1. Lemmikkiteollisuuden suuntaukset: markkinoiden kasvutila ja tilastotiedot

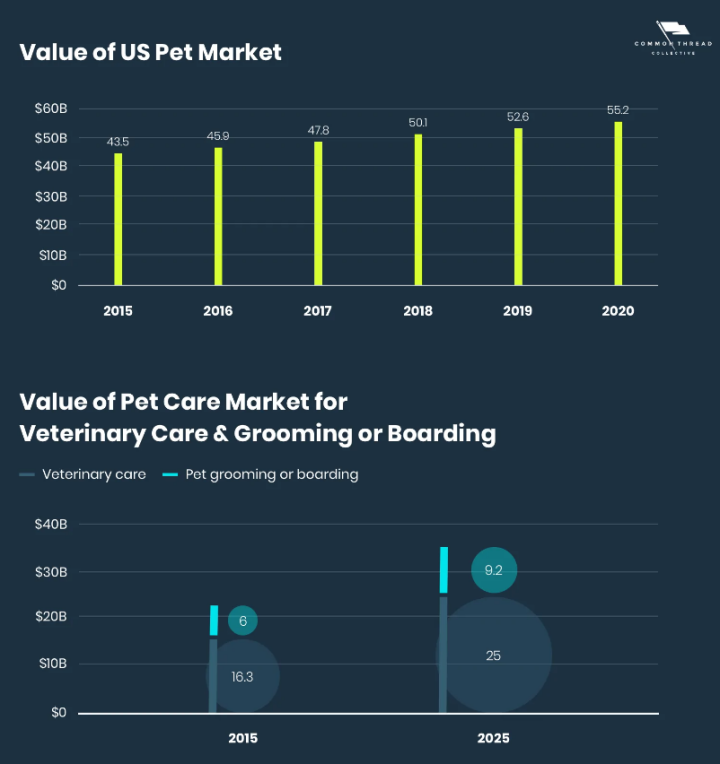

Global Market Insightsin mukaan maailmanlaajuisten lemmikkieläinten ruokatarvike- ja hoitomarkkinoiden odotetaan kasvavan 261 miljardiin dollariin vuonna 2022, kun se vuonna 2021 oli 245 miljardia dollaria, ja sen odotetaan kasvavan 6,1 prosentin vuotuisella kasvuvauhdilla (CAGR). saavuttaa 350 miljardia dollaria vuoteen 2027 mennessä.

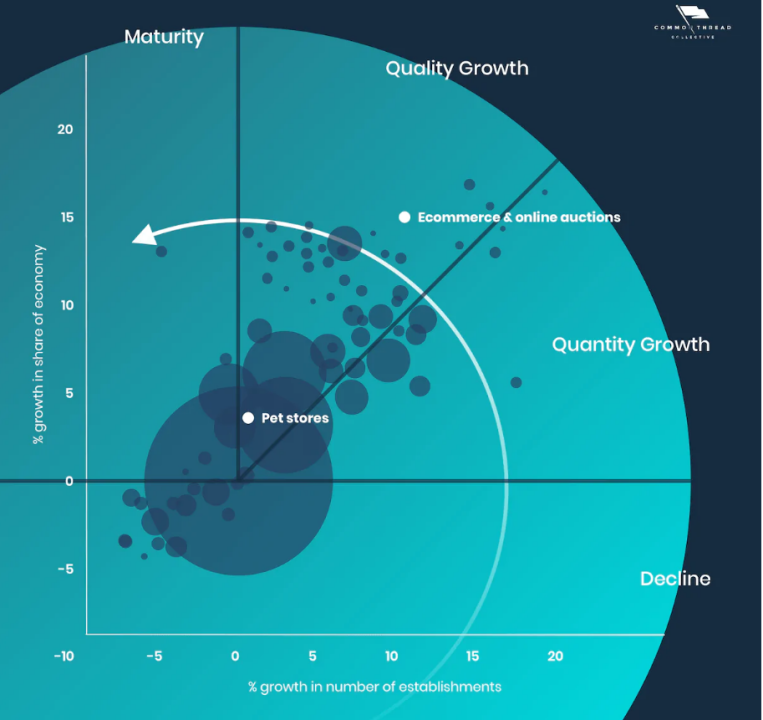

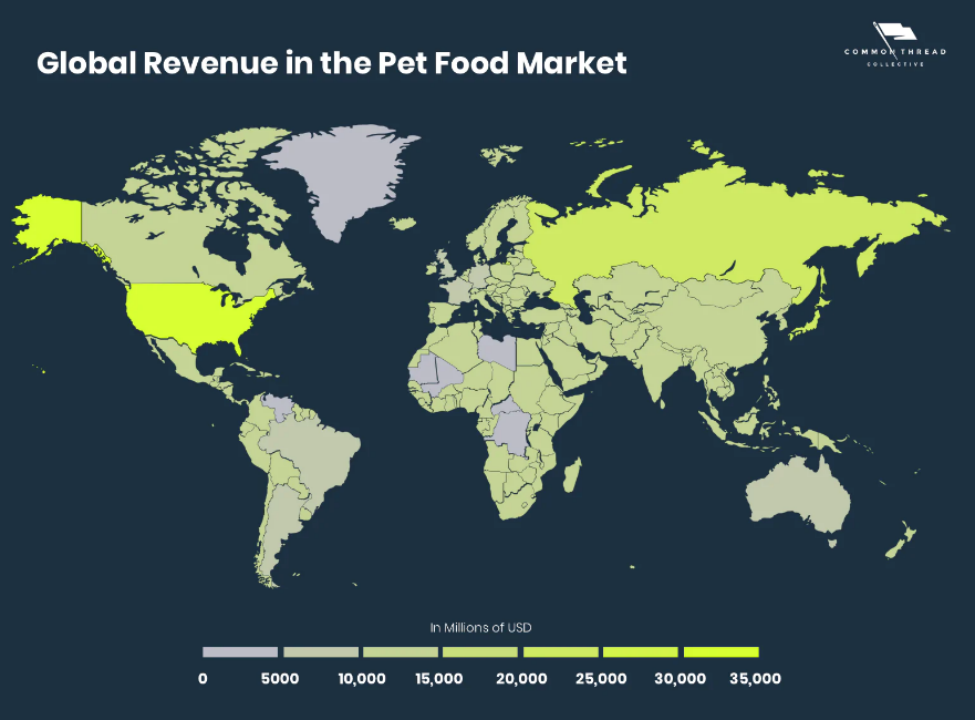

Näistä Pohjois-Amerikan ja Länsi-Euroopan markkinat ovat suhteellisen kypsät ja kasvunvaraa on vielä paljon. Nousevat brändit voivat tulla peliin uusien tuotekehityksen ja uuden kanavan käyttöönoton näkökulmasta.

· Yleiskatsaus lemmikkieläinten sähköiseen kaupankäyntiin

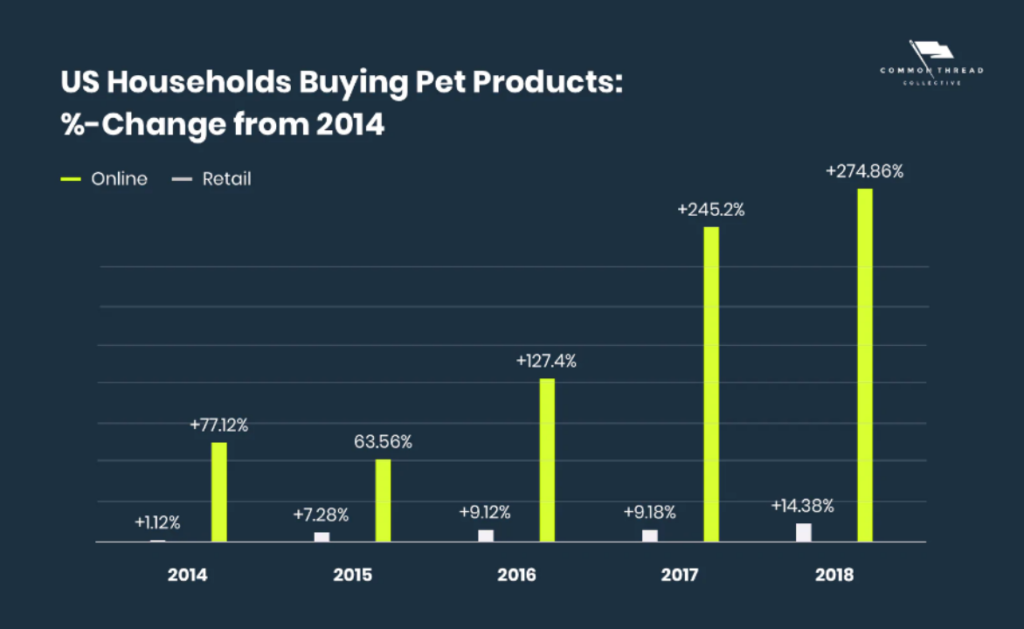

Compared to offline retail, where purchases have grown relatively slowly, online pet purchases have nearly quadrupled since 2013.

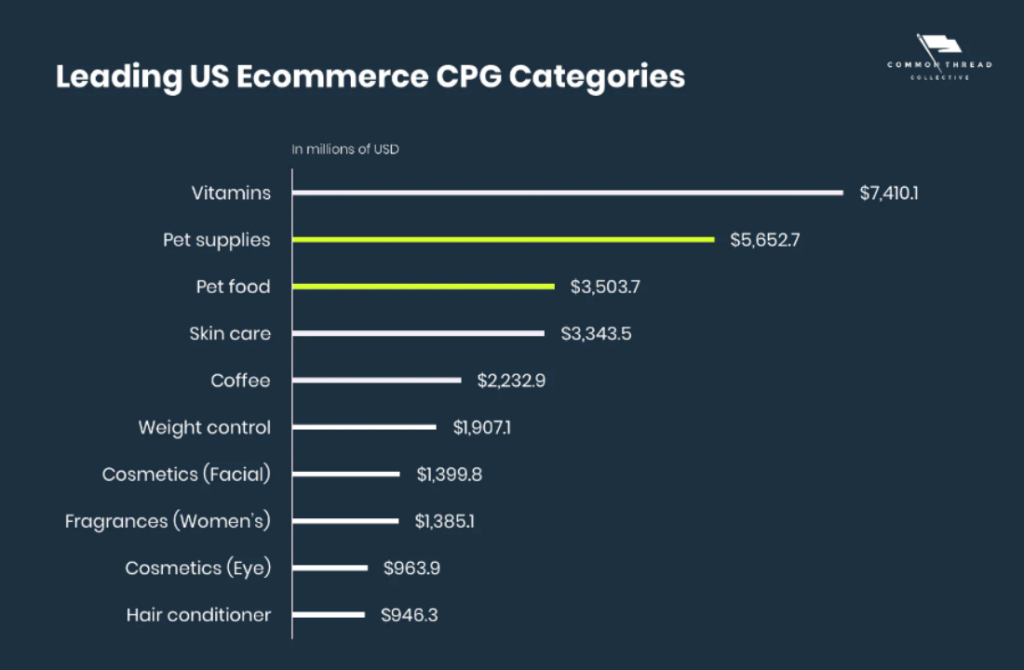

As the pet adoption rate continues to rise, the target market for the entire industry will expand, creating new penetration points. Pet food and pet supplies are a potential e-commerce CPG (fast-moving consumer goods) category for sellers eager to break into new markets.

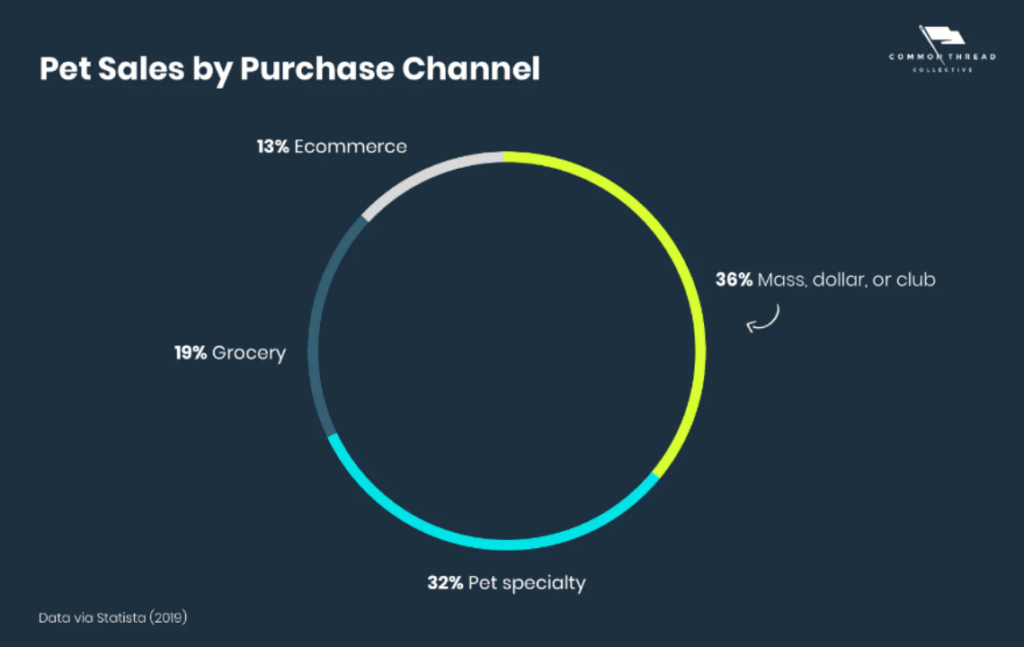

- commerce channels have broad growth potential and currently account for 13% of the overall pet supplies sales:

·Pet supplies consumer portraits and preferences

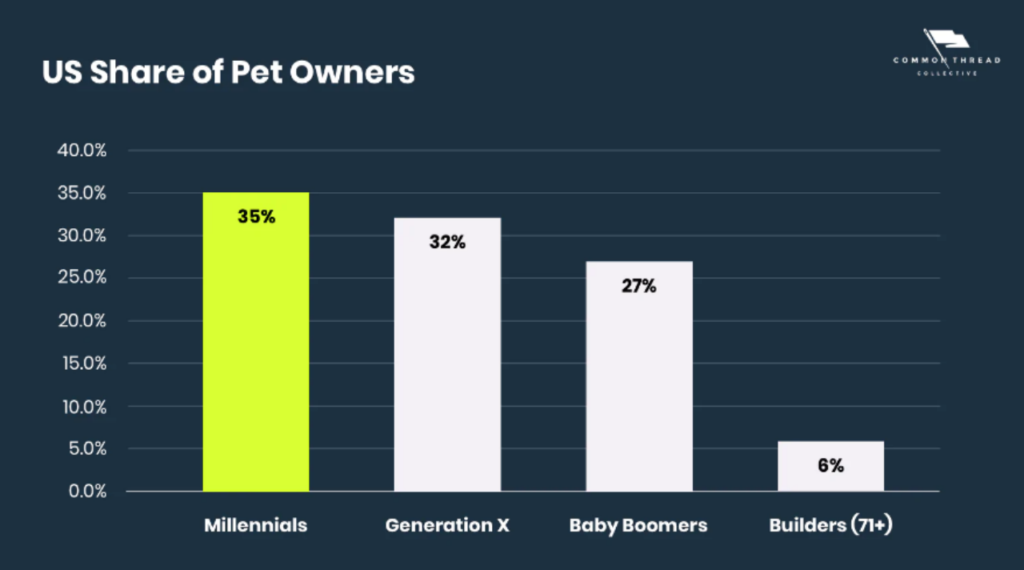

Today, millennials have surpassed baby boomers to become the main force in pet supplies consumption. If you want to grab market share, you must learn to capture the hearts of millennials.

The online purchasing power of millennials is strong. According to eMarketer, millennials spend almost twice as much time on social media as baby boomers: 90.4% of millennials are active social media users, compared to 48.2% of baby boomers. Pet products have unique advantages in content marketing, which can seize the nature of consumers’ “social Internet addiction” and seize the competitive advantage of channels.

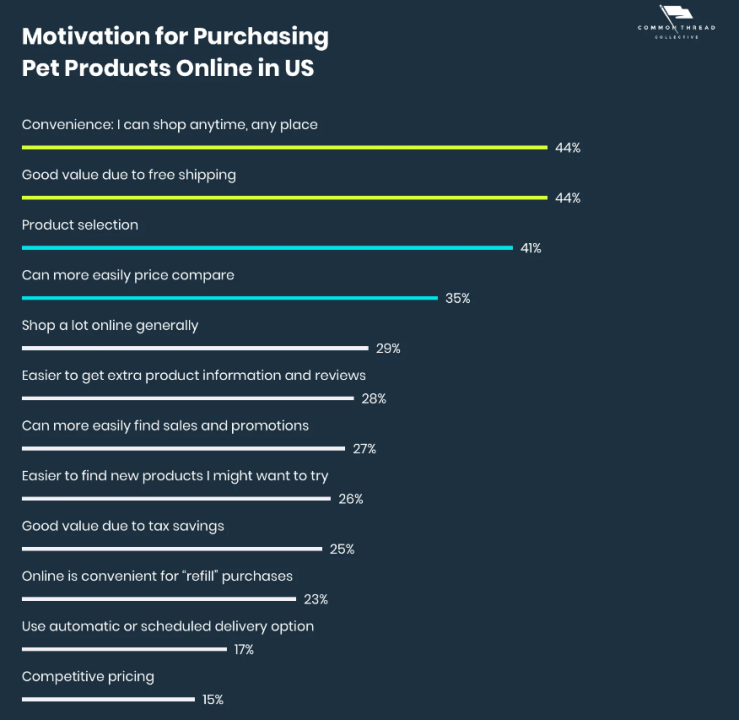

In addition, the main factors that promote consumers to switch to online consumption are: product price, convenience and personalized service.

The integration of online and offline channels, the realization of dual-channel retail, faster delivery, better cost control and home delivery are the shopping expectations of consumers and the call of the times.

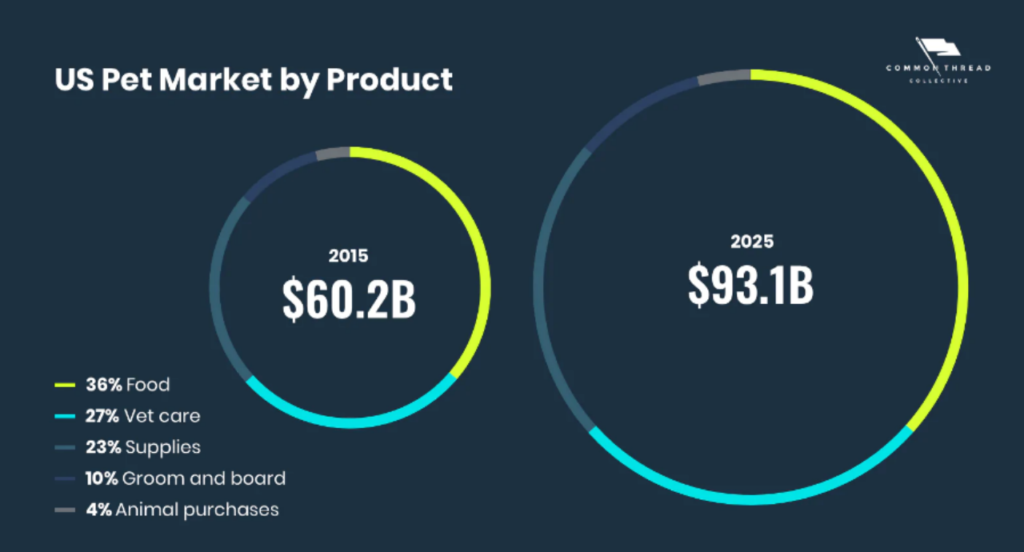

In terms of sub-category markets, each industry has different trends and value propositions. The following three sub-segments will be explained in pet food, pet care and other pet supplies.

· Market data of sub-categories

(1) Pet food

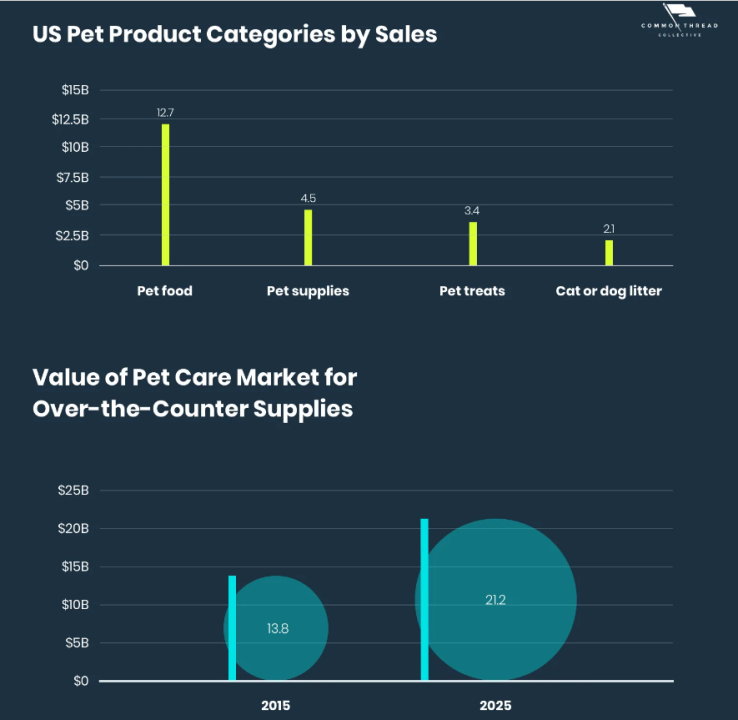

With global sales of $91.1 billion, pet food is the largest segment of the overall pet supplies market:

Taking the U.S. market as an example, its market size in 2020 is $30.9 million, with most of the revenue coming from the food segment, which also includes snacks and supplements.

Growing retail penetration across various channels has contributed to the growth of the pet food market. Among them, high-quality pet food is the potential development direction, and natural and organic food tends to have higher prices and greater profit margins.

(2) Pet care and services

The pet services market includes grooming, boarding, training and care and is the fastest growing product segment within the pet supplies industry over the past five years.

The rising demand for pet care and other special services by pet owners who view pets as family members, coupled with rising per capita income and increasing number of pet adoptions, has driven up the price level of the overall pet care service industry.

Eläinlääkintätoimiala on kasvanut lemmikkieläinten omistajien määrän vuosi vuodelta lisääntymisen myötä, kun taas muutokset, kuten kotitalouksien tulojen nousu ja epidemian hiljentyminen, ovat vaikuttaneet myös ihmisten matkustustiheyteen ja lisänneet lemmikkihoitopalveluiden kysyntää.

Jakelukanavasta riippumatta laadukas hoito on brändivoiton ydin.

(3) Muut lemmikkieläintarvikkeet

Other pet products include pet clothing, food bowls, collars, etc. Although the overall market growth is relatively slow, the development prospects are bright. According to the data in 2019, the revenue of this sub-category accounted for 40.6% of the total industry revenue, and the performance of the US market was particularly outstanding. , sales of about 4.54 billion US dollars.

The trend of raising pets like “parenting” has ushered in a booming market for pet accessories, and fashion and versatility will be the key keywords driving the development of the industry.

Divided by sales channels, about 17% of people purchased pet products online in 2017, a year-on-year increase of 13%. The sales of offline supermarkets are also facing fierce competition.

For e-commerce sellers, differentiation and product innovation are the focus for brands to gain a firm foothold and promote the diversification of product price competition, and niche products can attract more market attention.

· Big name chain retail vs digital online brand

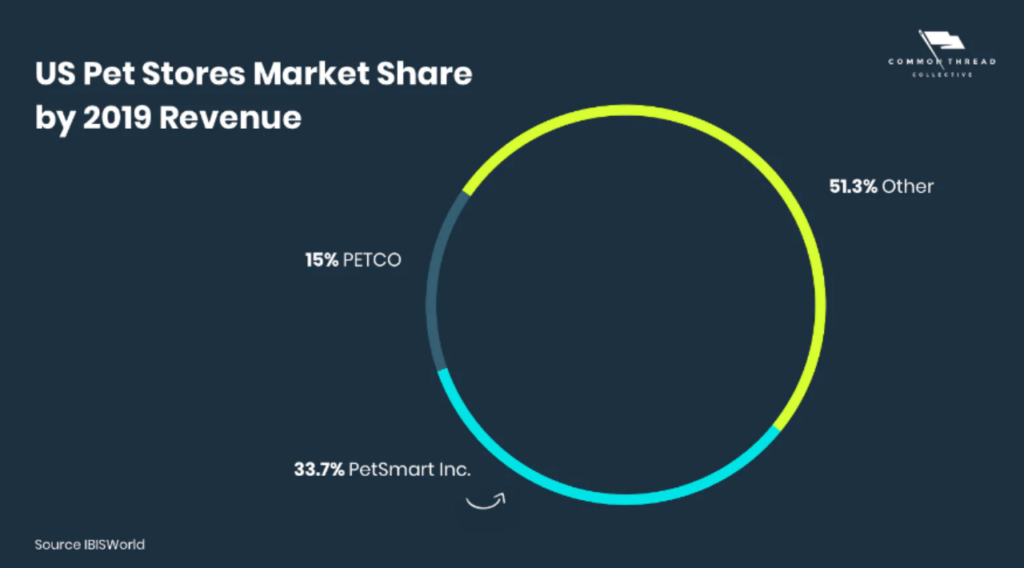

Two retailers, PetSmart and Petco, dominate the pet supplies market with a combined market share of 40%. According to the Pet Industry 2019 Top 25 Retailers list, PetSmart added a net 48 stores (over 100 in 2017) and Petco added a net 10 stores (39 in 2017).

IBIS’ World Industry Report states: “Competition from supermarkets, mass merchandisers and online retailing is increasing, while traditional brick-and-mortar stores have reinvented themselves to position themselves as pioneers and pioneers in high-quality food and services such as beauty or daycare. Sole supplier.” Meanwhile, homegrown pet brands in the digital age are steadily gaining more market share.

· Amazon

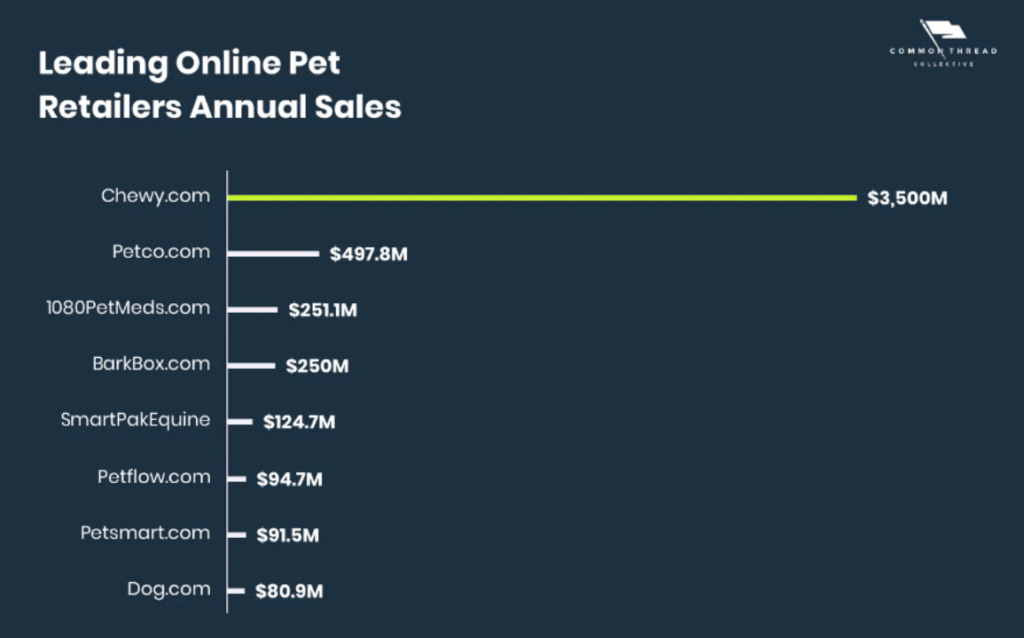

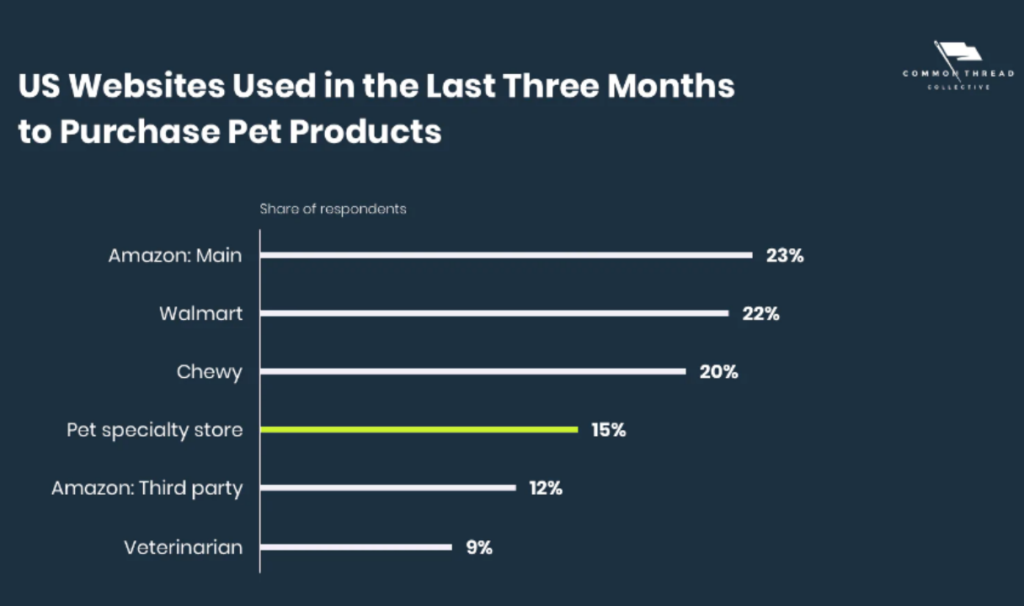

Amazon’s own and third-party sellers have grabbed 35% of the online market share, and pet startups can only compete for the remaining food in the bowl.

While Amazon’s size and market share may seem daunting, it also shows that there is something to be said for selling pet supplies online, and further affirms that pet brands need to digitize their products if they are to succeed and gain more market share. Laying online sales channels.

Second, the pet industry e-commerce marketing growth strategy

The growth of pet brands is based on four metrics: visitors, conversion rates, customer lifetime value, and variable costs. The e-commerce growth formula composed of these four indicators is the basic framework for brands to formulate a successful digital marketing strategy.

·case analysis

Established in March 2019, Crown & Paw is a custom brand of fun pet supplies that uses pet photos to create Renaissance-style portraits. By December of the same year, the brand had achieved a 10-fold increase in sales and was released globally.