Markedsværdien af sportsgrene & Udendørs i Europa er Mellemøsten og Afrika (EMEA) 12,04 milliarder euro i 2021 og forventes at overstige 13,18 milliarder euro i 2022. Denne rapport vil fortolke sportens resultater & Udendørs produkter på det europæiske marked fra flere perspektiver og guide sælgere til fuldt ud at værdsætte tendensen med populære europæiske kategorier.

Indholdsfortegnelse:

1. oversigt over europæisk sportsgrene & Marked for udendørs produkter

2. Forbrugertrends

3. Populære kategorier

4. Regional økonomi på det europæiske sportsmarked

5. Konkurrencedygtigt landskab på europæisk sportsmarked

6. Vækstpunkter i den europæiske sportsindustri i 2022

- Oversigt over europæiske sportsgrene & Marked for udendørs produkter

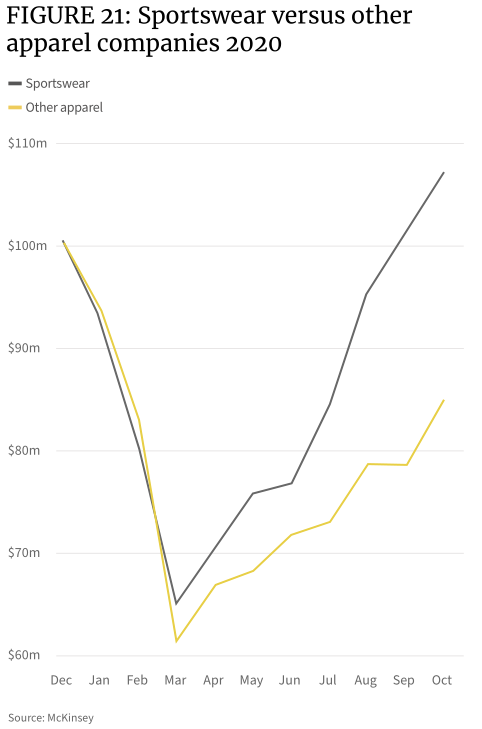

Epidemien er uden tvivl den stærkeste hjælp til stigningen i salget af sportsgrene & udendørs produkter. I marts 2020 spredte epidemien sig til det europæiske kontinent, og holdsport og indendørs sportsgrene kunne ikke udføres. Dette førte til en grundlæggende ændring i sportspræferencerne på hele det europæiske kontinent i 2020 og 2021. påvirket af rejsebegrænsninger, hvor de deltog i disse to års salg af vintersportsbeklædning faldt med færre mennesker, der skilier og andre vintersport.

Flere forbrugere henvender sig til personlig træning, herunder yoga og Pilates. Under epidemien er der ikke mange projekter, som folk kan gå ud for at implementere, hovedsageligt vandreture og løb, hvilket har skabt et godt marked for udendørs tøj og gåudstyr. Sports- og fritids tøjmarkedet, der kombinerer egenskaberne ved yogatøj, sportsbeklædning og afslappet tøj, er blevet en varm kategori, da folk arbejder hjemmefra og tager online klasser. Online shopping, som den eneste måde for forbrugerne at shoppe, når mursten og mørtelbutikker er lukket, har åbnet salget på grund af epidemien.

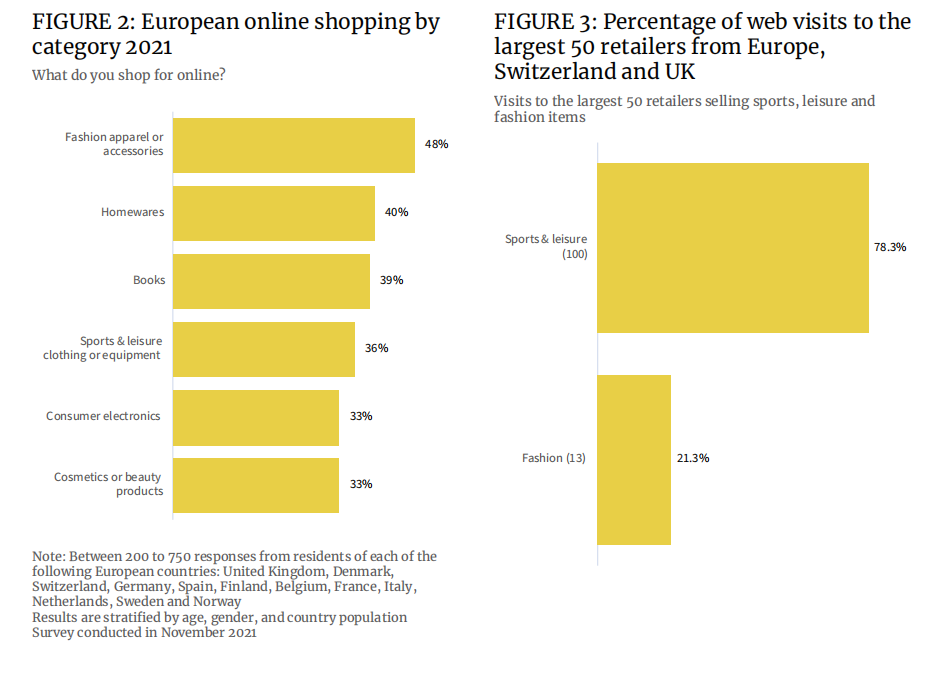

Data viser, at 36% af europæerne i 2021 vil købe sports- og fritidstøj & udstyr online, og andelen af nethandel i denne kategori er kun lidt bagefter bøger (39 %) og husholdningsartikler (40 %). Online shopping af modetøj & tilbehør tegnede sig for 48 %, hvilket indikerer, at den overordnede intention om online shopping hos forbrugere i denne region er lavere end i andre regioner.

Med hensyn til andelen af besøg hos de 50 bedste forhandlere i Europa, søgte mere end 78 % på søgeordet “sport og fritid”, mens kun 21 % søgte efter “mode” alene. Det betyder, at sportstøj, athleisure og sportsmode bliver en del af flere og flere tøjmærker’ produktlinjer.

Samtidig har sundhedstestning og fysisk træningsapplikationer, der hævder at forbedre folks bevidste træningsbegejstring, sat gang i endnu en runde fitness “revolution”.

Mange sportsbrands i første række har skabt deres egne fitness-apps, etableret brugerfællesskaber og opfordret brugerne til at træne, mens de åbner op for nye indtægtskanaler, inklusive betalte abonnementer. Nikes Run Club-app har 15,4 millioner downloads i 2020, en stigning på 45 % i forhold til 2019, og er blevet en vigtigere del af Nikes indtægtsstruktur. Analysen viser også, at appen har bragt en meget stor eksponering for Nike i kommunikationsfællesskabet for udendørs sportsbrugere som løb. Nikes marginale, men avancerede produkter udstyret med “Sort teknologi” er solgt til høje priser.

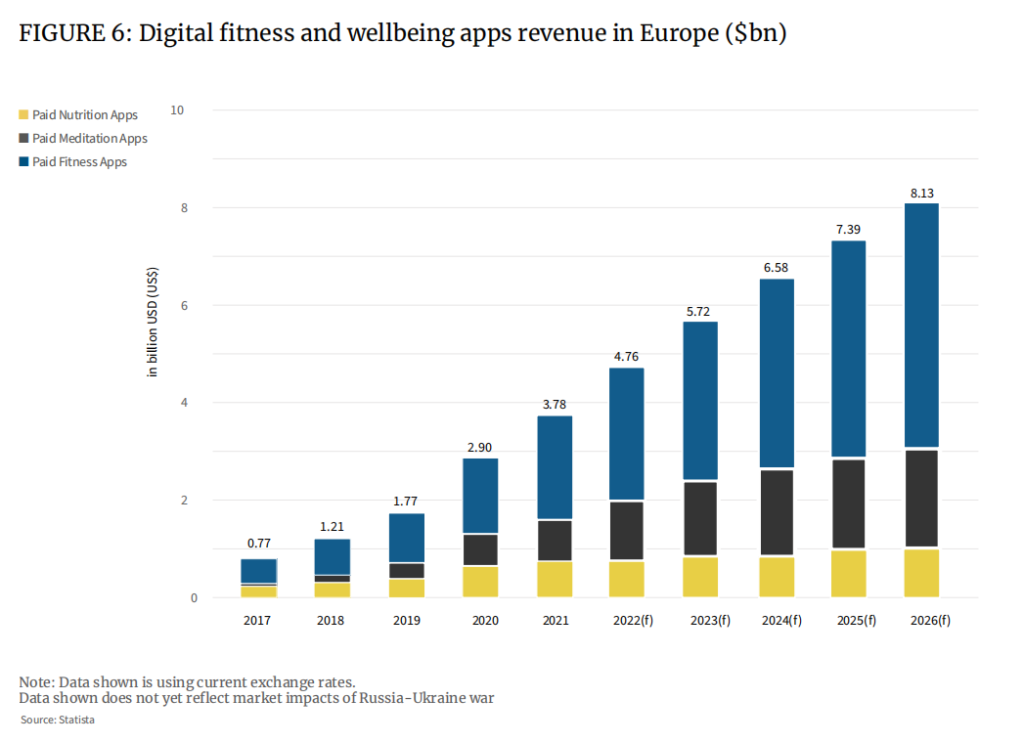

Disse applikationer indsamler en række biometriske data fra brugere, såsom højde, vægt, alder, tøj og skostørrelse osv., Og registrerer ændringer i forskellige fysiske funktionsindikatorer, herunder hjerterytme under træning. Dette alene bringer fordele til disse mærker. Årsagen er, at mærker kan give brugerne mere personaliserede købsanbefalinger baseret på data. I 2021 vil det gennemsnitlige forbrug på betalte fitness -apps i Europa stige fra $ 41 i 2017 til $ 60, og det forventes at fortsætte med at vokse i løbet af de næste 10 år.

Derudover påvirker bæredygtige koncepter også forbrugere’ Shoppingbeslutninger.

Dataene viser, at omkring 5 % af sports- og fritidsprodukter købt af forbrugere i 2021 er baseret på bæredygtig udvikling (4,5 % for mænd og 5,4 % for kvinder), selvom det er relativt lille, sammenlignet med 3,8 % i 2019. Sammenlignet med 4,6 % af kvinder er andelen af mænd blevet væsentligt forbedret. Ved udgangen af 2022 kunne salget af bæredygtige sportsartikler nå op på 4,9 % (mænd) og 5,9 % (kvinder).

I europæiske sportsartikler er markedsværdien af bæredygtige produkter omkring 600 millioner euro i 2021 og kan nå op på 800 millioner euro i 2022.

Virksomheder har nu et ansvar for at udforske nye, bæredygtige materialer og fremstille deres produktion, transport og emballage så bæredygtig som muligt. Leverandører, producenter og mærker vil også være opmærksomme på genbrug af materialer og drive modenheden på markedet for brugte sportsudstyr.

Mens bæredygtige produkter er afhængige af materialer, teknologi og fremstillingsprocesser og er materielle og energikrævende, er deres publikum mere tilbøjelige til at betale en præmie for bæredygtige varer, der tegner sig for 64% af de adspurgte. Dette vil få industrien til at øge investeringerne i overensstemmelse hermed for at tilpasse sig markedets efterspørgsel.

For eksempel har Nike siden 2019 indset, at 99,9% af affaldet fra skofremstilling kan genbruges eller omdannes til andre energikilder. Siden 2016 har Nike reduceret sit ferskvandsforbrug med omkring 23 milliarder liter om året. En anden gigant i branchen, Adidas, sagde på sin hjemmeside, at fra 2020 vil 60 % af dets produkter være lavet af bæredygtige materialer. Mærker som Patagonia er selv positioneret til at være miljøvenlige og som forbrugere’ interessen for bæredygtige produkter stiger, stiger salget også.

En række nye mærker er også dukket op. Organic Basics, Girlfriend Collective og Wolven er alle blevet mere populære siden 2020, og SportsShoe, et professionelt løbeskofirma, har omstruktureret sin forretning aggressivt som reaktion på markedstendenserne for at opnå titlen som “Verdens grønneste, holdbare løbesko” titel.

- Forbrugertrends

1. Personlig træning

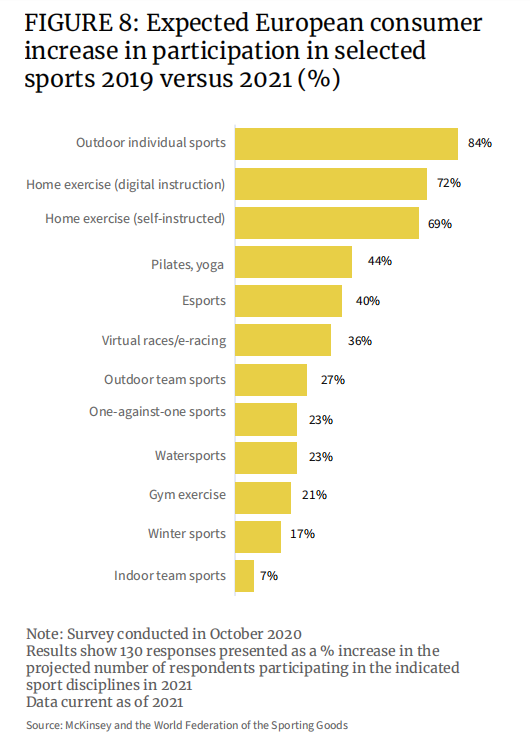

Ifølge dataene sagde omkring 65 % af de adspurgte i Tyskland, Italien, Spanien og Det Forenede Kongerige, at de efter epidemien ville integrere deres personlige helbred i deres daglige liv. Vejen er motion. Undersøgelsesresultaterne viser, at sammenlignet med 2019, de sportsgrene, som europæerne er mere tilbøjelige til i 2021, vil personlig udendørssport være blandt de bedste, med en stigning på 84 % inden for to år vil indendørs motion (onlineopfølgning) stige med 72 %, e-sport og virtuel sport. Motorsportsaktiviteten registrerede også betydelig vækst, en stigning på henholdsvis 40 % og 36 %.

2. Højtydende produkter

Brugere, der elsker højtydende produkter, forstår, at de køber forbrugsvarer, såsom løbesko. Efter 500 miles af slid begynder det støttende skum og slidbane at blive slidt, og slagfastheden er ikke længere tilgængelig; svedtransporterende tøj bruger små sølvtråde til at hjælpe med at fjerne sved og holde tøjet tørt, med begrænset effektivitet; og sports-bh'er Den mister sin vigtige støttefunktion efter gentagen brug. Baseret på dette er brugere af højtydende produkter generelt loyale gentagne købere. Med populariseringen af sundhedsbegrebet åbnede salget af sådanne produkter gradvist op.

3. Sport

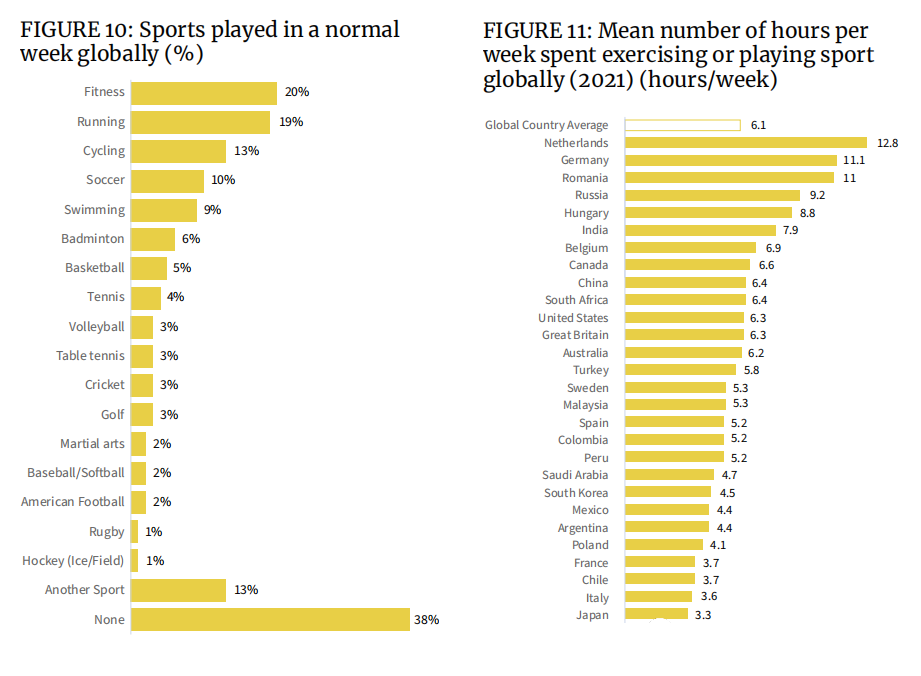

Som du kan se på figuren nedenfor, er fitness, løb og cykling de 3 mest populære sportsgrene på verdensplan. Holdsport som fodbold, basketball, volleyball og cricket samt en-til-en boldsport som badminton, tennis og bordtennis bliver også mere og mere populære, hvilket øger salget af specialiseret tøj, sko, og udstyr.

Ud fra perspektivet af ugentlig træningstid er folk i Spanien og Italien i Europa ikke særligt motiverede til at træne. Omkring 16 % af italienerne og 14 % af de spanske respondenter sagde, at det var påvirket af vejret. Fra et samfundsmæssigt perspektiv er begge lande blevet hårdt ramt af pandemien, og i modsætning til andre lande i Europa ser motion og fitness som nøglen til en sund livsstil.

4. Købspræference

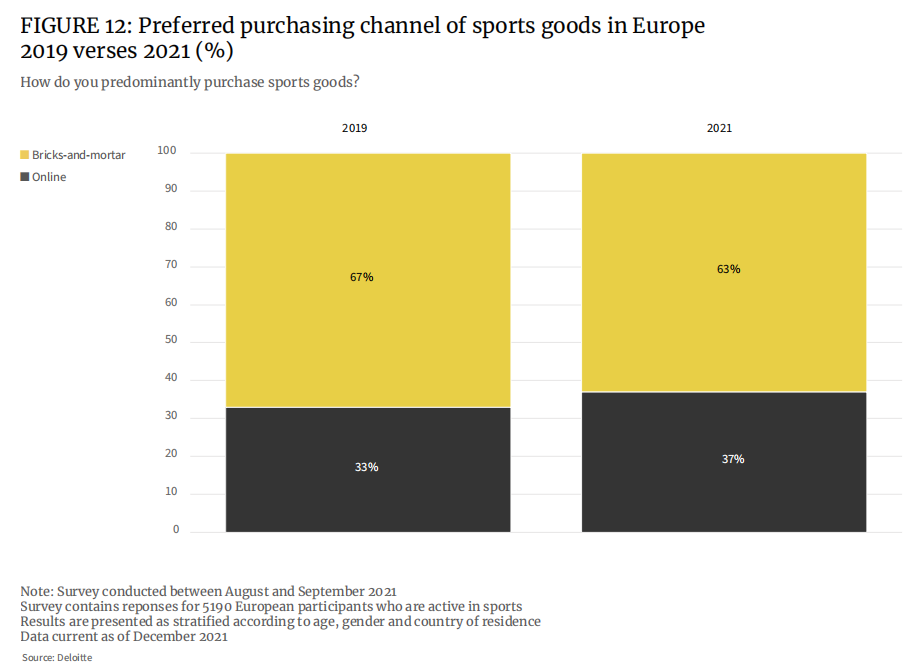

Før epidemien foretrak 67 % af de adspurgte fysiske butikker til at købe sportsartikler. I 2021 falder den procentdel til 63 procent.

Før epidemien var andelen af europæere, der handlede sportsudstyr online, 33 %, og den vil stige til 37 % i 2021. Flere produktvalg og højere omkostningseffektivitet på e-handelsplatforme er hovedårsagerne til stigningen i andelen af online shopping.

Det kan dog ses, at fysiske butikker stadig er det første valg for de fleste europæere at købe sportsvarer, såsom nogle dyre professionelle sportsbeklædningssko, eller tilpassede stilarter, som kræver, at forbrugerne kommer til butikken, såvel som rackets eller flagermus og flagermus og andet udstyr. Udseende og ydeevne skal opleves i butikken, før du kan købe med selvtillid.

- Populære kategorier

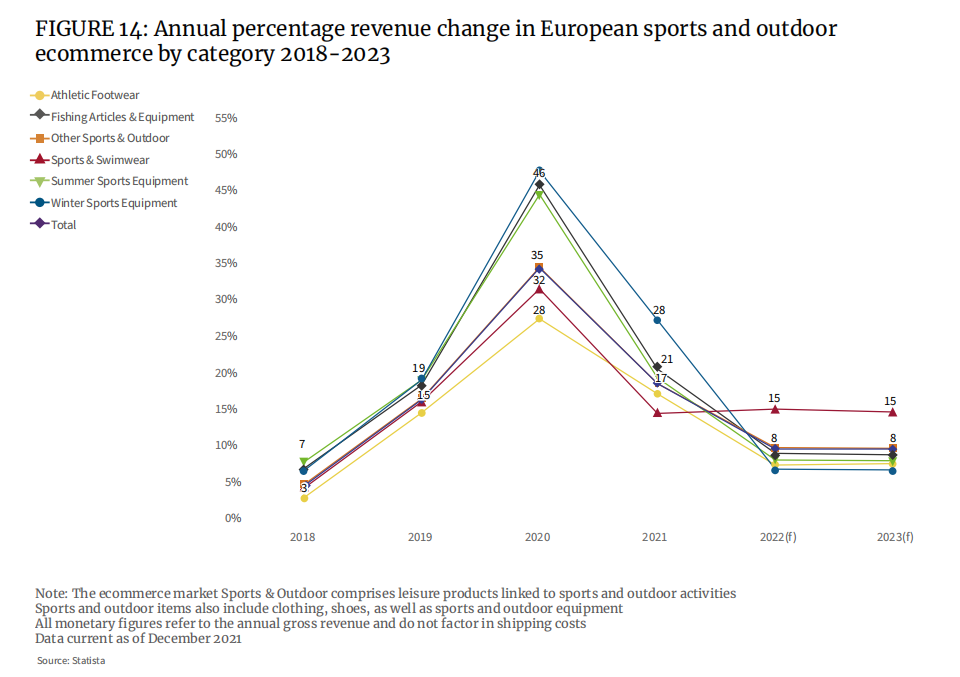

Markedsdata viser, at salget af alle markedssegmenter, fra sneakers, fiskeretning og badetøj, er steget i 2020. Den gennemsnitlige gevinst på tværs af alle kategorier toppede med 35% i denne periode.

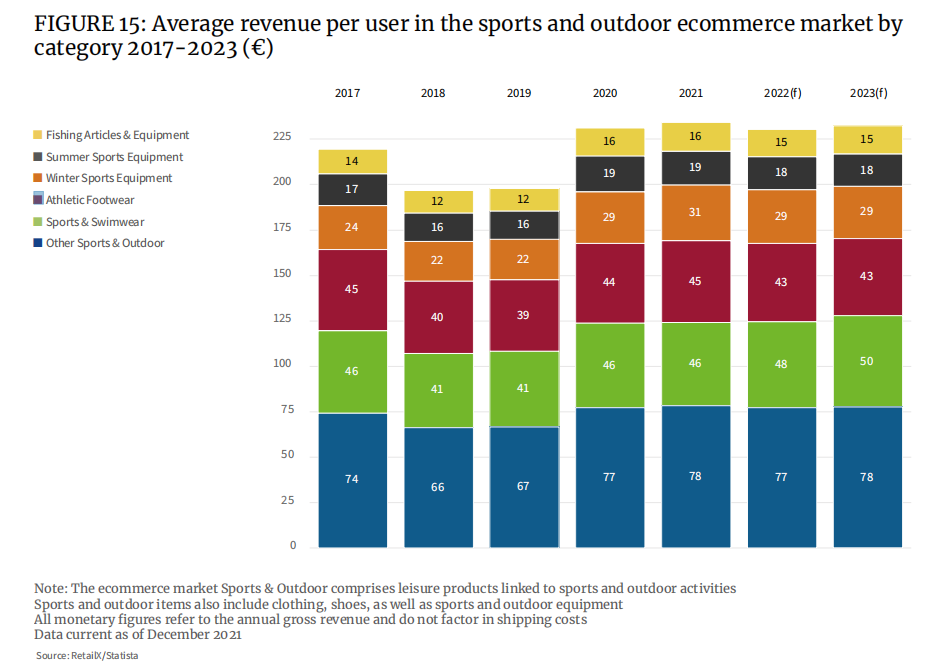

Det var tydeligt under pandemien, at forbrugernes udgifter til fiskeri, personlig sport og andet udendørs sportsudstyr er steget i vejret. Holdsportsudstyr og sko er omvendt. Den gennemsnitlige enhedspris for en enkelt forbruger viser, at fra 2019 til 2020 er forbruget af fiskeri og anden udendørssport steget markant. Den gennemsnitlige enhedspris for fiskeri steg fra 12 euro til 16 euro, og den gennemsnitlige enhedspris for andre udendørs sportsgrene sprang fra 67 euro til 77 euro, en stigning på henholdsvis 33 % og 15 %.

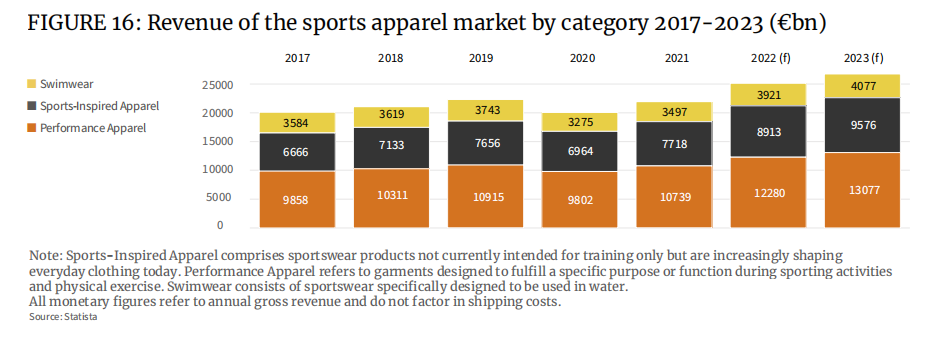

1. Sportstøj

Sportstøj kan forbedres yderligere til højtydende sportsbeklædning, moderigtigt sportsbeklædning osv., Især sidstnævnte, der gradvist har taget form som en iført stil siden 1960'erne, og sportsmærker som Fila, Adidas Originals, Champion osv. (OR produktgrene). ) tilhører denne stil. Efter epidemien er sportsbeklædning som yogatøj accepteret af flere og flere mennesker og er blevet et dagligt slid. Dette driver direkte væksten af mode -sportsbeklædning, som når 7,7 milliarder euro i 2021 og kan stige til næsten 9 milliarder euro i 2022.

2. udendørs sko

Som en underkategori af markedet for udendørs funktionstøj er markedsværdien af udendørs sportstøjssko i Europa omkring 3 milliarder euro, hvilket svarer til omkring halvdelen af markedsværdien af udendørsindustrien, og det forventes at opnå stærk vækst i fremtid. Efter epidemien længes folk i stigende grad efter udendørslivet, og indkøb af udendørstøj og udstyr til vandreture, camping og bjergbestigning er steget kraftigt. Tidligere var dette en luksus, men for flere og flere forbrugere er det blevet en hobby og et tidsfordriv.

Cykler har også set en stigning i efterspørgslen i 2019, 2020 og 2021. Det europæiske cykelmarked voksede med svimlende 40% i 2020 til 18 milliarder euro. På baggrund af dette vil det europæiske cykelbeklædningsmarked også vokse med 6% mellem 2020 og 2026. I Europa er der en voksende interesse for at bruge cykler som et dagligt transportmiddel.

3. sportssko

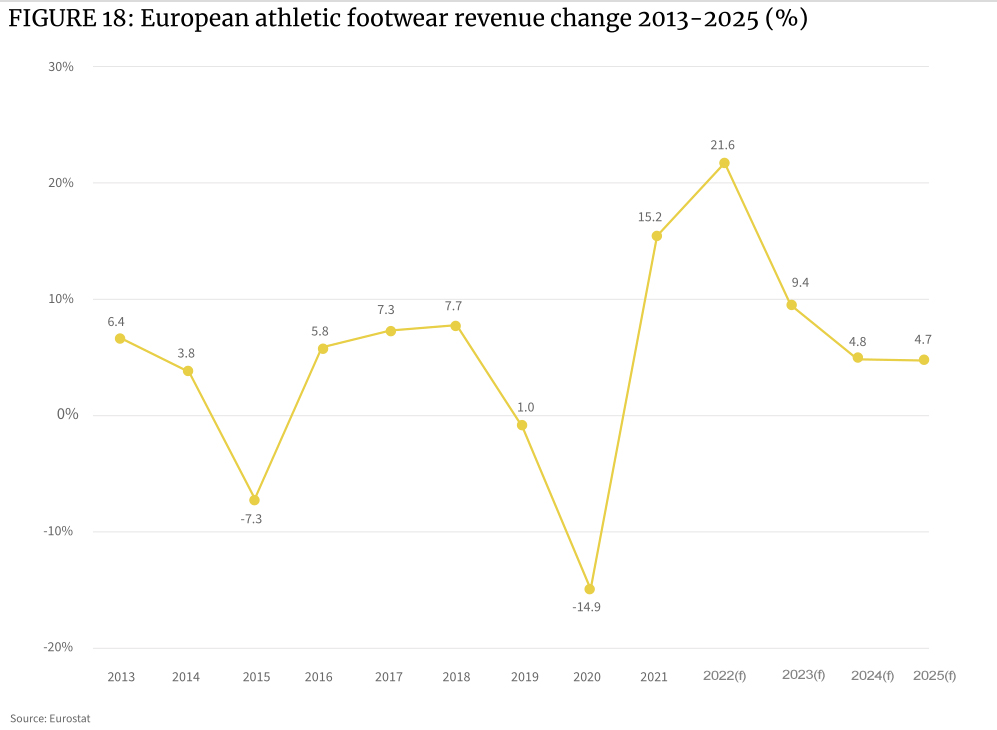

Sneaker -salg i Europa faldt under Coronavirus -lockdown i 2020, da mange sportssteder, der blev brugt til professionel sport, blev tvunget til at lukke. Imidlertid er den efterfølgende rebound i 2021 forbløffende, med indtægter for kategorien på tværs af kontinentet vokser med 15,2% og en yderligere stigning til 21,6% i 2022.

Epidemien har stimuleret forbrugere’ Shopping Desire, især den yngre gruppe på markedet, der er ivrige efter en sundere livsstil, så flere mennesker deltager alvorligt i sport. Folks disponible indkomster stiger, og det samme har den stærke interesse i det rigtige fodtøj til at bære for hver sport.

De nye fitness -apps brænder også interessen for sport og spiller en rolle i, hvordan man vælger det rigtige fodtøj samt oplysninger om forebyggelse af skader og forbedring af atletisk præstation. Dette kørte igen salget af højtydende sportssko på markedssiden.

Hele det europæiske fodtøjsmarked er værd omkring 130 milliarder euro, hvoraf Sports Footwear -markedet er værd omkring 50 milliarder euro, og det sportsgrene og det udendørs fodtøjsmarked er værd 48 milliarder euro.

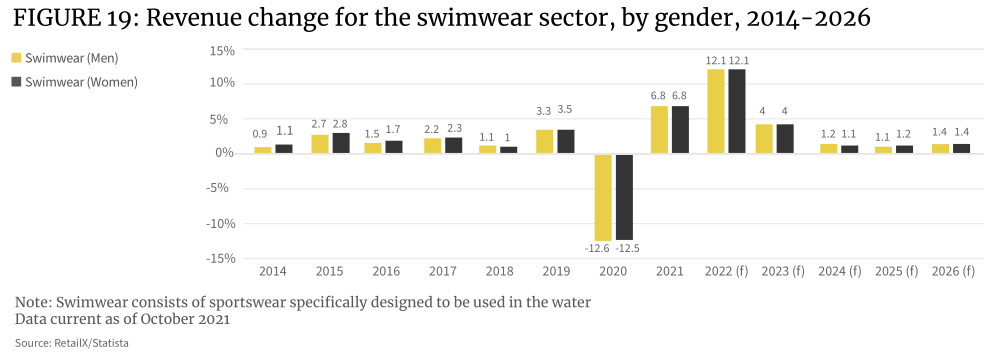

4. badetøj

Det forventes, at væksten af badetøjsmarkedet når 12,1% i 2022, og nogle af de ophøjede ferieforbrug og efterspørgsel efter rejse vil blive frigivet. Segmentet vil derefter stabilisere sig over 2019 -niveauer.

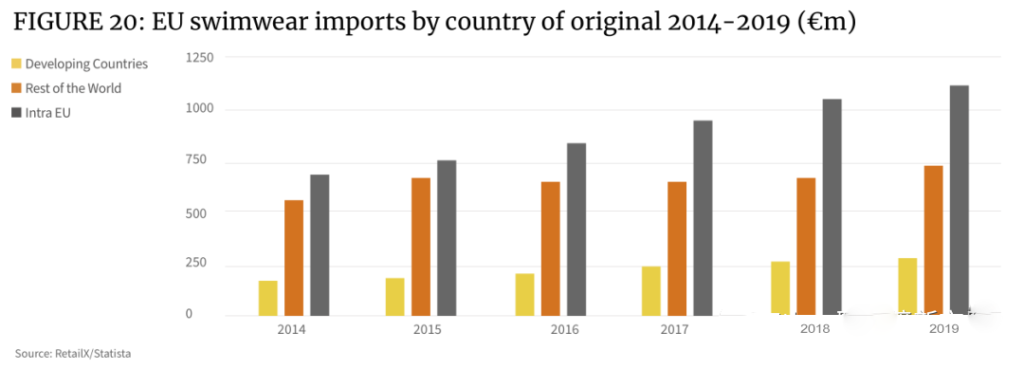

Værdien af EU -svømmetøjsimport er vokset med en årlig sats på 8,5% i løbet af de sidste fem år, højere end den gennemsnitlige vækstrate på 5,8% for al EU -tøjimport. I 2019 var den europæiske import af svømmetøj værd 2,1 milliarder euro, op fra 1,4 milliarder euro i 2014

Tyskland (295 millioner euro), Frankrig (176 millioner euro), Holland (171 millioner euro), Italien (166 millioner euro), Storbritannien (157 millioner euro) og Polen (109 millioner euro) er Europas største eksportører af badetøj . Den samlede eksportmarkedsstørrelse for badetøj i disse seks lande tegner sig for mere end 70 % af det samlede EU-marked.

5. Sports- og fritidstøj

Athleisure er blevet en nøgletrend forud for 2019, og mandatet til at arbejde hjemmefra har holdt salgsvæksten stærk i 2020 og 2021 og viser ingen tegn på afmatning.

Afslappet sportstøj er blevet ikke kun et specialiseret segment af sportstøj, men også et alignment mål for modemærker. Derfor er grænsen mellem sportstøj og modetøj også ret udvisket.

Mange forbrugeres skiftende indkøbsvaner sætter en sund livsstil over andre sysler og gør fysisk aktivitet til en del af deres daglige rutine. For eksempel er sportstøj til Zoom-møder blevet mere almindeligt accepteret i mange forretningsområder.

Fremkomsten af fitnesssoftware og tilsvarende understøttende tjenester under epidemien har også fået flere forbrugere til at acceptere sportstøj i deres daglige liv og aktivt engagere sig i sport på hverdage.

Som et resultat heraf kombinerer sportstøjsindustrien det hurtigt med tøjets moden for at skabe beklædningsgenstande, der opfylder behovene inden for mode, fritid og sport, hvilket muliggør væksten af dette nye produktsegment.

Andre faktorer har også flyttet fokus for modebranchen mod athleisure. I 2020 vil online-salget af DTC Sports Brands stige, og samarbejdet mellem sociale medier og selvmedieudøvere er gradvist blevet en vigtig markedsføringsmetode.

På nuværende tidspunkt er de vigtigste spillere på sportsbeklædningsmarkedet Nike og Adidas. Senere nye deltagere, Under Armour og Lululemon, har begge fremtrædende markedspositioner i Pantheon of Sportswear-mode.

6. Sportsudstyr

Størrelsen på markedet for sportsudstyr har oplevet krympning i 2020 og derefter oplevet hurtig ekspansion i 2021. Udvidelsesgraden på dette kategorimarked forventes at udjævne i 2022.

Tennisudstyr er en god referenceindikator. Europa ejer 52% af verdens tennisklubber, og det europæiske tennisracketmarked vil være værd 103,55 millioner euro i 2021 og forventes at nå 114,13 millioner euro i 2028 med en CAGR på 1,4%.

Også værdig opmærksomhed er fodboldudstyrsmarkedet. Den globale markedsstørrelse for fodboldudstyr blev værdsat til 1,9 milliarder USD i 2019 og forventes at nå 3,7 mia. USD i 2027. Det globale marked forventes at vokse til en CAGR på 18,3% fra 2021 til 2027.

Det europæiske marked for fitnessudstyr har boomet under pandemien, og selvom det fortsætter med at vokse i fremtiden, vil det vise svaghed hurtigere end andre typer sportsudstyr. Markedet for Home Fitness and Fitness Equipment er værdsat til 2 milliarder EUR i 2021 og vil vokse med en årlig sats på 3,1% mellem 2021 og 2031.

- Regional økonomi på større sportsmarkeder i Europa

Europa er hjemsted for mange verdenskendte sportsmærker, herunder Adidas, Puma og Fila. I mellemtiden dominerer vesteuropæiske markeder som Tyskland, Frankrig, Italien, Spanien, Storbritannien og Holland kontinentet. I modsætning hertil er det centrale og østeuropæiske marked mindre, men har større vækstpotentiale.

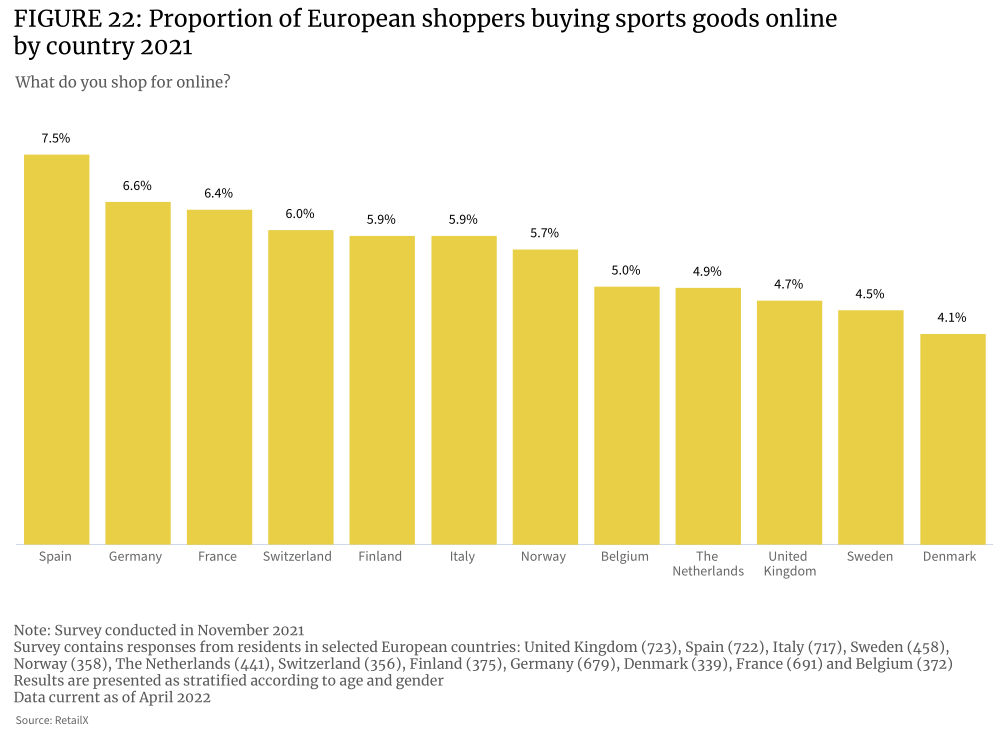

En analyse af shoppingmønstrene for europæiske sportsforbrugere fandt, at mindre end 10% af forbrugerne i hele regionen aktivt køber sportsvarer online. Hovedårsagen er, at forbrugerne foretrækker shoppingoplevelsen i en mursten og mørtelbutik, når de køber sportsudstyr. Mens pandemien har ført til en stigning i online -salg på tværs af brancher, er online detailsalg af sportsudstyr vokset relativt langsomt.

Interessant nok, blandt de online forbrugergrupper, udgør sportsforbrugere den største andel (7,5%), og Spanien er et af landene i det europæiske økonomiske område, der bruger sport som et tidsfordriv. Den sportslige penetrationsgrad i Holland er relativt lav (4,9%).

Mange forbrugere ønsker at shoppe personligt til sportsudstyr og udstyr i mursten og mørtelbutikker. I sportsorienterede lande er forbrugerne mere fokuseret på at finde det rigtige professionelle gear og tøj. På markeder, hvor sport er mindre udviklet, er det modsatte sandt, hvor forbrugerne har højere e-handelsdeltagelsesgrad (f.eks. Spanien).

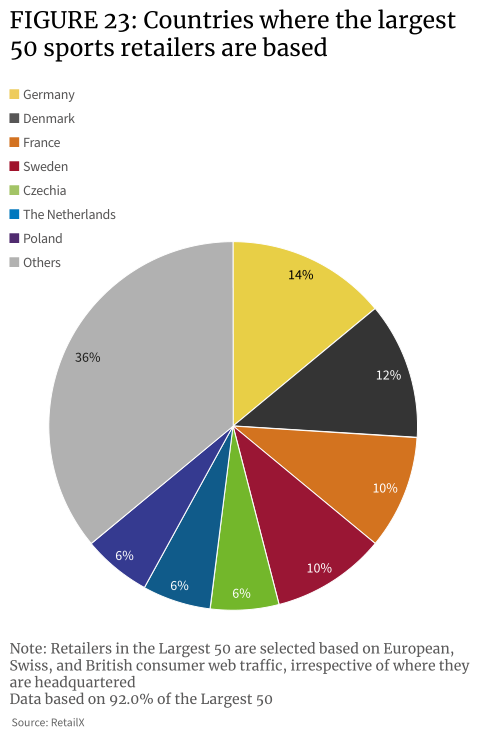

Tyskland og Danmark har den højeste koncentration af online trafik blandt de 50 bedste sportsforhandlere, der tegner sig for henholdsvis 14% og 12% af den samlede markedstrafik i Europa. Tyskland rangerer nummer to i antallet af online sportsforbrugere. I Holland, der har det største antal sportsforbrugere, tegner dets online sportsforhandlere kun 6% af trafikken.

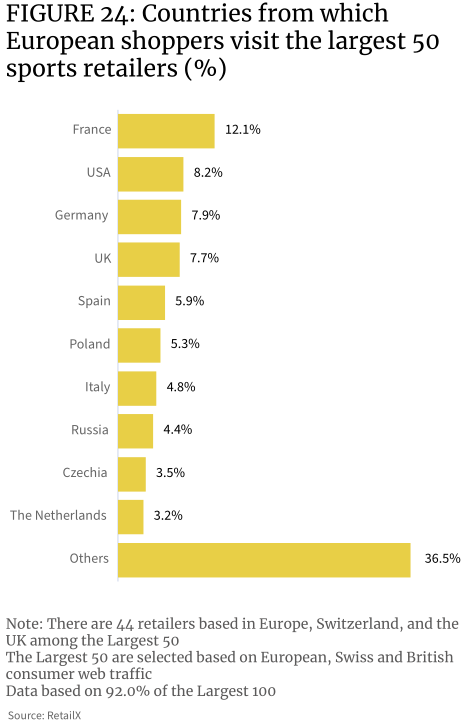

Dataene viser, at sportskategorien har en relativt stærk præstation på grænseoverskridende markedet. For eksempel fanger de top 50 sportsforhandlere 7,9% af de tyske forbrugere, og 14% af disse detailhandlere har hovedkontor i Tyskland. Ligeledes fanger de top 50 sportsforhandlere 12% af de franske forbrugere, hvoraf kun 10% har hovedkontor i Frankrig. Mere end 8% af de 50 bedste sportsforhandlere’ Webstedstrafik kommer fra USA.

Dette viser også til en vis grad, at det europæiske online sportsudstyr og udstyrsmarked er mindre påvirket af nationale grænser end andre detailkategorier.

Selv Storbritannien, hvor der kan være yderligere barrierer for at købe fra EU efter Brexit, har hele 7,7 % af besøg hos TOP 50 forhandlere af lokale forbrugere, hvilket tyder på, at mange britiske forbrugere stadig er på europæiske e-handelssider, når de køber sport varer, har britiske sportsforbrugere altid værdsat EU-specialmærker og forhandlere.

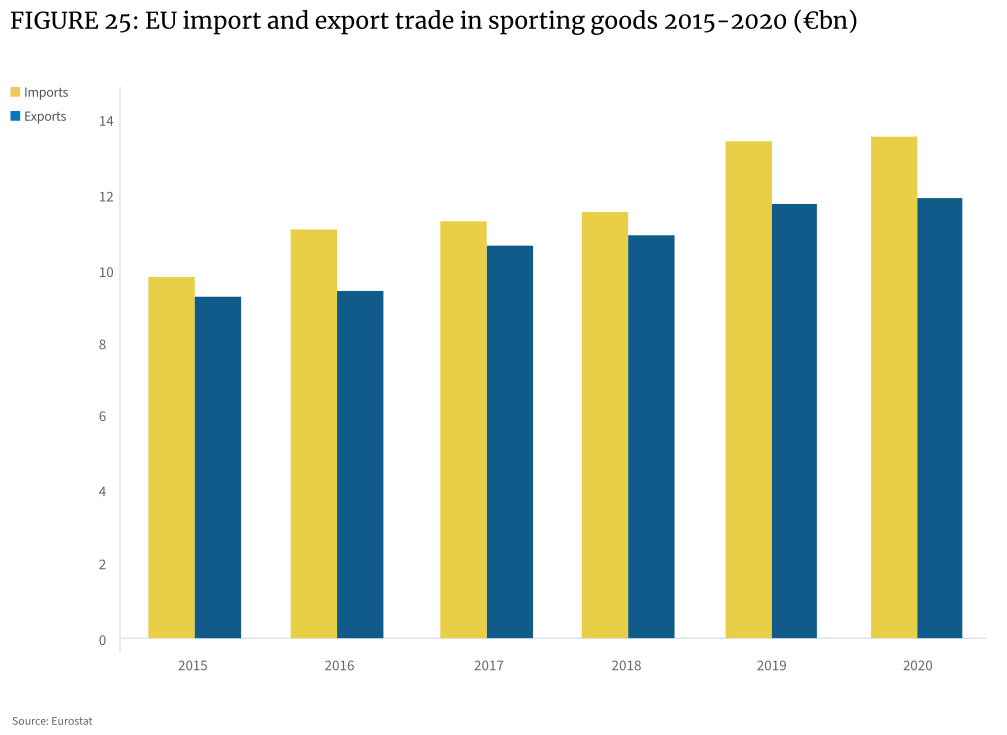

Europa er et stort forsynings- og markedsføringsmarked for sportsartikler og -udstyr, hvor importen stiger mellem 2015 og 2020. Sammenlignet med 2015 er både import og eksport steget i 2020, og vækstraten for importen (37,8 %) er højere end for eksport (28,2%), med en stigning i importen på omkring 3,7 milliarder euro og en stigning i eksporten på omkring 2,6 milliarder euro. Fra 2020 var Europas eksport 11,8 milliarder euro og importen 13,5 milliarder euro.

Europæisk sneakereksport vokser med en stigning på 74% mellem 2015 og 2020. De fleste af disse eksport går til USA, Japan, Kina, Rusland, Sydkorea, Tyrkiet, Canada, De Forenede Arabiske Emirater, Ukraine og andre lande. Blandt dem var det største fald i eksporten snowboards, der faldt med 5% år til år.

Antallet af både og vandsportudstyr, der importeres til Europa, stiger, hvilket stiger med 155% i de fem år til 2020. Import af gymnastik, sports- og svømmeudstyr steg også med 33% i samme periode.

I 2020, med hensyn til værdi, var Tyskland og Holland EU's førende eksportører af sportsudstyr med eksport værd omkring 5,3 milliarder euro, efterfulgt af Italien (4,4 milliarder euro) og Belgien (3,6 milliarder euro). De vigtigste importører i Europa er Tyskland (6,3 milliarder euro), Holland (4,7 milliarder euro) og Frankrig (3,7 milliarder euro). Italien, der har et betydeligt overskud på handel på 23 milliarder euro, eksporterer næsten dobbelt så meget sportsrelaterede varer og udstyr, som det importerer.

Intra-EU-handel med sportsudstyr er stærk, med import inden for EU og import uden for EU, der tegner sig for 51%: 49%. Importen af mode -sportsbeklædning inden for EU domineres af Tyskland, der tegner sig for 11,7% af markedsandelen, svarende til en markedsværdi på 1,8 milliarder euro. Dette efterfølges af Italien (5,7%), Holland (5,3%) og Belgien (4,9%).

I mellemtiden er Polen et nationalt marked at se på. Det har en af de hurtigst voksende import af sportsudstyr i ethvert land i det kontinentale Europa, har en stor og stadig mere velhavende forbrugerbase og er et af de nye online detailmarkeder.

- Europæiske Sportsartikler Marked Konkurrencepræget landskab

Sportsvarer sælges gennem detailhandlere, butikker og distributører i hele Europa med det markeds, der er segmenteret mellem specialforretninger, generelle sportsforhandlere og mærker. Markedspladsen er også i stigende grad i spil, og branchen ser også indirekte og digital konkurrence fra andre brancher, såsom modemærker, stormagasiner og andre detailhandlere.

Store integrerede sportsdetailhandlere udgør det dominerende detailhandelslandskab på markedet, der består af detailhandlere, der sælger en bred vifte af sports- og fritidssportsartikler, der henvender sig til en stor kundebase. De forbliver dog fokuseret på udendørssport og er derfor i stand til at tilbyde produkter til forbrugere, der fokuserer på præstations- og rekreativ sport. Nøglemarkedskonkurrenter i Europa omfatter Decathlon og Sports Direct. Disse forhandlere, som traditionelt har været fysiske butikker, har gradvist åbnet op for e-handelsområdet og fokuserer nu på omni-channel forretningsmodeller.

Mainstream-platforme som Amazon og Ebay har længe været store sportsudstyrs-sælgere, og velkendte mærker som Adidas og Nike har også åbnet deres egne brandede butikker på e-handelsplatforme for at sælge slutprodukter og andre merchandise for at undgå kannibalisering. Detailhandlere som Decathlon er gået et skridt videre ved at åbne deres egne markedspladser for at forbedre deres kerneekspertise og udvide deres rækkevidde til markedet for bredere sportsudstyr. Andre, mere specialiserede platforme, der imødekommer specifikke sportsgrene og kategorier, dukker også op.

Det europæiske marked for sportsudstyr betjenes af en række online- og omni-channel-forhandlere, med mindst én storspiller i top 100 i hvert land. For eksempel har Tyskland adskillige boldforhandlere, der optræder på ranglisten, som repræsenterer en vis størrelse på markedet for sports- og udendørsvarer og udstyr, hvilket også er udviklingen af grænseoverskridende e-handel med lande som Schweiz, Østrig, Polen og Tjekkiet. resultat af udvikling. I modsætning hertil har Storbritannien kun én forhandler (Sports Direct) i top 20.

Distributionen af europæiske detailhandlere er også påvirket af nogle velkendte mærker, normalt mærkegiganter som Nike og Adidas for at fremme grænseoverskridende salg gennem andre forhandlere og mærkevarebutikker rundt om i verden.

- Vækstpunkter for den europæiske sportsindustri i 2022

Som alle detailhandelsbranchen har sportshandlere i Europa set dramatiske ændringer i deres indkøbsvaner gennem pandemien, men måske ikke så dramatisk. Inden for sportsartikler har skiftet i forbrugeradfærd til onlinehandel været langt mindre dramatisk end på andre områder, mens tilbagevenden til fysiske detailhandel har været hurtigere.

Så hvad er vækstpunkterne og tendenserne for europæiske sportsartikler i 2022 og derefter?

Epidemien har fået flere forbrugere i Europa til at være opmærksomme på deres helbred takket være det stærke fokus på fitness blandt unge og den voksende indflydelse fra fitnessindustrien. Paradoksalt nok vokser Europas fedme -krise også, og regeringerne begynder at gribe ind for at begrænse den.

En UK-undersøgelse fra 2020 fandt, at otte gange så mange teenagere træner for at tabe sig end i 1986. Da de blev undersøgt sidste år, sagde 6 ud af 10 14-årige, at de udøvede for at tabe sig, sammenlignet med kun 7 procent i 1986.

Millennials og Gen Z udgør 80% af det samlede Fitness Club -medlemskab, mens 85% af gymnastikmedlemmerne også træner derhjemme. 89% af mennesker i alderen 16 til 34 bruger fitness -apps til at træne.

Da disse unge brugere fortsætter med at udøve og genoptage teamsport og andre aktiviteter, der er blevet begrænset under pandemien, vil dette yderligere skabe vækst i salget af sportsudstyr.

Fitnessindustrien drives også af Gen Z- og Millennial -kohorterne, da de ikke kun fokuserer på fitness, men også på den samlede fysiske og mentale sundhed. Fra 2017 til 2021 er den globale markedsstørrelse for sundhedsindustrien vokset med 6,4%med en markedsværdi på cirka $ 3,7 billioner.

Fitness er kun et vigtigt område af det. Væksten i wellness -industrien driver direkte væksten i køb af sportsudstyr, især fodtøj, beklædning og sportsudstyr, og fremmer relaterede teknologiopgraderinger.

Fedme i børnene er stigende i sydeuropæiske lande. Tallene viser, at i Cypern, Grækenland, Italien, Malta, San Marino og Spanien er omkring en ud af fem drenge (spænder fra 18% til 21%) overvægtige.

Det er her regeringen griber ind for at forbedre børns sundhed og tilskynde folk til at deltage i sport og motion. Dette vil føre til en stigning i efterspørgslen efter sportsvarer på hele det europæiske marked, og forretningsmuligheden kan beskrives som selvindlysende.

På samme tid driver Gen Z og Millennials vækst i sports- og fitnessindustrien. Yngre grupper tegner sig for mere end 65% af den samlede andel af virtuelle fitnessbrugere. De vigtigste forbrugergrupper er ivrige efter en problemfri og sammenkoblet fitnessoplevelse. Oplevelsen af købmænd skal tilpasse sig folks livsstil og matche forskellige sportsscenarier. Derfor inkorporerer fitness -software, der indeholder virtuelle teknologier som AR, og det tilsvarende fitnessudstyr/teknologi kan tiltrække forbrugere’ opmærksomhed mere end nogensinde.