facing chip manufacturers is that some customers may have “double booking” situations, that is, deliberately over-purchasing in order to prevent insufficient supply, resulting in unpredictable future demand trends. “The shortage of stock caused by double bookings made the situation worse,” said Willy Shih, a professor at Harvard Business School.

Analysts believe that companies that can produce these chips may be reluctant to invest in new plants because of the meager profits of such chips and the strong cyclical nature of the semiconductor industry. Demands often skyrocket and plummet. They worry that the oversupply of chips in the future will drive down product prices.

“Looking back at the history of the semiconductor industry, you will find that after profits and prices have skyrocketed, there will be a serious decline cycle.” Harvard Business School’s Jofi said, “We don’t know whether the current demand growth can continue.”

Although there are many new chip production capacities, most of them will be used to satisfy cutting-edge products. A report released by Gartner in January this year predicts that chip manufacturers will invest 146 billion new capacity this year, an increase of 50% over 2019, but only a small part of it will be used for more common old chips.

In theory, increasing the production capacity of cutting-edge chips can free more factories to produce older chips, but this will not happen when the supply is in short supply. Sourceability’s Pushi said that although companies have recently begun to invest in building capacity for old-fashioned chips, they must make customers commit to two-year orders before considering starting construction.

When will the chip be missing?

ASML CEO Peter Wennike (Peter Wennink) recently explained: “Last year because of the epidemic, customers were very cautious. But looking back, they seem to be overly cautious and suppress demand too small. Now demand is soaring and we It will definitely take a while to achieve a ramp-up of production capacity.” In his view, it will take 2022 to meet today’s output demand.

Intel CEO Pat Gelsinger (Pat Gelsinger) said that the surge in online activities during the COVID-19 pandemic has triggered a “semiconductor explosive growth cycle.” He added: “Although the industry has taken some measures to resolve the recent tensions, it will take two years for the entire ecosystem to resolve the shortage of chips, substrates and components.”

TSMC Chairman Liu Deyin is optimistic about his ability to meet demand. He said last year: “We currently think… we can meet the minimum requirements of our customers by the end of June (2020).” But as he said, this does not mean that the shortage will disappear soon. “There will be delays. Especially for automotive chips, the supply chain in this industry is long and complicated. The supply time will take seven or eight months.” He added.