Kynning

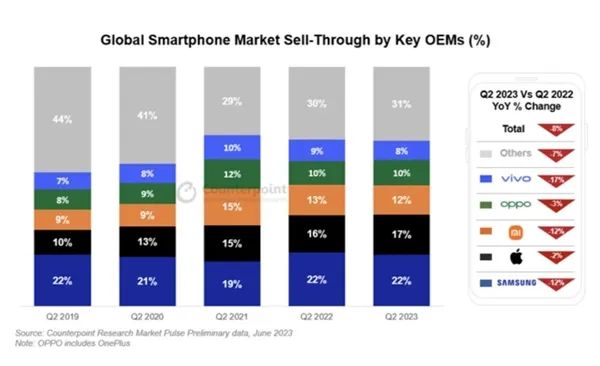

The world of smartphones is a dynamic landscape, constantly evolving and presenting new challenges and opportunities. As we delve into the latest report by research firm Counterpoint, it is evident that the global smartphone market faced a downturn in the second quarter of 2023, with sales declining by 8% year-on-year and 5% sequentially. Surprisingly, this marked the eighth consecutive year of year-on-year declines, leaving major smartphone manufacturers astounded. However, amidst this turbulent environment, the size of the market provides some resilience to weather the storm.

Global Smartphone Top 5: Rise of Domestic Brands

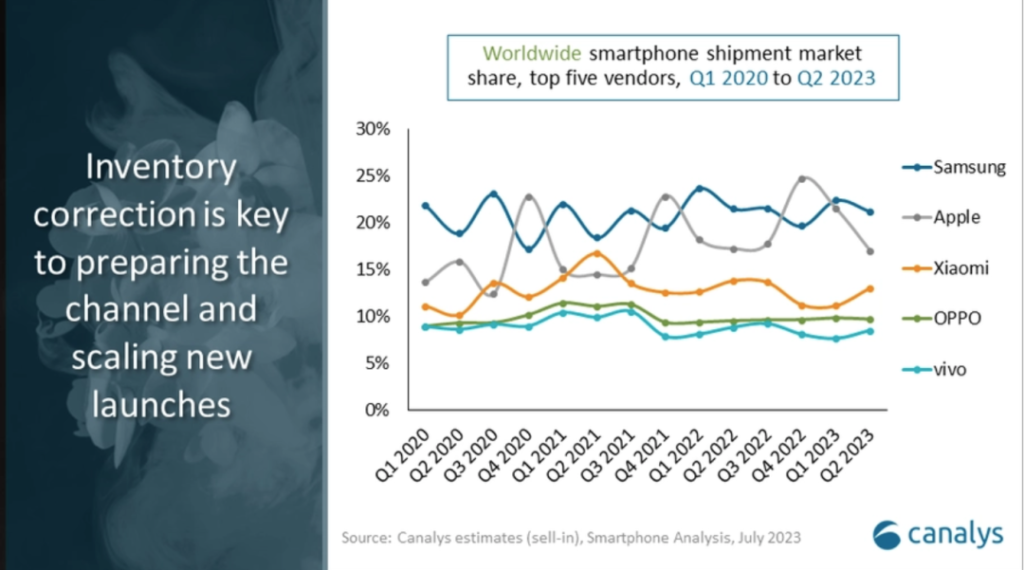

Despite the overall decline in smartphone sales, the market’s landscape has seen minimal changes in terms of market share distribution. In this quarter, Samsung and Apple retained their positions at the top, holding 22% and 17% of the market share, respectively. Together, they dominate almost half of the global smartphone market.

Domestic Brands Take Center Stage

Following closely behind Samsung and Apple are Xiaomi (12%), OPPO (10%), and vivo (8%), forming the other significant portion of the market. Huawei and Honor did not secure a spot in the top 5.

Apple and Samsung: A Tale of Two Giants

Apple’s placement in the second position during the year’s first half is unsurprising, given their strategy of launching new products in the autumn after their keynote events. Despite innovative promotional efforts, including integrating Apple Store official mini-programs and live-streaming events to attract loyal customers, the impact on sales has been marginal. However, the company still demonstrates resilience in the high-end segment, stimulating sales with well-timed price adjustments.

A Giant Facing Challenges

On the other hand, Samsung continues to shine, leveraging its accumulated experience and brand reputation to maintain its standing in the global market. During the year’s first half, Samsung unveiled the Galaxy S23 series and the Galaxy A54. While the Galaxy S23 Ultra’s top-of-the-line version crossed the 10,000 yuan threshold at 12,699 yuan(1800USD), the Galaxy S23 standard variant started at 5,199 yuan(749USD). The Galaxy A54 caters to the mid-range market, reflecting Samsung’s strategic focus on both mid-range and high-end products.

New Innovations in High-end Market

Additionally, Xiaomi collaborated with Leica to introduce the Xiaomi 13Ultra, positioning it as a high-end flagship with a starting price of 5,999 yuan(859 USD). OPPO’s Find X6, also priced at 5,999 yuan(859 USD), and Vivo’s X Flip and X Flod2, with their impressive foldable screens, contributed to the competition among the top players.

The Hopeful Future: Upsurge of High-end Flagship Devices

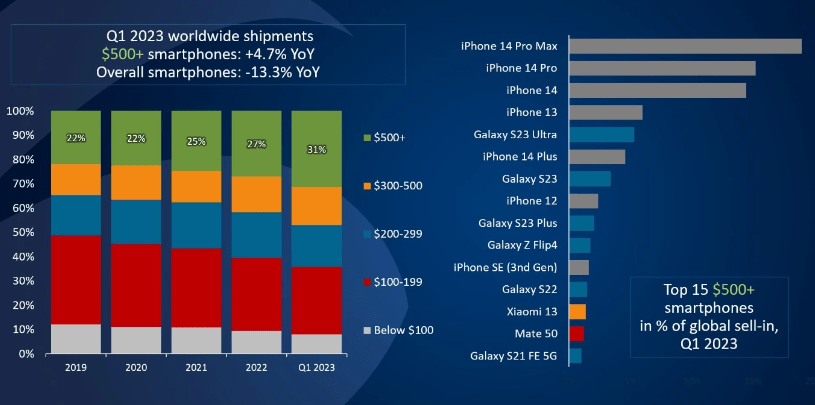

Despite the overall smartphone market’s challenges, high-end flagship devices have been showing continuous growth in shipment volumes. Counterpoint data indicate that during a period of stagnation in the global smartphone market in 2022, the high-end smartphone market experienced a 1% growth in sales and contributed over 55% of the overall market’s revenue.

Heading 3: A Ray of Light in High-end Segment

This upward trend continued in the second quarter of 2023, with high-end smartphones accounting for one-fifth of the total shipments. This means that for every five smartphones sold, one belongs to the high-end category. The popularity of foldable form factors became a fiercely contested battleground for companies like Samsung, Vivo, and OPPO.

The Balancing Act: From High-end to Mid-range

As the overall smartphone market enters a saturation phase, low-end devices maintain their volume-driven approach, while mid-range devices face increasing pressure due to technological advancements. In contrast, high-end smartphones become the focal point for innovation and differentiation.

Striking the Right Balance

The emergence of various high-end flagship devices, priced around 5,000 yuan, with strong profit margins, aligns with the current market dynamics. Moreover, the luxury retail sector’s resilience during the economic downturn suggests that the impact on the potential buyers of high-end smartphones remains relatively minor.

Niðurstaða

The second half of 2023 promises exciting new smartphone launches, including the iPhone 15 and Huawei’s Mate 60 series. Manufacturers are gearing up to unveil their trump cards and secure their share of the high-end market.

The Future Holds Promise

However, this surge in high-end devices also brings challenges as competition intensifies and the pace of updates accelerates. Despite the recent market downturn, there is hope for a “little spring sunshine” in the smartphone industry, but it primarily hinges on the high-end segment’s ability to pull the market out of its current lull.

The smartphone landscape is ever-changing, and it will be fascinating to witness how manufacturers adapt and innovate to meet consumers’ evolving needs and desires in the coming months and beyond.