Itaalje is ien fan 'e earste Jeropeeske lannen om te wêzen “snap” troch de epidemy. Neffens de frijlitting fan 'e Bank fan Itaalje waard de Italjaanske ekonomy hurd troffen troch de epidemy yn 2020, mar it sil yn 2021 herstelle mei it herstel fan ynwenners’ besteechber ynkommen en konsumintfertrouwen, en yn 2022. Yn 2018 fersteurde it útbrekken fan geopolitike konflikten it herstelplan fan 'e finansjele merk. 40% fan Itaalje syn ierdgasfoarsjenning kaam út Ruslân. Nei it útbrekken fan it konflikt moast de Italjaanske regearing alternative enerzjyboarnen sykje, en de ekstra kosten kinne foarsteld wurde.

Yn 2020, fanwege de ynfloed fan 'e epidemy, foelen de totale Italjaanske konsuminteútjeften mei 10,6%, en stegen mei 5,2% yn 2021, mar sakke yn it lêste fearnsjier fan 2021, mei 0,1%; BBP ferhege ek yn it earste fearnsjier fan 2022. Nei in skerpe delgong yn 2020 (-9%), gie it yn 2021 (+6,6%). De Italjaanske regearing sei dat it konservatyf wie op it herstel fan 'e konsumintemerk, foarsizzend groei fan 2,4% yn 2023, leger as de prognose fan 2,8%; gemiddelde leanen foelen fan 29,828 euro yn 2019 nei 27,997 euro yn 2020.

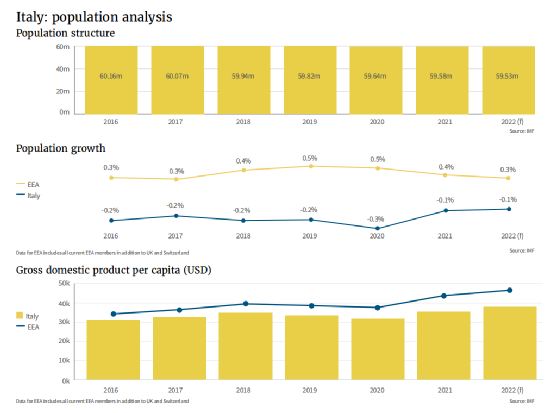

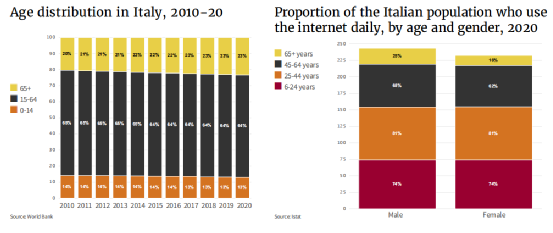

Op it stuit is de befolking fan Itaalje 59,5 miljoen, en it sil yn 'e takomst trochgean. It oanpart fan 'e befolking fan 65 jier en âlder nimt ta (goed foar 23% fan 'e totale befolking yn 2020), en it oanpart fan' e befolking fan 14 jier en ûnder nimt ôf (goed foar 2020 13% fan 'e totale befolking), de fergrizing situaasje is net optimistysk. Yn 2021 sil it bertepersintaazje fan Itaalje sakje ûnder in heule heech fan 400,000. Yn itselde jier stiet it totale oantal deaden fan Italië troch de epidemy achtste yn 'e wrâld.

Italjaanske e-commerce merk

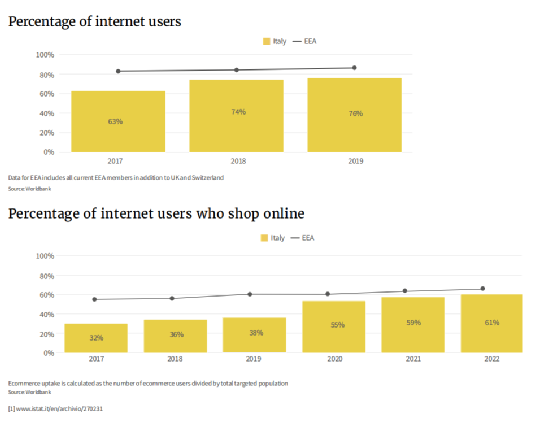

Wat ynternetpenetraasje oanbelanget, leit Itaalje ûnder it EER-gemiddelde. Neffens de Wrâldbank wie ynternetpenetraasje yn Itaalje 76% yn 2019 (it EER-gemiddelde foar deselde perioade wie 86%), in ferheging fan 63% yn 2017. , de lêste rint fan 38% yn 2019 nei 55% yn 2020, en dan nei 59% yn 2021, en wurdt ferwachte dat se 62% yn 2022 berikke.

Neffens gegevens fan Statista seine 74% en 81% fan 'e Italjaanske respondinten ûnder de leeftyd fan 24 en 25 oant 44 dat se online winkelje brûkten as konsumpsjemetoade, en d'r wie gjin dúdlik ferskil tusken geslacht, wylst de respondinten oer de leeftyd fan 65 Gender gap yn Sina wurdt fergrutte, mei 25% fan manlju winkeljen online, wylst mar 16% fan froulju.

Yn maart 2022 naam de totale retailferkeap yn Itaalje foar 13 opienfolgjende moannen ta yn fergeliking mei deselde perioade ferline jier, en wylst de totale retailferkeap yn 't algemien ferhege fergelike mei 2021, foel online winkeljen mei 3.9%, neffens Istat. %. Ferkeap ferhege yn alle kategoryen útsein kompjûters en telekommunikaasjeapparatuer (-0,5%), mei learguod en reisguod (+24,6%), meubels, tekstyl en húshâldlik guod (+20,9%) en klean (+20,5%) %).

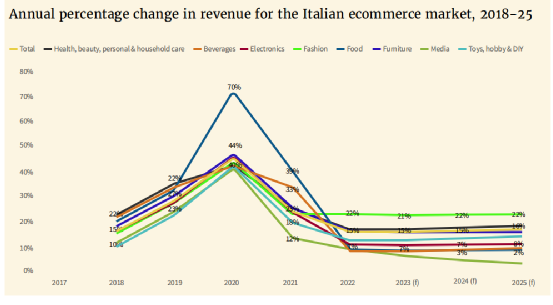

Neffens gegevens fan Statista is it folume fan transaksjes fan Italjaansk e-commerce oan 'e opkomst west foar de epidemy, mei in tanimming fan 27,2% yn 2019, in tanimming fan 43,8% yn 2020 fanwegen de epidemy, en in weromfal nei 14,7% yn 2021 It wurdt ferwachte om groei te behâlden oant 2025. It positive stimulearjende effekt fan 'e epidemy op kategoryen lykas iten. (+70% yn 2020, +39% yn 2021), boartersguod (+40,5% yn 2020) en meubels (+45% yn 2020) is dúdliker.

Spotlight op lokale Italjaanske trends

- Konsumpsje gewoanten

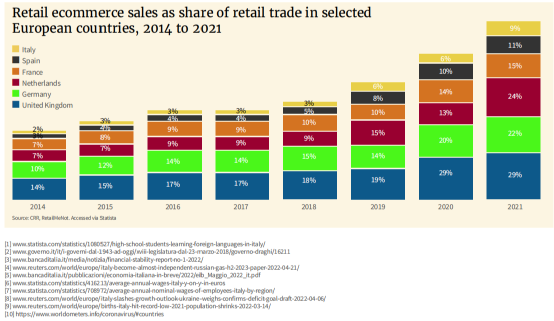

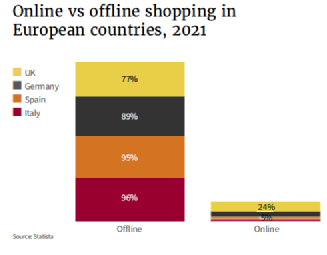

Yn ferliking mei guon Noardske lannen binne Italianen mear ree om offline te besteegjen. Neffens statistiken fan Statista sil it oanpart fan online en offline konsumpsje yn Italië yn 2021 respektivelik 4% en 96% wêze. Statista's analyse fan foarkarren foar winkelstyl lit sjen dat de e-commercemerk fan 'e regio genôch romte hat om te groeien.

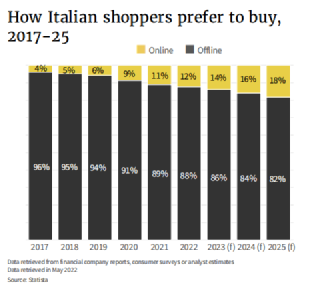

As can be seen from the figure below, since 2020, the willingness of Italian consumers to shop online has shown an upward trend year by year. It is estimated that by 2025, the online shopping rate of Italian consumers will reach 18%, and 82% will still choose to buy in offline supermarkets or stores. Analysts say retailers with multi-channel business models and convenience services could benefit from this change in user behavior.

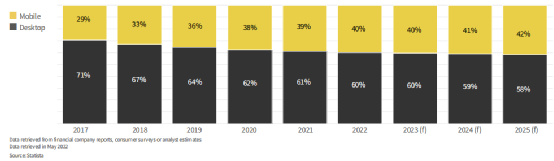

In Italy, computer-side online shopping is still very popular. In 2017, the proportion of mobile and computer-side online shopping was 29% and 71% respectively. As time goes by, the gap between the two is gradually narrowing. Data shows that more and more people will shop online through smartphones or other mobile devices. According to Statista, the proportion of online shopping on mobile in Italy will rise to 39% in 2021 and is expected to reach 41% by 2024. Additionally, Statista predicts that by 2025, 70% of consumers will own a smartphone.

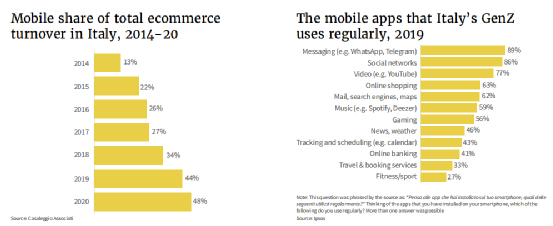

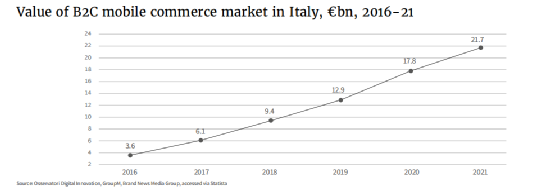

Analysis by Casaleggio Associati shows that the proportion of online shopping on mobile devices has risen significantly. In 2014, mobile e-commerce sales accounted for 13%, and in 2020, this proportion rose to 48%. The market value of mobile commerce is also on the rise – from €3.6 billion in 2016 to €17.8 billion in 2020 and €21.7 billion in 2021. This shows that Italians are increasingly interested in mobile online shopping. Statista pointed out that the 25-34 age group of respondents made the highest proportion of online shopping on the mobile terminal, reaching 77%.

- Social media e-commerce

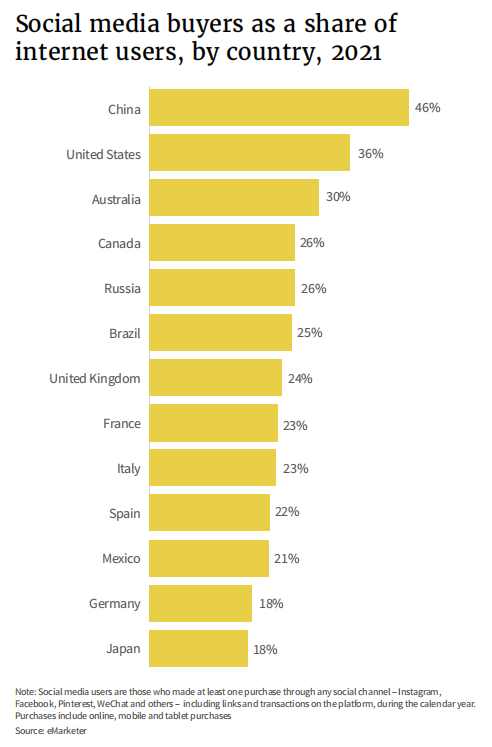

According to eMarketer, 23% of Italian netizens shop online through social media channels such as Instagram, Facebook or Pinterest, second only to the UK at 24%. Social media shopping is even lower in Spain and Germany, at 22% and 18%, respectively. However, social media e-commerce usage in all European countries lags far behind China and the United States.

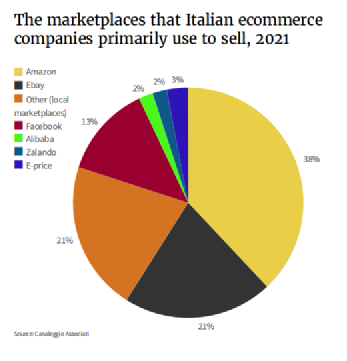

According to data from Casaleggio Associati, in 2021, 13% of companies will choose Facebook as an e-commerce trading platform. As mentioned earlier, Generation Z is the main driving force for the development of Italian social media e-commerce. Amazon (38%), eBay (21%) and other local platforms (21%) are the choices for most businesses.

- Silver economy

Older shoppers make up a higher percentage of the total population in Italy than in Europe as a whole. World Bank figures show that the share of Italy’s population over the age of 65 has been rising steadily over the past decade, from 20 percent in 2010 to 23 percent in 2020. In 2021, the European population over the age of 65 will account for 19.1% of the total population. At the same time, the proportion of young Italians is also slowly declining, from 14% in 2010 to 13% in 2020 (15.5% in Europe over the same period). Under the trend of an aging population, e-commerce companies or retail companies need to pay more attention to the needs of the elderly.

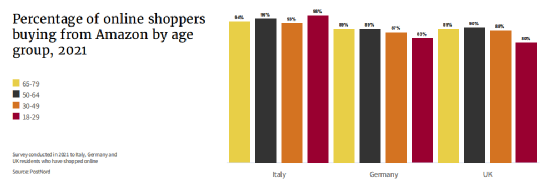

In Italy, 65 percent of respondents aged 45 to 64 were male and 62 percent were female, according to Istat. Among respondents aged 65 and over, the proportions were 25% and 16%, respectively. Elderly Italians seem to be more receptive to e-commerce than the UK and Germany. Judging by purchases from Amazon. 96% of Italian netizens aged 50 to 65 use Amazon, and 94% of netizens aged 65 to 79 are higher than the respondents in the UK and Germany in the same age group.

- Payment method

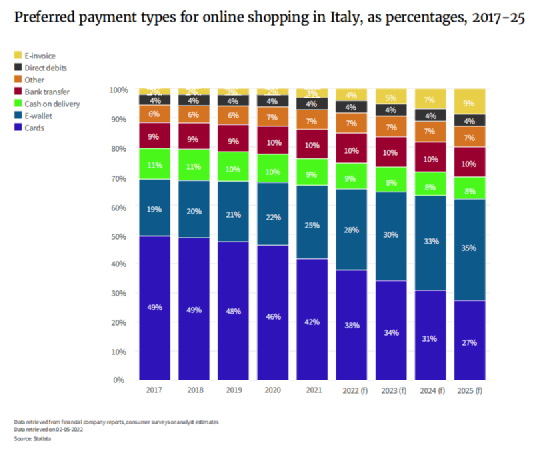

According to Statista, more convenient means of payment, such as e-wallets, are starting to gain popularity in Italy. In 2017, 49% of consumers made purchases with a card. Since then, this proportion has declined and is expected to drop further to 27% by 2025; in 2017, the proportion of using electronic wallets was only 19%, and it will increase to 25% and is expected to reach 35% by 2025. The popularity of smartphones is an important reason for the rise in e-wallet usage.

- Online shopping returns

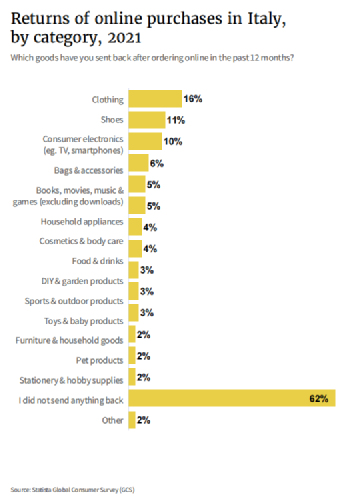

The current return rate for online shopping in Italy remains at a low level. In a 2021 Statista study, 63% of respondents said they had not returned a product purchased online in the past year. Categories with higher returns are apparel (16%), footwear (11%) and electronics (10%). At the same time, the categories that consumers are most likely to buy online include electronic products, accounting for 44%, and the online shopping rate of clothing accounts for 31%. Categories with particularly low return rates include household goods, pet products, and stationery, all at 2%.

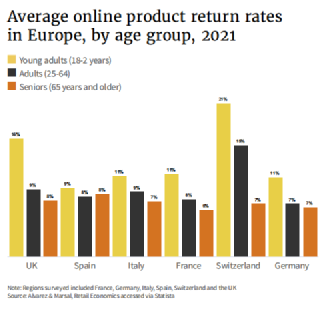

In the study by Alvarez & Marsal/Retail Economics, young consumers had the highest return rates of the six European consumer markets surveyed. Research shows that the return rate for online shopping among Italians aged 18-24 is 11%, 9% for those aged 25-64, and 7% for those over 65. It is worth noting that the penetration rate of online shopping is often proportional to the return rate, and returns will become an unavoidable cost over time. Like the rest of the EU, Italian consumers have at least 14 days to return products purchased online. EU law also stipulates a two-year free warranty period, regardless of the purchase channel, giving consumers enough life cycle to return the faulty product.

- Consumer goods

Fashion and electronics are the two most popular online shopping categories in Italy. According to Statista, Italians will spend an average of about 554.79 euros in online shopping for fashion in 2021, and this figure is expected to rise to 936.43 euros in 2025; the average online purchase of electronic products is about 392.50 euros, which is expected to rise by 2025. to about 429 euros.

When asked “Which categories are more willing to buy online than brick-and-mortar stores”, 44% of the respondents chose electronic products including mobile phones and TVs, and books & movies & music & games goed foar 39%. Klean en skuon makken respektivelik 31% en 28%. Op it stuit prioritearje minder Italjaanske konsuminten online boadskippen (8%), meubels en húshâldlike items.

Statista fûn ek dat 68% fan minsken op syk nei ynformaasje online foardat se elektroanika keapje, wylst 51% seit dat se dat dogge foardat se hûsapparaten keapje. As it lykwols giet om it keapjen fan boeken, films, muzyk, klean, skuon en oare kategoryen, is it oanpart fan “húswurk dwaan” is lytser op 37%.

Neffens de 2021 Statista Global Consumer Survey, binne de redenen wêrom't Italjanen leaver dizze kategoryen online keapje kinne foaral foar wearde foar jild (64%) en levering thús (60%).

- Fakânsje winkeljen

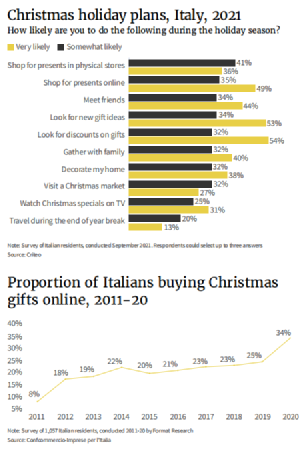

According to 2020 McKinsey data, more than half (51%) of Italians are likely to shop during the holidays. This ratio is higher than in the UK and US, but lower than in France, Germany and Japan. A study by Format Research for Confcommercio-Imprese per l’Italia shows that Italians are increasingly shopping online. After the outbreak of the epidemic in 2020, the online shopping rate on holidays has further increased.

- Retailers

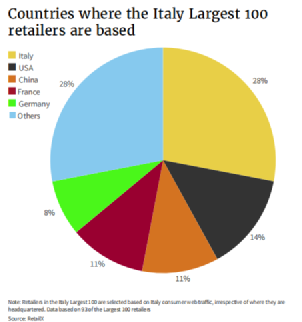

The RetailX study found that 28 of the top 100 retailers are headquartered in Italy, and U.S. retail companies have a large market share in Italy, with headquarters in China (11%), France (11%) and Germany (8%). of retail companies also have a strong presence in the Italian e-commerce market.

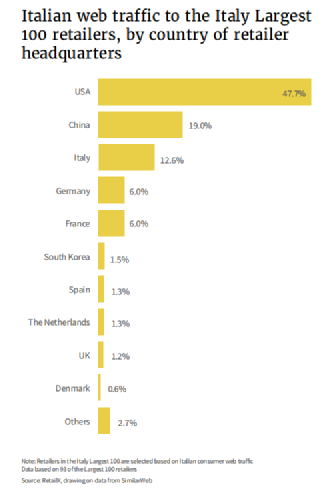

In terms of the traffic distribution of the top 100 retailers in Italy, retailers headquartered in the United States accounted for the largest share of traffic at 47.7%. Chinese online shopping platforms have a larger traffic share (19%) than Italian online shopping platforms. Site traffic was lower in Germany and France (both 6%), with smaller shares in South Korea (1.5%), Spain (1.3%), the Netherlands (1.3%) and the UK (1.2%).